Do you know how much Will you need when you retire? Many of us, including myself, never think of how much do we need when we retire. Especially for us who belong to the generation-x. Thus we just take what the company and the government offer as a retirement plan. The question is, "Are they enough when you reached retirement age?"

No retirement in sight?

Video Credit: The National Via YouTube

No Retirement Plan

Sadly, many people who now reached retirement age don't have enough savings and investments that could sustain their financial needs once they retire.

Here in the Philippines, the retired parents who don't have enough ends up being dependent on the support of their children. Some continued to work, a few ended up in a home for the aged.

This is a sad picture for those who retire without investments. For the generation-x and millennials, however, there is enough time to prepare for your retirement. But perhaps the big question is, do you know how much you need when you retire?

In this post, I will share with you how to determine how much savings do you need when you reach retirement age. I will use two generations as examples in this post, the generation-x, and the millennials. With the help of Financial Calculator App (available in Android, iOS, and Windows Mobile), we will compute how much do we need in order to sustain our lifestyle when we reach retirement age.

How To Determine How Much You Need For Retirement

Image Credit: @geralt via Pixabay

In order to determine how much you need for your retirement, the first thing you need to do is know how much you are spending annually. To do this, you must make a list of your average monthly expenses. Then multiply it by twelve then add the non-monthly expenses like house maintenance, vehicle maintenance, a yearly vacation, etc.

Common Expenses

Just to give you an idea, here are some items that you need to include in your monthly expenses:

- Food

- Bills and Utilities (electricity. phone bills, water, etc…)

- Mortgage (vehicle and real estate)

- Gas and transportation

- Groceries

- Children's allowances (assuming you have kids)

- Entertainment (movies, DVD's, liquors, cigarettes and other vices)

For your annual and other non-monthly expenses

- Education

- House and Vehicle maintenance and repair

- Vacation

- Clothes

If needed cut down your expenses by spending less on unnecessary pleasures, or simplify your lifestyle.

Example:

let's assume that in your household the total monthly expenses are $800.00 multiply by 12, you get $9,600.00.

Add the other expenses, let's say another $1,000.00. So your Annual expense is now $10,600.00

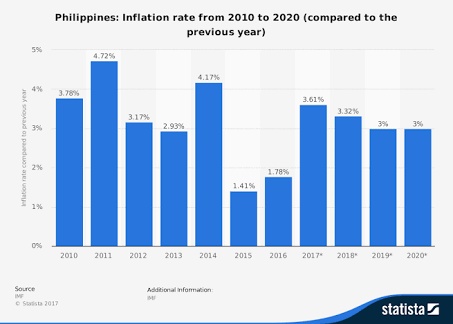

The next you need to do is determine your country's inflation rate, or better yet a forecast of it in the coming years.

Philippine Inflation Rate :

Source: https://tradingeconomics.com/philippines/inflation-cpi/forecast

In the image above, the projected inflation rate is projected to be around 2.80 percent by twenty. Presently, however, it is at around 3.5 percent.

When the inflation rate goes up, the buying power of your money goes down

With inflation, do you know how much a $1,000.00 expense would be worth in the next ten years? How about in twenty years?

considering the inflation rate of 3.5, if you are spending $1,000.00 today, in ten years it will be $1,410.60. In twenty years it will be $1,989.79! That's almost twice the amount.

How did it get that much? That's the magic of compound interest! With compound interest, the interest gained the previous period, will gain additional interest on the next period. In this example, the interest gains additional interest every year.

