The Basics of Investing: Third Lesson - Bonds - Photo credit: Amber255 via Bitlanders.com

Welcome to my series about the basics of investing. This will be my third lesson, and this time we will talk about bonds: what the type of investment it is, what the characteristics it has, how the bonds are divided, why the earnings from bonds can be different, and what risks you take when buying one or two different bonds.

When you hear the word investment, many people immediately think about the stocks. Information about stocks trading around us is everywhere: in the newspapers, TV and eventually, even friends are telling that invest money in stocks. And there are so many stories of success when a person earns a million in stocks trading just in a year. It seems that while sitting on a computer and starting trading in shocks, the money will flow to us like from the sky.

Unlike stocks, bonds are much less popular among investors. Well, in fact, the purchase of bonds is much more boring - there is not much of adrenaline, minor changes, long investment periods, and, after all, not many of us have heard success stories associated with bond trading. On the other hand, everyone remembers bonds when stocks fall down.

So, what is a bond, whether it's worth investing in bonds, what strategies to use and what to expect - all this you will find out after reading this article.

The basics of Investing: Bonds - Video Credit: TDAmeritrade via Youtube.com

Bonds are the More Secure Type of Investment

Bonds are classified as a low-risk investment. Not the safest but one of the safest type. Automatically this means that the expected return is lower than investing in equities. The risk is lower also: the lower is an amplitude of price fluctuations, the lower the loss probability.

Bonds can be very diverse. They can be divided according to the terms when they will be redeemed, according to who has issued them, and many other aspects. First of all, before we start talking about the bonds profitability, we have to find out some of the terms used when talking about bonds.

While reading, kindly check the Querlo chat:

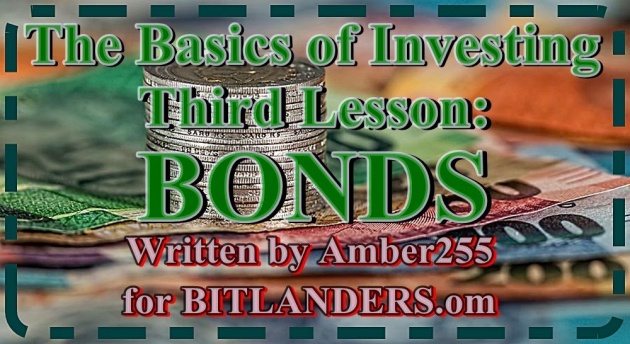

Bonds Mean Money Lending

Bonds are called debt securities. Since this title contains the word debt, it is possible to understand that bonds are related to money lending. Being an investor, you can lend money to the state or the company. Usually, during such an operation you should specify the term for which you borrow the money.

For example, you borrow money for the one year, for 5 years, for 10 or 20 years or even longer period. It is said that the bond is respectively of the one, five or twenty-year term. Also, it must be indicated an annual interest, how many percents of interest you can get per year for the money lent. At the end of the specified term (which is called the redeeming term), of course, you get not only interest, but you get also that amount, which you borrowed.

Benefits of Bonds - low-risk investment - Photo credit: imoney.my

I have mentioned earlier that bonds are a low-risk investment, which means that investing in bonds is more recommended for conservative or investors of older age. That is, bonds may be suitable for a young investor if he is unwilling to take risks or for an elderly person who will retire soon and who is not willing to accept high price fluctuations.

When investing in bonds, there is usually one main objective - constant income with annual interest.

For example, you lend money to the Government, say for one year, you have been promised a 5% annual interest on this loan. If you invest 1,000 Euros, your main source of income is paid interest. After a year, you will be reimbursed 1,000 Euros + 5% interest, i.e. the initial 1000 +50 Euro interest.

Credit: Amber255

Interest payable on bonds, otherwise known as a bond coupon. This interest (coupon) is the source of profit that you should expect to receive when investing in bonds, and this should be the main source of profit.

Bonds are the Only One Conditionally Secure Type of Investment

We already know that bonds are classified as a conditionally secure type of investment. They are conditionally safer than other asset classes. The bonds of some countries or corporations become the only one safe shelter for the money during the crisis. In the event of an economic shock or a country experiencing a downturn, bonds are becoming one of the few safest types of investment to which money starts to flow, so it is likely that you will not suffer a big loss. Anywhere else, during periods of crisis, losses can be quite large.

Low-risk investment in Bonds - Photo credit: themortgagecoach.wordpress.com

How Much Money do People Invest in Bonds?

