Just as a new day may be dawning, the Eurozone appears to be reliving the previous one. This week will mark something like the 20th high-level meeting of Eurozone leaders in trying to find their way out of the current crisis and what might seem to them and us a never ending spiral, or is it repeating cycle? Last year we pointed out to the pattern of history repeating itself: from crisis to rhetoric and conferences and then back to reality that in eyes of the financial markets political leaders had done little to remedy the underlying causes. Read: “Groundhog Day: Euro Crisis Trickling to US Economy/Business”.

Banking Union:

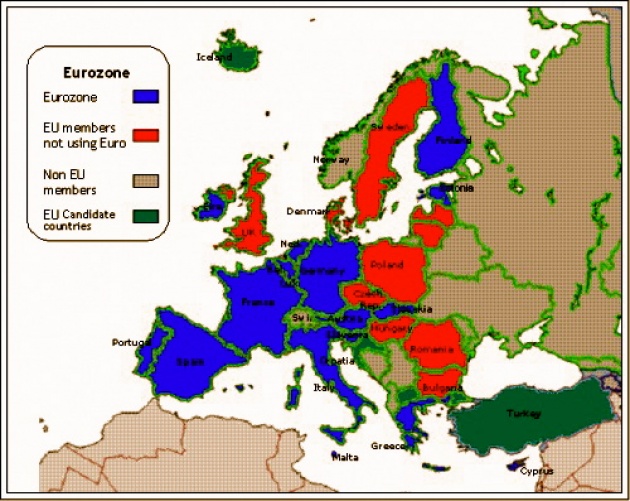

The next stage of the evolution of the Eurozone crisis has logic. Political leaders are proposing elements of a banking union, from shared regulatory standards and oversight to deposit insurance and thus presumably implicit assurance to savers/investors. However, the details and potential entanglements with national sovereignty remain to be resolved. Most critically, Angela Merkel continues to resist any substantive notion of shared liability. Without such, most weaker economies may see less incentive to further their national fiscal policy to some broader Eurozone or EU authority (UK and Czech Republic have already opted out of a new design now being developed and to be implemented). Indeed, a banking union may be even difficult to proceed with some greater backstop from Berlin.

Bleeding Credibility:

However, the most damaging and draining, some would say self-inflicted, wound is one of lost credibility. Each purported operation to heal the Eurozone appears just like another scalpel cut without benefit. Perhaps the better analogy is that the current leadership of the Eurozone is more akin to Medieval doctors that prescribed “bleeding” as a heal all – austerity has proven just as effective as bleeding in healing the patient. Read Blog for Film: "Austerity is Killing Jobs & Economic Health"

Most Eurozone officials are finally cognizant that the “mirror, mirror on the wall” does not lie – they are not convincing anyone with mere rhetoric as the bloom has faded from the Euro and the EU. Joaquin Alumnia, European Commission VP noted: “recent Summits have generated expectations that were not met by decisions. We at the European Commission hope that this time around will be different.”

Unfortunately all indications are that not much will be different. While some will promote modest development/stimulus projects, others are already speaking of elaborate and elongated processes to amend/alter EU/Eurozone treaties. It is not just “Groundhog Day” but turning into another comedy of chaos. Read our Blog for Film: “Eurozone Greek Tragedy Not in Final Scene”

Ambassador Muhamed Sacirbey - FOLLOW mo @MuhamedSacirbey

Facebook-Become a Fan at “Diplomatically Incorrect”

Twitter – Follow us @DiplomaticallyX

For many further current news event articles, see our popular video blogs at “International Financial Crisis” Channel