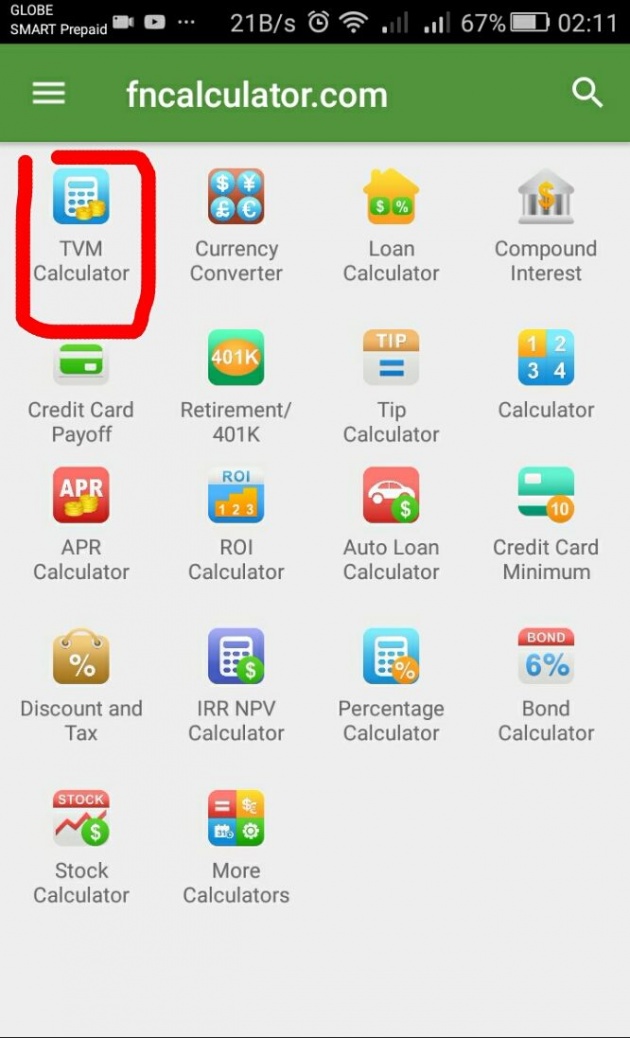

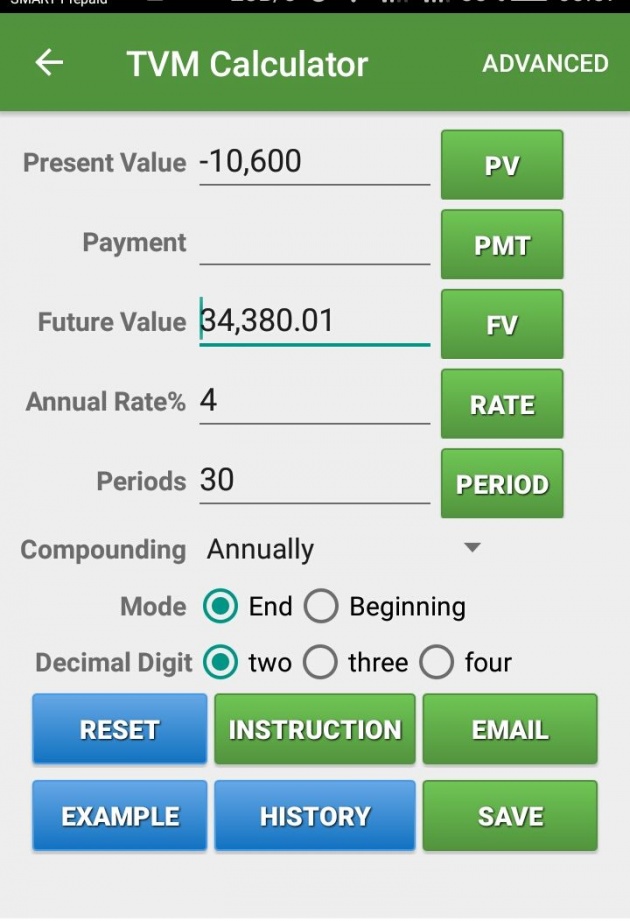

To show that using the Financial Calculator, I will use the TVM Calculator or the Time Value of Money Calculator.

Screenshot of the Financial Calculator App

Image Credit: @Artbytes via Bitlanders

Using the TVM Calculator

- Enter the Present Value: -1,000 (It has to be negative so that the result later will become positive)

- Annual Rate: 3.5

- Periods: 10

- Change the Compounding from "Monthly" to "Annually"

- Tap on the FV button

(See the image below)

Change the Periods to 20 and tap FV again.

Effects of Inflation

The example above shows the effect of inflation. We often ignore this but probably you have noticed that most of the items you buy today were worth half the price a few years ago, right?

Using the same process above, let us now compute for how much do we need to retire and how much do we need to save annually. We are now computing for the Time Value of Money.

This is a two-step process.

- We will compute the amount needed during the retirement age,

- We will compute the amount of annual savings that we need.

In this example we will use the information we assumed earlier;

- Annual expenses: $10,600

- Average inflation rate: 3.6

- Since inflation rate fluctuates, let's round the value up to 4.0 to be conservative.

For the Millennials.

Let's make the following assumptions:

- Current age: 25 Years Old

- Retirement age: 55 years old

- No of Years to retire (period): 30

Screentshot of TVM Calculator

Imag Credit: @artbytes via Bitlanders

Consider Life Expectancy

Using these values in the TVM Calculator, we get $34,380.01. That's how much you will be spending in a year after 30 years. But wait, you don't want to live just a year after retirement. The average life expectancy to date is 75. That means you have at least another 20 years to live! So assuming you no longer have any source of income after you retire, you are going to need to save $687,600 by the time you retire!

You might be thinking that divide this by 30 (years), you need to save $22,920 a year, and that's $1,910.00 a month! I have news for you, YOU DON'T!

How?Let's use the power of compound interest to our advantage this time.

