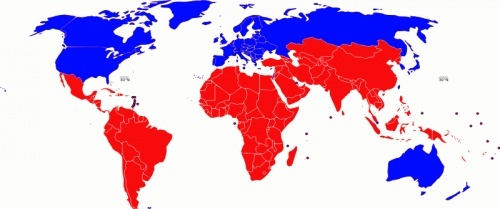

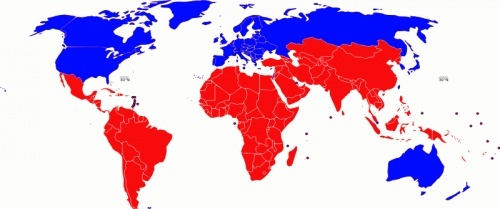

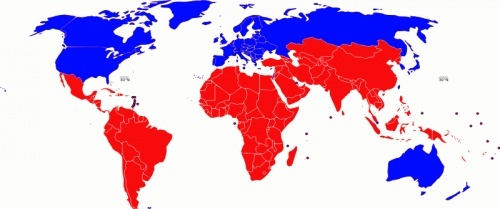

Developing and transition economies were the source of most of the global foreign direct investment (FDI) last year, with 70 per cent of their investments flowing to other emerging economies, according to the United Nations Conference on Trade and Development, (UNCTAD)a UN agency that promotes the integration of developing countries into the world economy.

“When US Sneezes, rest of World Catches Cold!”

The traditional model was funds flowing from more mature developed economies to the newer emerging, developing economies. When a financial or economic crisis hit, funding was quickly sucked out of these emerging markets leaving those economies in even more dire condition than the mature economies. Thus, the expression: “When the US would sneeze, the rest of the world would catch a cold.”

The last such cold or displacement occurred in the late 1990’s when the “Asian financial crisis” struck leaving many of the “smaller tigers” in decline mode for years. Some only recovered in the last few years.

China to Brazil to Turkey

The game appears to have now dramatically changed. China is the largest foreign holder of US debt. More to the point though, it was China that led the globe’s recovery back from the 2008-2009 recession. Did China even experience a recession? China’s impact also kept many of its neighbors from falling into any extended recession.

China was not the only miraculous recovery, from Brazil to Turkey, this last recession was felt most in the mature economies, those most dependent upon them (“New Europe”) and those still looking to emerge. Commodities of course played a role, but Turkey is an example of growth that more resembles a consumer/industrial production economy.

Shifting Investor Preferences

From the UNCTAD Report – Summary: “as developed countries continued to confront the effects of the global financial crisis, many transnational corporations (TNCs) in developing and transition economies invested in other emerging markets, where recovery was strong and the economic outlook better, according to the Global Investment Trends Monitor of UNCTAD. An estimated 70 per cent of investment by developing and transition economies were directed towards other developing and transition economies, compared with developed countries whose share was about 50 per cent.

Overall, global FDI outflows rose last year to an estimated $1,346 billion compared with $1,189 billion the previous year. The rise reflected an improvement in corporate profits and the increasing internationalization of TNCs, according to the UNCTAD data. The statistics also indicated that the global financial crisis caused firms to rationalize their corporate structures and increase efficiencies, often by relocating business functions to areas where they could take advantage of lower costs.

After a temporary setback in 2009, FDI flows from developing countries reached an estimated $316 billion in 2010, 23 per cent more than in 2009. A strong rebound of outward FDI flows from Latin America and the Caribbean and developing Asia more than offset the decline of outflows from Africa and West Asia.

Flows of FDI from Africa declined further last year and UNCTAD estimates its value at $4 billion, barely one per cent of the developing economies’ total, down from $4.5 billion in 2009. Outflows from the two major outward investors, Libya and South Africa, which together accounted for more than half of the regional total in 2009, fell significantly. Outflows from Egypt, however, more than doubled, to $1.2 billion.

Outward FDI from South, East and South-East Asia rose by more than 20 per cent in 2010, particularly from Hong Kong (China), China, the Republic of Korea, Taiwan Province of China and Malaysia. Outflows from the region’s two largest FDI sources – Hong Kong (China) and China – rose by more than $10 billion each, reaching estimated historical highs of $76 billion and $68 billion respectively. Chinese companies continued to be on a buying spree, actively acquiring overseas assets in a wide range of industries and countries, according to the UNCTAD survey.

FDI outflows from West Asia dropped to near zero last year, due to mainly to large-scale divestments by West Asian firms from their enterprises abroad. The largest divestment deals included the $10.7 billion sale by Zain Group (Kuwait) of its African operations to Bharti Airtel (India), and the $2.2 billion sale by International Petroleum Investment Company (Abu Dhabi’s sovereign wealth fund) of a 70 per cent stake in Hyundai Oilbank in the Republic of Korea.

Latin America and the Caribbean was the sub-region with the strongest increase of outward FDI flows in 2010 mainly due to the surge in cross-border mergers and acquisitions. The region’s TNCs, bolstered by strong economic growth at home, increased their acquisitions abroad, particularly in developed countries where investment opportunities have arisen in the aftermath of the financial crisis, according the UNCTAD investment trends monitor.

Last year’s FDI outflows from developed countries rose to $970 billion, an increase of 10 per cent over the previous year. The increase was only half of the peak level recorded in 2007, the year before the financial crisis set in. The limited recovery was made possible by an unprecedented amount of cash on TNCs’ balance sheets and historically low rates of debt financing. UNCTAD noted that the with the global economic recovery gaining strength, rising stock market valuations and rebounding corporate profits of TNCs, FDI outflows are expected to continue rising in this year.

“Ongoing corporate and industrial restructuring and a new wave of privatization in some countries with empty State coffers in the wake of the financial crisis are creating new investment opportunities for cash-rich companies in developed and developing countries,” the survey pointed out, adding that emerging economies, particularly Brazil, China, India and Russia, have gained ground as sources of FDI in recent years.

More Related Reports:

International Financial Crisis Channel at Diplomatically Incorrect –

diplomaticallyincorrect.org/c/international-financial-crisis

Including: “Fickle Capital Flows – IMF Report”

diplomaticallyincorrect.org/films/movie/high-oilfickle-capital-flows-imf-study/26164

IMF World Economic Forecast –First Quarter) -

diplomaticallyincorrect.org/films/movie/imf-world-economic-forecast2-speedsss/24257

By Ambassador Muhamed Sacirbey

Face Book at “Diplomatically Incorrect”

Twitter - DiplomaticallyX