The US Dollar is up and the Euro is down - is only the first layer. What about the British Pound, Zloty or Rupee or other emerging economy currencies?

“Anti-Dollar”:

The unfavorable trend for the Euro is likely to continue at least for the year as it is dragged down by fiscal austerity delivering a slowing economy and the political discountenance inevitable as the Eurozone and EU go through structural reformation. However, many other currencies have been effectively linked to the Euro as the “anti-Dollar.” Only a few months earlier some key capitals, including BRICS, were pushing the Euro as a global reserve currency alternative to the US Dollar – that project is now on ice if not necessarily dead. The British Pound has also been dragged down if by nothing other than geographic proximity. Most of the other Euro currencies have also suffered, from Sweden to Hungary. However, some are holding out greater hope for the Polish Zloty – a fiscally more healthy country, still playing catch-up with western European economic development, closer to Germany’s more healthy economy and not caught up in the political murkiness of Hungary.

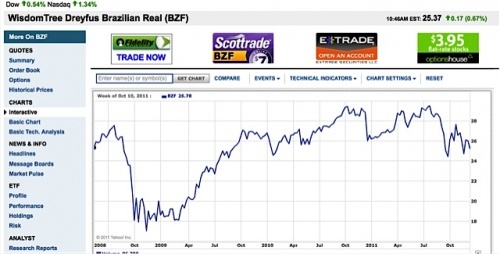

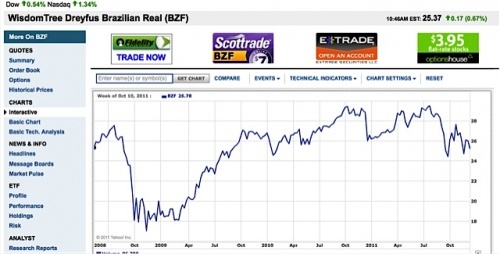

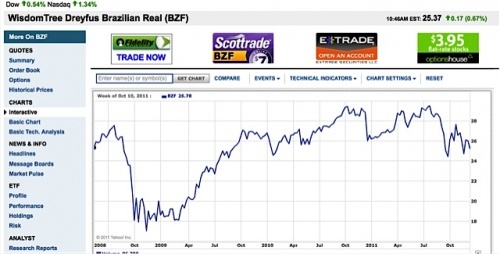

Developing Economy Currency Swoon:

The most notable but least globally noticed currency declines involve India’s Rupee or Turkey’s Lira or Brazil’s Real. All have seen drops as significant or more than the Euro. Part of this is the reversal of the “anti-Dollar” sentiment” and search for “safe-harbor” as investors seek security over risk return driven higher profits. This trend should have a profound effect on several levels – from increasing inflationary pressures in such countries, to enhancing their export competitiveness advantage, to putting pressure on commodities as petroleum and grains which in part were driven by speculative surges based upon growing demand in such countries along with currencies facilitating such. The more recent drop in gold, easing of food prices, and decline of industrial metal prices is part of the consequence. Petroleum is driven by its own speculative and political forces, and I would expect a significant decline corresponding to other commodities unless a conflict erupts around Iran and the Strait of Hormuz. Read: -“How Iran Affects Oil Prices” -

diplomaticallyincorrect.org/films/blog_post/how-iran-affects-oil-prices-by-ambassador-mo/43204.

Also though, in the near term, I expect a de-coupling of the “anti-Dollar” currencies. Developing economies will be affected by Europe’s malaise, but most will resume more positive growth.

Resource Driven Currencies Still Solid?

Australia and Canada have relatively benefited from the best of both worlds – resource driven but also developed economies. While perhaps not as much of a boom, resource driven economies beyond Australia and Canada - see Brazil and South Africa - are likely to see a modest rebound.

What about Russia, you ask? It is resource driven but is also undergoing a political transformation or maybe not? This process is likely to be negative for perceived currency stability. Further, Russia’s economy is neither as diversified nor favoring middle classes as Australia or Canada.

Political Change Lagging Economic Growth/Development – Will There be Political Maturation to Follow Economic Revolution?

Political change could be a factor in many Asian Tiger economies. However, the perceived rising dominance of China’s economy affects neighbors as well in terms of currency appreciation. (This includes Japan and the Yen, although it has its own dynamics). Consensus says the China Yuan should continue but slow in appreciation with respect to the US Dollar. However, China may have a more defined swoon this time around than even in 2008 – recent data shows declining manufacturing activity in China and real estate prices have dropped, at least from bubble like spikes. The other consideration that is underestimated though is political stability. I think China faces some significant challenges, mostly internal.

Health of Working/Middle Classes Best Indicator of Economic Viability/Potential?

The health of the middle class is key for many currencies, in the US. The growing income and wealth disparity in the US is perhaps the US Dollar’s greatest challenge – even more than any factor as deficits and rating agency downgrades. However, the US Dollar will have one positive factor going for it by the end of the coming year – 2012 – a political decision and course will have been set and more securely than the divisive situation now in Washington. Regardless of who wins the US Presidency, (an Obama victory translates to a second term president and even more certainty and less politics), the US will have moved through a dynamic phase as other countries, from European Parliamentary democracies to more authoritarian developing countries face their own political challenges produced by a rapidly evolving global economic/financial environment. Perhaps it is only perception, but I sense that economic developments have outpaced political change – from plight of the working classes to freedoms and rights beyond just the economic to the multilateral evolution of institutions as the EU, the ECB and even IMF.

Read: -“Human Development Index Rankings – UN” -

diplomaticallyincorrect.org/films/blog_post/human-development-index-rankings-un-by-ambassador-mo/39306

By Ambassador Muhamed Sacirbey

Facebook – Become a Fan at “Diplomatically Incorrect”

Twitter – Follow us at DiplomaticallyX

“International Financial Crisis Channel” -

diplomaticallyincorrect.org/c/international-financial-crisis