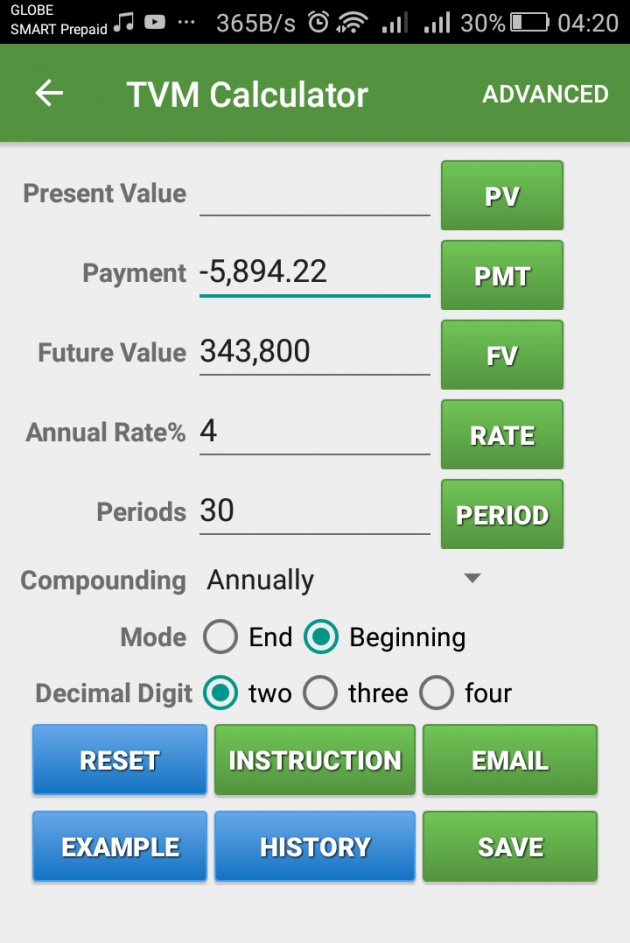

Instead of computing for 20 years after retirement, let's just use 10 years. That means we need to save at least $343,800.00 for our retirement. Not that we are going to live just 10 years after we retire, but again, we will use the power of compound interest to our advantage.

How Much Should You Save Each year?

Using the TVM Calculator again, let's compute the amount we need to save annually.

- Future Value: 343,800

- Annual Rate: 4

- Periods: 30

- Compounding: Annually

- Mode: Beginning

Tap on PMT: On the "Payment" you will get -5,894.22.

That means you need to save $5,894.22 a year. or $491.17 a month. Is the amount achievable or not?

Computing For The Monthly Savings Needed

Imag Credit: @artbytes via Bitlanders

By saving that amount annually and putting it on an investment that will grow at 4% a year, you will achieve your targeted retirement amount

Where to put your money:

The next question is:

"John, where will I put my money that will earn 4% a year?"

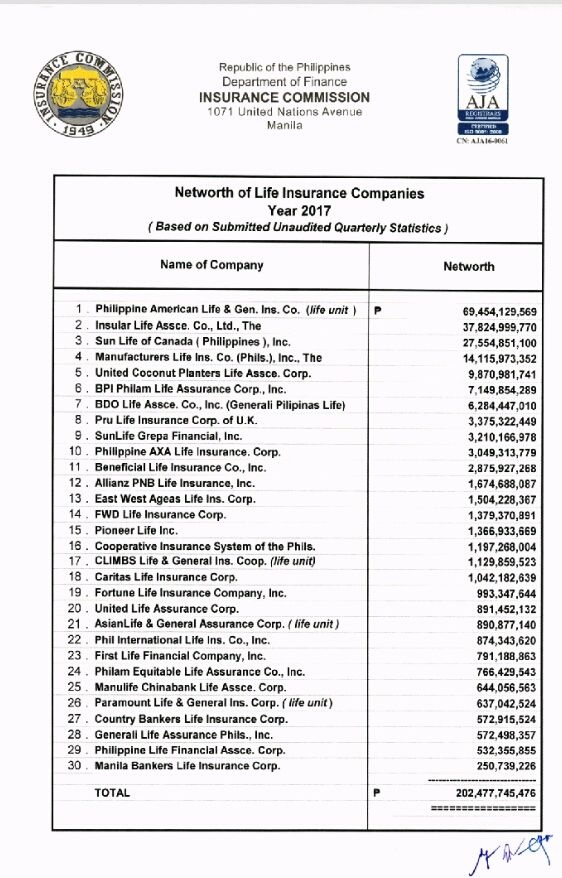

One thing for sure, banks can't give you that.There are investment companies that could actually give you more than 4% interest a year. To be safe check what insurance companies are available and reliable in your country. Go to the top 10 companies that are regulated by your government. Here in the Philippines, insurance companies are controlled by the Insurance Commission and the SEC. I'm not talking about the pre-need companies that made a fiasco in the past. They were not life insurance companies at all.

