Moving eastward to Asia is part of already visible economic trend, but it is also toward US and away from Europe’s long standing financial giants. Beginning of this week, Standard & Poor’s downgraded a large swathe of bigger US and European banks. At the same time, some of Asia’s, particularly China’s banks were upgraded. Bank of China is now the globe’s largest bank. However, perhaps noticed is the shift from European to US banks.

More Capital Lower Credit Rating?

The downgrades ironically occur as the Financial Stability Board, (FSB), a regulatory arm of the G20, along with the Basel Committee on Banking Supervision has pressed forward for a designation of “Too Big to Fail” list of banks (29 so far and mostly in Europe and US but also including Bank of China), which would require higher capital requirements. Read: “29 Banks Too Big to Fail” -

diplomaticallyincorrect.org/films/blog_post/29-banks-too-big-to-fail-by-ambassador-mo/40678. Although Japan’s banks can be seen as more aligned with recent history/model of US and European banks, geographic proximity will apparently now favor them being increasingly seen in broader context of Asia.

Opportunity Moving East:

S&P though offers a rationale that perhaps is even more disconcerting for the Atlantic economies – the longer-term prospects are brightest in the lands of the rising sun. Bank health and profit prospects in other words are just following where growth is expected to be highest over foreseeable future. Further, the business model employed by US and European banks over more than a decade and dependent on trading and capital markets activity is under attack from regulators, markets and to a degree an angered public after the failures of the 2008 financial crisis. There is even pressure for a “financial transaction tax” to further slice into profits – although such appears more remote now – Read: “Why Financial Transaction Tax” -

diplomaticallyincorrect.org/films/blog_post/why-financial-transaction-tax-money-flash-by-ambassador-mo/40599

A Shift from Europe to US?

Less noticed perhaps has been the underlying shift in the corporate lending/loan syndication business just over the last few months. Same time as European banks have been shedding assets, US and other global banks have been adding to their balance sheet. It is no secret that European banks have been selling sovereign debt in almost fire-sale type style. Many such Euro banks are also more closely associated with the state/government of their home base. Read: “European Banks Shed Sovereign Debt” -

diplomaticallyincorrect.org/films/blog_post/european-banks-shed-sovereign-debt-by-ambassador-mo/41642.

Most notable of longer-term business indicators, European banks shed 6% of their share of the corporate syndication business. However, it appears mostly US based banks stepped in to fill that void with a 6% rise in the comparable period. This is not only the “bread & butter” of the banking profit model, but it also reflects relationships among boardrooms at the top.

A few possibilities that may be considered behind the headline trends:

---Asian banks may be experiencing a boom reflective of the economic center of gravity shifting eastward, but they may not be as well established with the traditional multinational relationships and global corporate syndication business.

---The S&P downgrades, with all due respect to my old employer, may be an overstatement. As US and European banks add capital and revert to more traditional businesses, this may make them more boring but also more stable – despite less risky business lines such may provide more durable and overtime profitable returns. It may not be a bad thing for the underlying economies where such banks are dominant if they return to more banking rather than trading focus.

---The more fundamental shift may be from Europe to “New World” – both South and North America – as Europe’s ongoing structural problems dominate perceptions, potential and actual growth.

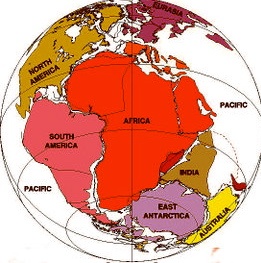

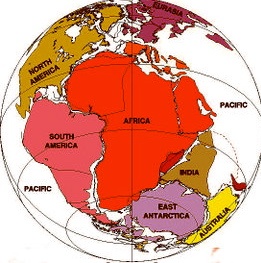

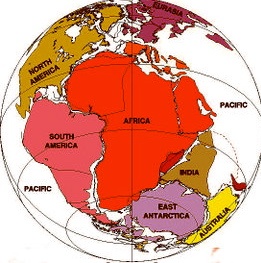

---There may also be other evolving pockets of opportunity: Australia - Middle East, Central Asia and Turkey - India and Indonesia (the latter 2 perhaps developing an economic path more independent of China’s dominance). Each of these has a slightly different rationale behind its potential: from commodity driven to vast financial liquidity (including Islamic banks) to domestic demand of rapidly growing and evolving populations (India, Turkey and Indonesia – latter recently cited for broad upgrade possibility to investment grade). The trends and dynamics are considerably more complex less in any single or tidy direction - but banking Pangea it no longer is.

By Ambassador Muhamed Sacirbey

Facebook – Become a Fan at “Diplomatically Incorrect”

Twitter – Follow us at DiplomaticallyX

International Financial Crisis Channel -

diplomaticallyincorrect.org/c/international-financial-crisis