Accounting is an art of recording summarization generalization the records in terms of monetary events and interpreting the result their off. Accounting is maintained by two methods. Double entry system and single entry system, in double entry system both debit and credit aspects are recorded and in single entry system only one aspect is recorded.

Items are categories as income expenditure assets and liabilities. Income: The earnings are known as income e.g. sales and rent earned etc. Expenditures: The expense are known as expenditures e.g. salary purchases bills carriage interest wages depreciation postage bad debts rent paid etc. Asset: The items which benefits the company for more than one year is known as assets.

For example furniture goodwill vehicle debtor’s stock truck machinery and plant prepaid expenses etc. Liabilities: Creditors due expense prepaid income capital accumulated depreciation tax etc.

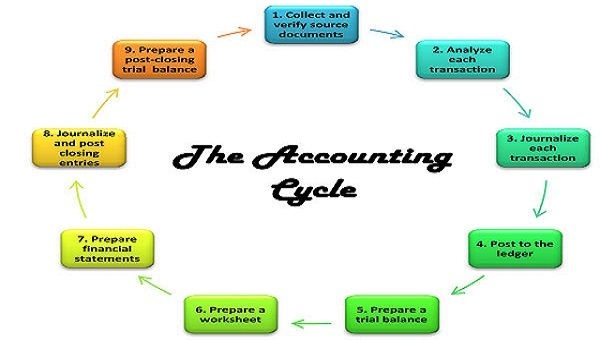

In accounting cycle Journal is prepared which is known as original book of entry. The entries are recorded. Then ledger is prepared the items are recorded in chronological order in ledger. Then trial balance is prepared. It has two columns assets and liabilities. The balance should be same of the both side.

Then the final account is prepared. It is prepared for calculating profit or loss. Final accounts have two things. The trading and profit and loss account. And other is balance sheet. Balance sheet is prepared for equalizing assets and liabilities.