Image Credit: @artbytes via Bitlanders

Introduction

Last year, I passed the licensure exam for Variable Universal Life given by the Philippine Insurance Commission. Passing the exam makes me a licensed Financial Adviser. Currently, I am under the only Filipino-owned Insurance company in the country, Insular Life.

Variable universal life insurance (VUL) is a form of cash-value life insurance that offers both a death benefit and an investment feature.

-reference: https://www.investopedia.com/

Financial Advisers focuses on investments that come with insurance. Unlike traditional life insurance, the potential growth of a policy owner's investment in VUL could grow along with the country's inflation rate.

I admit though, that I am not good as a salesman. However, my main purpose is to learn how to manage my personal finance and share what I have learned to my friends.

One of the important things that I have learned is the necessity of having personal savings and how to invest my savings that could potentially grow from 4% to 20% (or more) annually.

Three-part Blog

At the moment, I came up with an outline for this blog series. This will be at least a three-part blog. My aim is to share with you how to start saving and investing for your future.

- Are You Saving For Your Future?- Include the following sub-topics:

- The Rate Race -The financial situation of common people;

- Why Save? -The importance of having personal savings and saving for the future; and getting out of the rate race.

- How to Start Your Saving Habits and Increase Your Income - Tips that will help you start saving for your future.

- Saving For Your Future - Tips on where to invest your money and some caution on so-called "Investments".

What Do You Do With Your Earnings?

We all want to earn money. Who doesn't? You are here in Bitlanders to earn extra money, right? Question is what do you do with your earnings?

Whether you earn from your 9 to 5 job or freelancing services, what do you do with your income? Before you answer that, let me share with you this short film by Steve Curtis.

Video Credits: Happiness by Steve Curtis via The SCRAMBLERS @YouTube.

The Rate Race

There are lots of lessons to be learned from this video, some are quite obvious, some are quite sublime. Nevertheless, it shows the situation and lifestyle of a common employee and the bad side of getting into the rat race.

A rat race is an endless, self-defeating, or pointless pursuit. It conjures up the image of lab rats racing through a maze to get the "cheese" much like society racing to get ahead financially.

-Source: Wikipedia.org

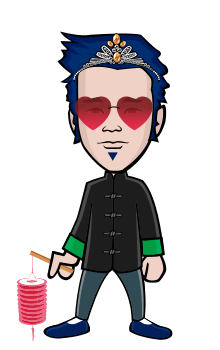

Payroll to Payroll Cycle of A Typical Employee

Life Cycle of a Typical 9 to 5 Employee Living From Payroll to Payroll

Image Credit: @Artbytes Via bitlanders

The image above shows the life cycle of a typical employee who works 8 hours a day.

- Work from 9 to 5. Here in the Philippines, it's 8 to 5 with 1-hour lunch break.

- Receive his/her salary during payday.

- Pay utility bills, buy groceries, sometimes, new clothes, etc...

- Spend for daily expenses like gas or transportation fare, lunch, snacks, vice, etc..

- On or before the next payday, there is nothing left to save.

- Then go back to daily work and wait for the next payday.

Sounds familiar? I know that most of us, except for the very fortunate few, went through this cycle. I went through this cycle. To be honest I am not fully out of this cycle yet. Some, however, are in the far worse situation than this.

Some, without even knowing it, are now deep into the rat race!

How To Join The Rat Race.

Sadly, joining the rat race comes naturally for most us. Without even thinking about it, we involuntarily join the rat race! It's almost our natural instinct that once we got a job, we dive right in this undesirable race. It is definitely a race that you don't want to join in the first place. Once you are in, it is not easy to get out.

The Rat Race

Image credits: original clipart is from Clipart Library. Layout by @artbytes for Bitlanders

What Forces Us Into The Rat Race?

Unfortunately, it is our uncontrolled spending habits that force us to join the rat race. Most of us were never trained at home or even in schools on how to save.

We have a tendency, or an urge even, to spend every centavo we have. Sometimes we buy things that we don't even need. The problem is, we often don't know the difference between 'needs' and 'wants'.

We sometimes buy things that we don't need.

Image source: clipart library

Americans spend all or most of their income on things that have little or no lasting value.

