Last week Chief Mario Draghi promised that the ECB would do whatever it takes to save the Euro. The capital markets reacted most ebulliently and the Euro shot up versus other currencies. However, since then, the market has reacted as if disappointed by the lack of concrete measures.

Evolving Mandate & Powers in Politically Divided Europe?

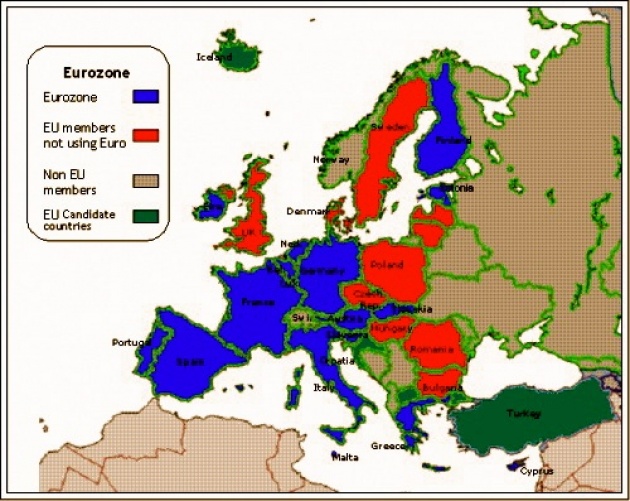

The problem for Mario Draghi (below) and the Eurozone is that the powers of the ECB (European Central Bank) to live up to its promise are either not yet evident or evolving. Angela Merkel and Germany have been particularly stuck in the mode of “we done enough.” However, Mario Draghi’s gamble was that once he promised Germany and Merkel would have to back him up or the entire Eurozone will suffer including Germany which is now also exhibiting signs of economic weakness.

Another Groundhog Day?

Today the market was again disappointed in the lack of concrete measures by Draghi and the ECB seeing the whole thing as another indication of “Groundhog Day”(below)– rhetoric and promises followed by the same old cycle of do nothing and a collapsing Euro. Read our Blog for Film – “Another ‘Groundhog Day’ for Euro-Tragedy or Comedy? Mario Draghi is not yet a proven commodity – his promises do not have either a unified Eurozone or proven mechanisms to live up to the spirit of the commitments/threats uttered. (The US Fed Chairman is frequently described as the first or second most powerful man/woman on earth because of the monetary policy which they can wield largely without political accountability – US Congress performs oversight but cannot dictate.)

Restoring Euro, European Economic Growth and Credibility to “European Project”

Now, Mario Draghi appears to have resolved to pull both willing and unenthusiastic Eurozone partners into developing a Euro debt purchase program – in fact the ECB would be the buyer of last resort and thus a safety net particularly regarding European sovereign debt. If in fact executed, the plan should stabilize the debt markets in the Eurozone, subject to the ECB’s not infinite buying power. Here is the catch: Germany in particular will have to agree to effectively back the ECB’s expansion of its purchases and balance sheet. Further, the problematic sovereign will have to request the purchasing assistance of the ECB and thus become subject to conditionality, including potentially austerity and structural reform. This also could have the immediate effect of further eroding the Euro’s valuation with respect to other currencies as more liquidity is pumped in. Nonetheless, if this effort is followed through upon longer term it could harmonize the Eurozone, strengthen European economies and thus restore credibility to both the Euro and the “European project.”

Read our Blog for Film: “Eurozone Greek Tragedy Not in Final Scene”

Ambassador Muhamed Sacirbey - FOLLOW mo @MuhamedSacirbey

Facebook-Become a Fan at “Diplomatically Incorrect”

Twitter – Follow us @DiplomaticallyX

For many further current news event articles, see our popular video blogs at “International Financial Crisis” Channel