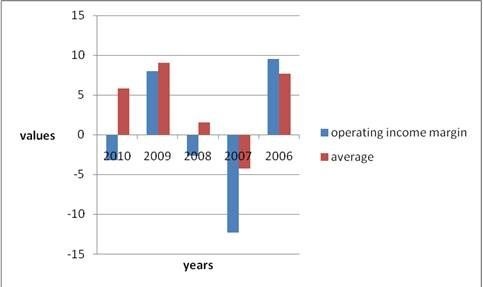

Operating Income Margin

|

Details |

Unit |

2010 |

2009 |

2008 |

2007 |

2006 |

|

Operating Income Margin |

% age |

(3.2) |

8.0 |

(2.64) |

(12.3) |

9.5 |

|

Average |

|

5.833 |

9.0328 |

1.5306 |

-4.2468 |

7.698 |

Interpretation:

Operating income margin is negative in three years out of five years it is a problem for company. Operating income margin is below the average except2006 this is not good.

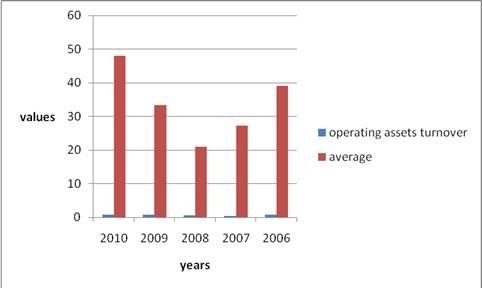

Operating Assets Turnover

|

Details |

Unit |

2010 |

2009 |

2008 |

2007 |

2006 |

|

Operating Assets Turnover |

times per year |

0.70 |

0.67 |

0.48 |

0.42 |

0.85 |

|

Average |

|

47.906 |

33.25 |

20.904 |

27.2164 |

39.038 |

Interpretation:

Operating assets turnover is improving this appears to be very good. Operating assets turnover is below the average it is not good.

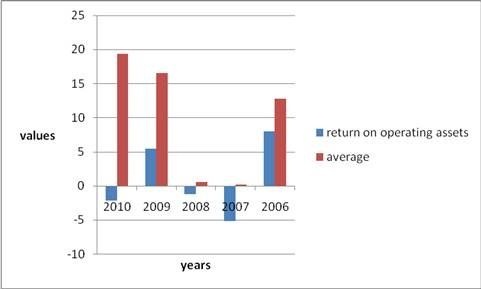

Return on Operating Assets

|

Details |

Unit |

2010 |

2009 |

2008 |

2007 |

2006 |

|

Return On Operating Assets |

% age |

(2.2) |

5.4 |

(1.27) |

(5.2) |

8.0 |

|

Average |

|

19.3494 |

16.5312 |

0.5642 |

0.1464 |

12.7362 |

Interpretation:

Return on operating assets is negative in 3 years out of 5 it is problem for company. Return on operating assets is less than average it is not good.

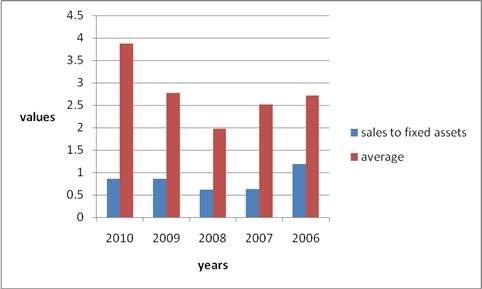

Sales to fixed assets

|

Details |

Unit |

2010 |

2009 |

2008 |

2007 |

2006 |

|

Sales to fixed assets |

times per year |

0.859 |

0.864 |

0.62 |

0.622 |

1.187 |

|

Average |

|

3.8692 |

2.7688 |

1.9648 |

2.5142 |

2.7134 |

Interpretation:

There is a little improvement in sales to fixed assets after decreased it is very good. Sales to fixed assets is less than average it is not good.