-source: www.inspirational-quotes.info/money.html

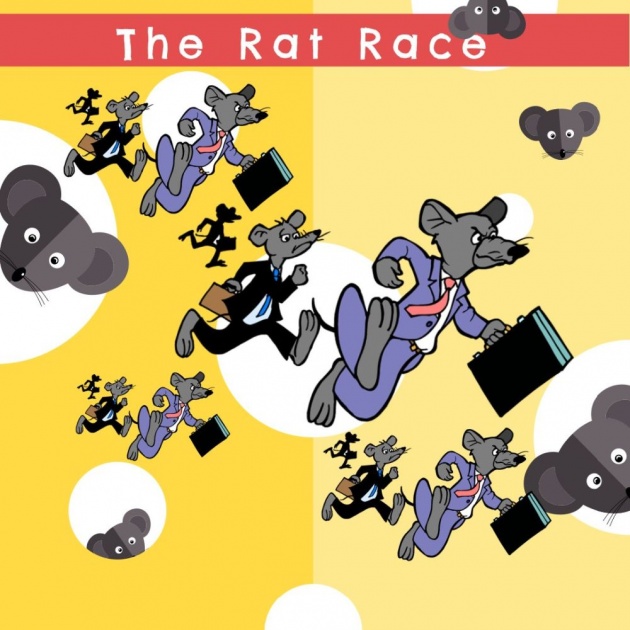

Typical Spending Habits

Infographics: Typical Spending Habits

Image Credits: Created by @artbytes for Bitlanders

The image above shows our typical spending habits.

- We work from 9 to 5, 5 to 6 days a week.

- Payday - We receive our salary.

- We pay the bills and buy our groceries.

- As days go by, we spend for lunch, transportation, and other small expenses every day.

- Before the next payday, we have ZERO cash left.

- We resolve into borrowing money or using credit cards.

- Using the loaned money or credit card(s), we buy new gadgets, appliances, clothes, etc... Sometimes we buy things we don't even need.

- Payday comes again, and we receive our salary

- This time aside from the utility bills, and groceries, we now have to pay our debts.

- Since our expenses now increased because of the debt payments, we now have less money.

- In order to have money for our daily expenses until the next payday, we borrow some more money.

- Then it goes on and on in a vicious cycle... This is 'The Rat Race'!

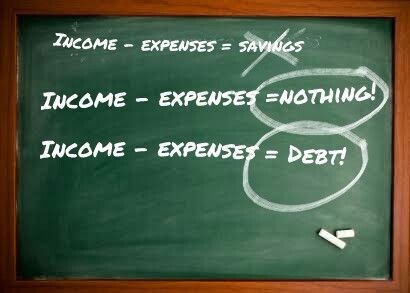

To translate this spending habit into a mathematical equation:

Income - Expense = no savings

Image Credit: by @artbytes- originally posted on http://palaguinangperamo.blogspot.com

The formula is shown above is simple.

- If your expenses are less than your income then you will have savings. However, it is not the case for most of us.

- If the expenses are equal to your income, then you will have no savings.

- This is the dangerous situation. If your expenses are greater than your income, you will get into debt! Then the cycle begins.

A Vicious Cycle

You would be one of the fortunate few if you did not experience this. For sure, however, you know someone close to you who had or have this spending habits. Personally, I had experienced this, but not too deep into it, that I found a way out.

However, I know some people, who earn much more than I do per month, who accumulated more debt than their annual income. Some even work abroad and earn 5 to 10 times more than I do.

The danger of this spending habit is, the bigger your income, the bigger your expenses become. Thus, no matter how much you increase your income, you will have always have a tendency to spend more! Nothing changes expect for accumulating more debts.

The worse thing is, they don't know how to get out of their situation. Much worse is, some of them resolve to borrow money to pay their other debts. Just imagine then the accumulated interests on their debts. It's a vicious cycle.

Image credits- The Modern Rat Race by Stuart Roger Miles via Pixabay

Are You In the Rate Race?

At this moment, I would ask you to take a pause and assess your own financial situation. Let's have a little activity and answer these questions.

- Are my expenses more than my income?

- Have I bought, and keep buying things that I never or seldom used?

- Have I bought things that I could not afford and used my credit cards or borrowed money to buy them?

If your answer to at least one of the three questions above is 'YES', chances are you are already spending more than your income and you are already in the Rate Race. If all your answers are 'No' then good for you, leave a comment below saying 'No, I'm not overspending.' and I wanted to interview you how you are doing it and we could share it with our fellow Bitlanders.

List Down Your Expenses

Are you making a list of your daily expenses? Are you aware where your money has gone to? If no, get a notebook or download Evernote or other expense tracking apps on your phone or tablet and start making a habit of listing down your expenses. I know this is easier said than done. But this is important if you want to manage your money effectively.

Start the habit and start now.

Use a notebook or an app (Evernote) to list down your daily expenses

Image Credit: @artbytes

Get Out of the Rat Race and Start Saving

First of all, you don't want to get into the rat race. However, if you are already in it, you have to find a way get out of it! I can give two of reasons why you need to get out of the rate race.

- If you are in the rat race and can not get out, you will just be buried deeper and deeper in debts. By the time you retire, a large portion of your retirement pay might just be spent to pay for your accumulated debts.

