China shares fail to lift on the central bank's rate cut

Chinese shares continued to lose ground despite the central bank's latest effort to reassure traders.

The mainland's benchmark Shanghai Composite was down 1.1% to 2,930.23 points after a volatile open earlier.

The index had already fallen about 16% this week, sending shockwaves through global markets.

The dramatic losses and volatility in China has shattered investor confidence and led to sharp falls in Asia and the US over the past days.

On Tuesday, China's central bank cut its key lending rate by 0.25 percentage points to 4.6% in an effort to calm stock markets after the past days' turmoil.

It is the fifth interest rate cut by the People's Bank of China since November last year.

Hong Kong's Hang Seng index fared only slightly better than the mainland, shedding 0.3% to 21,328.55 points.

China economy woes

Chinese shares had experienced a year-long rally - mainly fuelled by investors borrowing money to buy shares - which came to an end in June.

The Chinese government then intervened in financial markets to try to maintain momentum in the economy.

Two weeks ago the central bank devalued the currency, the yuan, to boost exports - this raised fresh concerns that China's economy could be in worse shape than previously thought.

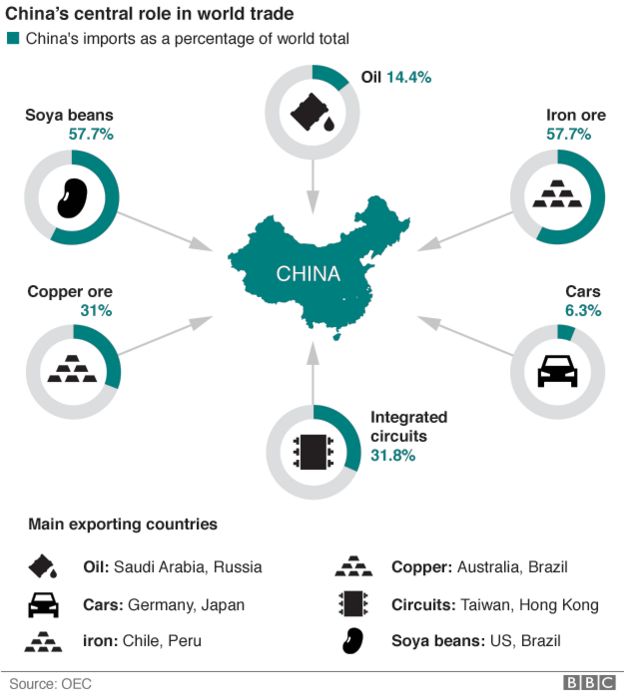

Given China's central role in world trade, a slowdown in the world's second largest economy would likely reverberate around the globe.

Read more: The six Cs of the China stock slump

The stocks fall in facial expressions

Cautious optimism elsewhere

Elsewhere in Asia, the region's largest index, Japan's Nikkei 225 edged higher on Wednesday, up by 0.4% to 17,877.49.

The Nikkei's gains come after a painful week for the Tokyo index which had shed more than 8% in the past two sessions.

South Korea's Kospi index was also in positive territory, trading 1% higher at 1,865.54 points while in Australia, the S&P/ASX 200 failed to make any gains but instead fell by 0.5% to 5,110.10.

Overnight, European and US markets saw another session of volatile trading.

- Wall Street's Dow Jones closed 1.3% down, marking the sixth consecutive day of falls for US stocks.

- London's FTSE 100 index closed up 3%.

- Major markets in France and Germany both gained more than 4%.

Read more from our experts:

Robert Peston: Why is the FTSE 100 shrugging off Shanghai Noon?

Duncan Weldon: What next for the global economy after China market woes?

Andrew Walker: How the China share slump affects the rest of the world