As many contemplate and more than few mourn, Wall Street will look to immediately translate Steve Job’s passing into calculations of Apple company’s future and current stock price. Depending on the day, Apple is the largest company on the globe by equity market value or close to it.

Willingness to Take a Risk & Record of Success to Deflect Detractors:

Steve Job’s was not unique merely because of talent and vision but courage and success. In order for vision to be realized and new products/services developed, it is frequently decisive that the person standing behind the innovation have a record of success and have survived intermittent failure. That is what provides self-assurance to push ahead and confidence to others to follow. Risks are necessary and proven risk takers are decisive. (Not compare directly my career to Steve Jobs, as a very young Senior VP and department head in investment banking I was told by a senior bank executive that he was not certain that my proposal was best but that my record of success and persistence in the face of obstacles that convinced him to support it). So many of Apple’s great success had been initially labeled by technology and finance experts as big mistakes.

Apple will be in good shape for the next few years at least as Steve Jobs and his team had set into motion development and product lines for the intermediate future. However, will there be credibility and/or courage to address unexpected challenges and chart the course to reflect new opportunities as well as risks without the confidence, willingness and record of Steve Jobs? That will only become known over several years, and the track record of successors will set the trend for either more caution or greater vision. For technology companies, innovation as well as critical mass are proving essential as part of not only profitability but survival. (The current woes of RIM -“Research in Motion” – are only the most recent example).

The Halo & Rapid Rise from Financial Crisis Ashes:

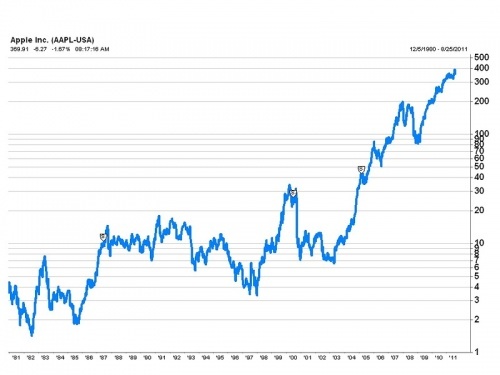

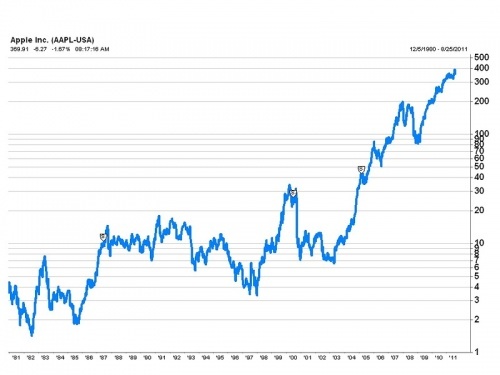

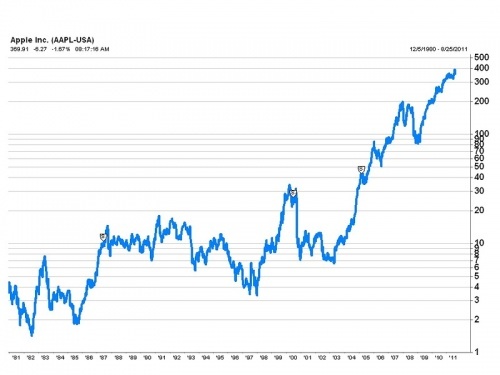

For nearly a decade, I have been a proponent of Apple as technology and stock. It became evident that it was embarking upon a fundamental strategy of connecting its product lines into what some called a “halo” – the popular appeal of the I-pod designed specifically for music would lead users to try out other then current products as the MAC or yet to be delivered innovations as the iPhone or iPad.

Apple was also one of the most prolific performers after the 2008-09 crash. It hit a low, (which ironically coincided with Steve Job’s first leave of absence announcement) in the mid $70s. In the last few weeks it had traded over $400.

The stock value of a company is based on several factors. The most critical are earnings and its price to earnings multiplier (or defined by PE ratio). The latter reflects beyond current earnings but future potential. Innovation and technology have generally fueled higher expectations and thus PE ratios.

The expectations for Apple had already incorporated Steve Job’s absence, at least since his illness became known and subsequent retirement took effect. Thus, the question is how much is already cooked into the current stock valuation. What cannot be yet valued is the absence of Steve Job’s vision and willingness to take a risk, if not as a CEO but as the founder and most important shareholder.

Apple’s Community of Innovators & Developers:

Another perhaps critical element of Apple’s success is not even within the Apple corporation. Rather, much of the innovation is being undertaken by independent enterprises, medium and small sized tech companies and even individuals who develop off the Apple platform, from applications to training of customers. All of these enterprises and individuals also look to leadership and confidence at the top. Risk takers respect other successful risk takers.

Willingness to Take Calculated Risk Followed Through by Exceptional Execution:

Apple shares this morning moved relatively little in response to Steve Job’s passing. That was already being incorporated into current valuations for some time. However, it is more difficult to assess what longer term market thinking has or not been cooked into Apple’s stock price. Share prices represent an amalgamation of information and views largely indistinguishable in their impact.

Apple’s success impacts equity values but also creation, innovation and also success at many related enterprises. The situation will take some time to become more clear, and it will relate more to decisions about future strategy rather than implementing that what has been set in motion during Steve Job’s tenure. I’m still a believer, due to momentum and what I perceive as the corporate culture that is also part of Steve Job’s legacy – calculated risk followed through with exceptional execution.

ARTICLE -“Steve Jobs: 1955-2011”

diplomaticallyincorrect.org/films/blog_post/steve-jobs-1955-2011-not-the-story/35822

By Ambassador Muhamed Sacirbey

Facebook – Become a Fan at “Diplomatically Incorrect”

Twitter – Follow us at DiplomaticallyX

International Financial Crisis Channel -

diplomaticallyincorrect.org/c/international-financial-crisis