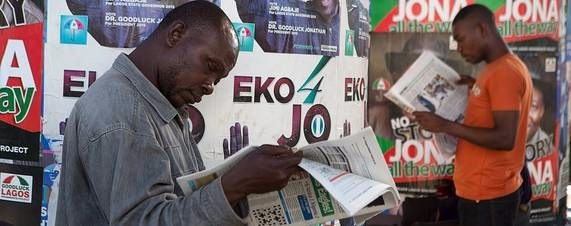

- Men read newspapers in front of electoral campaign posters in Lagos, the largest city in Nigeria, this past spring.

- Reuters

Welcome to BitBeat, the latest in cryptocurrency news and analysis.

Bitcoin Latest Price: $374.81, up 0.4% (via CoinDesk)

Crossing Our Desk:

- BitPesa, the two-year old Kenyan startup that offers money-transfer servicesover the bitcoin network, has expanded into Nigeria and Uganda, marking the third and fourth countries in which it operates. It started operating in Tanzania in the spring.

BitPesa is an interesting firm to follow. There’s been a lot of interest in bringing bitcoin into the emerging markets, and tapping the billions of people who are considered “unbanked.” But actually building a sustainable business is harder than it seems. There have been myriad bitcoin startups trying to crack this market around the world over the past two years. Some, like 37coins, which shut down this summer, have found building a money-transfer business harder than expected.

Entering Nigeria puts BitPesa into the continent’s largest economy. At $568.5 billion, Nigeria is nearly ten times the size of Kenya’s $65 billion economy. And while it has its share of problems like many frontier markets, and its own share of the unbanked, it also has tens of millions of people who live in cities and have access to banking services, and build businesses like in any other nation.

It is that market, the business sector, where BitPesa is finding its growth. BitPesa began as a service aimed at consumers, but it’s growing as a service for business. “Nearly all (at least two-thirds) of our customers are using BitPesa for business needs,” said CEO and co-founder Elizabeth Rossiello via email, “such as salaries, suppliers or operations. There are very few people transacting for basic livelihood needs, such as food or rent.” This is where the company is focusing its efforts now.

BitPesa’s service was first aimed at a single corridor of the remittance business: Kenyans living abroad in the U.K. It has built up its customer base by going into the diaspora community and building ties. The company is seeing double-digit sales growth this year, Ms. Rossiello said.

The growth is coming from new directions, though. What BitPesa is finding is that there’s demand for its service among businesses, especially businesses working for foreign suppliers that need to move money across borders. The firm, which has operations in the U.K. as well, applied for and received a license from the U.K.’s Financial Conduct Authority to become a payments services institution, meaning it operates under the same rules as traditional money remitters and nonbank credit-card issuers.

The firm has raised $2.7 million in total funding, including $1.1 million earlier this yearfrom a group that included Pantera Capital. It was founded in 2013 by Ms. Rossiello and Duncan Goldie-Scot, a well-known veteran of the microfinance sector.

UPDATE: BitPesa has raised $2.7 million to date. An earlier version of this post incorrectly said it was $1.7 million.