It is also very interesting that bonds are the largest part of the world's financial assets, although the beginner investors rarely start investing in bonds. The whole worldwide financial assets in 2016 are estimated at 160 trillion dollars. Bonds on this property make up about 60%. This is a very large and very hard-to-understand amount, and it is invested in bonds.

So, you should not seriously appreciate the sometimes heard thoughts that this asset class is uninteresting and can be forgotten. Investing in bonds, you surely can earn money, and this type of investment mostly should be interesting for people who seek passive income.

Terms Related to Bonds

We will now discuss the most commonly used terms talking about bonds. You will need these terms if you are going to invest money in bonds:

-

Issuer

This is probably the most common term talking about bonds. The issuer is called the government or a company that issues bonds. Means, it's called the legal entity who wants to borrow money from you, and who issues the bonds.

-

Nominal

This is a term that indicates what size is one unit of lending (usually 1000 US Dollars, Euros, etc.).

-

Duration

The bond duration is a time span for which the issuer of the bonds is borrowing the money. There may be five years, ten years and so on.

Types of Bonds - Photo credit: kiplinger.com

How is the duration commonly classified?

If you hear about short-term bonds, know that their term will be one, two, or three years. In the case of medium-term bonds, it is usually discussed for bonds of 5 or 7 years duration, and if you are talking about long-term bonds, know that the duration before their redemption is 10 years or more.

Sometimes bonds are issued for up to 100 years. Most often, such bonds are acquired by non-physical persons, but the legal entities, support charities funds who have been planning their activities for decades and centuries.

-

Coupon

The term coupon sometimes has one more name - segment. This is a term that specifies how much

percentage of interest you receive each year from the amount invested. For example, a coupon may be 5%. That means if the bonds starting value are one thousand euro, then a year later you will get 5% interest or 50 Euro.

-

Yield

This term is important if you are going to buy or sell bonds on the secondary market, means, not from the issuer of the bonds (state or company that issued them).

For example, the bonds have been issued and distributed to those who wanted to lend money to the issuer (original distribution is called the primary market). You have acquired a bond that the issuing state or company will redeem, for example, after 5 years. At any time, you can decide to sell your bonds to someone before the duration of 5 years ends. Or you decide to buy more bonds that were issued earlier. Such pre-issued bonds (which have not yet expired) can be traded on the so-called secondary market.

Bond interest rates - Photo credit: bitmakler.info

On the secondary market, you can trade earlier issued bonds. There, the price of a commodity varies. Just as daily changes in raw material or oil prices, the price of bonds changes on the secondary market as well. The changing price affects the yield of specific bonds, i.e. how much you can expect to earn after acquiring a bond on the secondary market.

Bonds yield can be easily understood as the percentage of return that you can earn after acquiring a bond on a secondary market. Yield is important only if you intend to sell the bonds before the official maturity date, and if you intend to acquire them not at the time of the initial distribution.

-

Quotes

What do bond quotes mean? Most often this term refers to all of the above bond parameters. Usually, this is just a table that you can find on various bank pages, sometimes in investment journals. Such a table indicates the name, duration, coupon, profitability, and various other values of the bonds.

We discussed the key terms you will encounter if you are interested in investing in bonds.

Bonds yield - Photo credit: bixmalaysia.com

Not All Bonds are Equally Secure

Most investors make a big mistake in thinking that all bonds are similar according to their parameters, they estimate them as one unit. It is often assumed that all bonds are equally secure. But this is not the case. Now let's look at what the difference between the bonds is, why they are different, and what these differences mean.

The easiest way to evaluate the risk of a bond is their term - the longer a bond is, the riskier it is. However, only the same bonds can be classified in this way. For example, the one-year bonds of the of the particular country are safer than five years bonds of the same country.

The second measure how it is possible to evaluate the risk of bonds is paid profitability. The safer the bond is, the profitability will be lower. The higher the risk, the higher the profitability will be. If we want to compare bonds by its profitability, at least two different bonds are required. Only by comparing this can we know which bonds are safer, which are riskier.

For example, the profitability of a bond will vary between the state and the company operating in that country. In most cases, the risk of corporate bonds will be valued as higher, automatically the proposed profitability will be higher also. If we compare countries with each other, there are usually two main groups: developed countries and developing countries. Mostly, it will be considered that the risk of developed countries is lower - profitability will be lower; developing countries risk higher - higher will be the profitability.