- It is most likely that you will continue with your spending habits. If you do that, how long do you think your retirement pay last?

If those two reasons are not good enough to convince you to find a way to get a way out of the rat race, think of good reasons why you want to start saving for your future.

Start With Why

Just as I have shared in my previous post (My Goals for 2018), let us follow the suggestion of inspirational speaker Simon Sinek and let's start with why.

Your reasons might be different from mine, but I will list down here at least four of my reasons why I wanted to save for my future.

- I intend to retire in ten years. By that time, I wanted to have at least PHP 10M in my investment portfolio that gives me an average interest of 10% annually. That interest alone is enough to sustain my simplified lifestyle each year.

- Since I am retired at that time, I can spend more quality time with my family.

- In case of medical emergencies within my family, I will have enough funds to cover the hospital bills.

- Even before I retire, I want to have enough savings to take my family to a once a year vacation on other places.

In one of the talks of my favorite Filipino preacher and inspirational speaker Bo Sanchez, you should find your 'emotional why'.

Write Down Your Emotional Why

"You need a fierce emotional reason to become wealthy — or it won’t happen. Here’s why: We make choices based on emotional reasons, not logical ones. (Oh yes, after the choice, we justify with logical reasons. But the initial reason is always emotional.) The reasons must always come from the heart, not just from the brain."

-Bo Sanchez

To emphasize my point, my emotional why boils down to my love for my family and for the security of their present and future.

Again, pause for a few minutes and think of your 'emotional why' and list them down.

How to Get Out of the Rat Race

Now that we have taken care of the "Why" let's go to the "How".

I will go staight to the point. The only way to get out of the rat race is to change your spending habit into savings habit!

Again our spending habit is:

Income-Expense= Savings

Where savings could be usually equal to or less than zero. Depending on the amount of your expenses. To start a savings habit, it should be.

Savings formula as suggested by various financial gurus.

Image credit: by @artbytes originally posted on palaguinangperamo.blogspot.com

How Much Should You Save?

The formula above suggests that once you receive your income, wether from salary or freelancing services, you should set aside a certain amount. The question is, "How much should you save?"

In his book, The Abundance Formula, Bo Sanchez suggests that we should set aside 20% of our income to our savings. That 20% percent is actually taken from the Bible.

Let Pharaoh appoint commissioners over the land to take a fifth of the harvest of Egypt during the seven years of abundance. They should collect all the food of these good years that are coming and store up the grain under the authority of Pharaoh, to be kept in the cities for food. This food should be held in reserve for the country, to be used during the seven years of famine that will come upon Egypt, so that the country may not be ruined by the famine.”

Genesis 41:34-36 NIV

https://bible.com/bible/111/gen.41.34-36.NIV

"Take a fifth of the harvest" - A fifth of course is equal to 20%. It is also stated in this verse the purpose (or the why) of setting aside the twenty percent - as a reserve and to be used during the famine. I would like to note that the 20% were taken during the seven years of abundance. Which means during those years, Egypt was producing and harvesting more than usual. Thus the 20 percent that was collected and reserved was more than enough to cover their needs during the seven years of famine. I will go back to this point on the next installment of this series.

The Abundance Formula by Bo Sanchez

Image credit: Kerygmabooks.com

You might be wondering what those numbers "100-10-20-70" on the book cover is all about. One thing for sure, it is not the next winning lotto numbers. Let me re-write those numbers into a mathematical equation.

100-10-20=70

Let me translate it further into a formula

Income - tithe - savings = expenses

Meaning, once you receive your income (from salary or freelancing gig, or from your Bitlanders earnings), the first thing you do is set aside 10% for your tithe (which literally means 10%). Then set aside 20% for your savings. The remaining 70% is for your expenses.

If you were like me when I first saw this formula, your reaction would be...

WHAT!!!!???? LIVE ON 70% OF MY INCOME?!?!?! I can't even make ends meet with 110% of my income!

And probably you are thinking of 101 reasons that living on 70% is impossible. The truth is, I agree with you. Or rather, I agree that living on 70% is difficult but NOT impossible. There is a two-step solution for this predicament.

- Simplify your lifestyle and cut down your expenses.

- Get a second job as discussed by @Sharon-Lopez in her blog post "Why Do We Need a Second Job"

I will discuss these two on the next part of this series. For the meantime here is a short video that more or less sums up this post plus 5 tips on how to start saving money.

How To Save Money Fast

Video CRedits: by Project Better Self Via YouTube

Thanks for reading. If you have questions or reactions, I would be glad if you write them on the comments below.

- o0o -

If you have not joined Bitlanders yet and you are a content creator- a writer, blogger, photographer, an artist or a hobbyist, you can earn from your creations by uploading them in Bitlanders. Join now by clicking here.