Credit: Amber255

Bonds Ratings

Another method of risk assessment is the use of credit ratings' evaluation. Certain agencies such as Fitch,

Moody, Standart, and Poor assess the ability of companies or states to pay interest and repay the loan. These agencies give a certain rating for each country or company - from the best to the worst. The very best ratings are rated triple-A (AAA), the worst one gets a C or D rating.

Bonds ratings - Photo credit: imoney.my

These ratings are else subdivided into the bonds of investment grade, and into non-investment grade bonds or, in other words, speculative bonds. The higher the bond rating is, the lower the profitability, and the lower the risk of the bond is. The lower the bond rating is, the higher the risk of the bond is, and automatically, the higher the expected profitability.

The difference between those ratings is the higher the rating, the higher the risk of bankruptcy of the bond. Investors naturally ask the higher interest rates for riskier bonds.

Understanding Bond Interest Rates

OK, now we have discussed the main risks and profitability evaluation criteria, so now we can examine what kind of interest can we count on investing for a year, five or ten years? Do profitability of different maturities bonds vary or not? Here, we are faced with another term - the bond interest rates curve.

If we analyze such curves, we will see that the profitability of the shorter-term bond is lower. Longer-term bonds profitability is increasing. Such bond interest rate situation when the bonds profitability increases together with bonds duration is called normal situation.

However, we may have a situation in which the curve is displayed horizontally, i.e. short and long-term interest rates overlap. Then it's called inverted, this is often the case before the crisis.

Usually, the relationship between duration and profitability is as follows - as the duration grows, bonds profitability also increases. Most often, lending money for a longer period, we are getting bigger obscurity of the future, and therefore we require bigger interest.

The recipe of investment success - Photo credit: Amber255

If you acquire one-year bonds, the risk is too low. If you buy ten-year bonds, after five years can face a negative situation when you will be forced to sell bonds before its redemption. It may happen that you will sell them on the secondary market with a loss. Therefore, it is important to remember that longer-term bonds prices are higher than having a shorter duration.

What About Inflation?

Now, it is a time to remember what we were talking about in previous lectures - when we invest, we cannot avoid the consequences of inflation. We already know that inflation is what eats our money. It can vary from 2 percent up to 10 percent. Long-term global inflation varies from 3 to 4 percents What does this mean?

If we are analyzing real bond earnings, we will see that even after inflation, the global average over the long term is around 2% real return (minus inflation). This is very important because we can conclude that investing in bonds for a sufficiently long period will ultimately not only save the value of our money but also will earn an additional 1-2-3%.

But you still must be aware that when investing in bonds, a situation can arise where your real return (nominal return minus inflation) will be negative.

How Bond Investing Works - Video credit: ZionsDirectTV via Youtube.com

On the Final Note

From what we discussed, we should understand that investing in bonds we cannot claim that we just invest money and will earn 5%. We can cut a long story in periods and will find good periods, but there will be bad times also. Most often, the trend is likely over a bad period we can expect a good period, and otherwise. Now we had a very good period for the bonds, so it is likely that in the future we will have a worse period.

And still, the bonds are valued as one of the safest type of investment compared to shares, real estate or raw materials). Also, that means investing in bonds, the return is lower than other investment tools offer. Accordingly, this also means that the range of bond fluctuations is lower.

Make money investing in Bonds - Picture credit: freepressjournal.in

What should we remember?

- Bonds are not equal.

- Government bonds are usually safer than corporate bonds.

- Developed country bonds are usually safer than developing countries.

- Big company bonds are safer than small or new corporate bonds.

- By investing for a long time you can expect to earn 1-2-3 percent actual annual return on investment (minus inflation).

- But there is no guarantee that investing in the near future for 10 to 20 years, you will earn such a return.

Now, you can ask may it not worth investing at all? It worth! Because investment drastically increases the probability to ensure a high-quality lifestyle; it helps not to lose money due to inflation; it helps to earn money for unforeseen life's events, and it helps to achieve your goals and dreams.

What is the most important aspect in order to earn money? It is your WISH.

Make money investing in Bonds - Photo credit: bixmalaysia.com

*************************************************************************************************

Thank you for stopping by and reading my blog.

2018, All Rights Reserved.

You are very welcome to join Bitlanders and share your valuable knowledge and opinion.

***************************************************************************************************

You can check my other blog about investing:

1. The Basics of Investing: First Lesson - What is Money Investing?

2. The Basics of Investing: Second Lesson - Profit and Risk

3. Investing for Beginners: Easy Steps and Tips to Start Investing

Come back to find more...

**************************************************************************************************