Networth of Life Insurance Companies in the Philippines

Source ( https://www.insurance.gov.ph/statistics/life/ )

Insurance With Investment

When contacting the insurance company, don't look for an insurance agent, look for a Financial Advisor. insurance policies have changed in the recent years. They are now offering insurance policies that come with investments. Ask for Variable Unit Link (VUL) products.

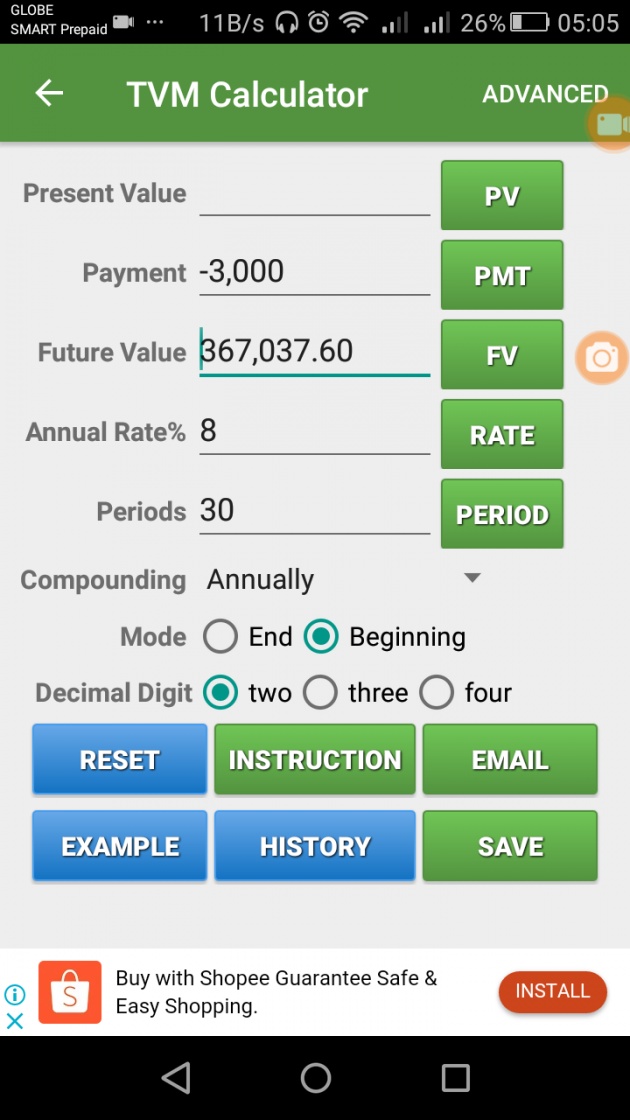

How Much Will You Get Overtime

Let's say you can't save $5,894.00 a year. Instead, you can save only $3,000.00 a year. The beauty of these investment plans is the interest rate also fluctuates but usually are higher than the inflation rate. If the fund managers are really good, the gain could be as high as 10% per year (or higher).

For the next example, we will use the following:

- Savings (payment): 3,000.00 per year

- Interest Rate or Rate of Return: 8

- Period: 30

- After 30 years you get: 367,037.60

That's even bigger than what you are preparing for.

Screenshot: Your 3,000 annual savings after 30 years

Imag Credit: @artbytes via Bitlanders

How do you make this amount last for more than 10 years?

That's the next question. Because the amount we computed for is only good for 10 years, right? Actually, we could make it last for more than 10 years, 20 even.

How? Again let us use the magic of compound interest to our advantage.

If your savings of $3,000.00 a year grew to $367,037.00 with 8% rate of return (or interest). You can let part of your money stay in that investment vehicle and let it continue to grow.

Note that your annual expense per year after you retire is:34,380.00. So we deduct that at the beginning of the first year. (This is not advisable but just to simplify the discussion, let's do that).

$367,037.00 - $34,380.00= $332,657.00

You let that grow for another year with 8% rate of return. After a year you get:

$332,657 x 1.08 = $359,269.56

Let's say your expenses next year grew due to inflation by another 4 %, that's 35,755.20

Repeat the process, and you will see that at after three years you still have more than $300.00 in your investment.

Money Wise Tips

Do you want to make your retirement last forever? Here are a couple of tips.

- Compute for at least 12 years. Assuming you don't change your lifestyle into a more expensive one, you will notice that you can live off the interest of your investment year after year.

- Earn more, save more and spend less today and you will enjoy your retirement even more. Instead of just saving based on your annual expenses, why not add a little more to your target amount. like 10 percent or 20 percent. And the growth of that extra 10 or twenty percent will give you the privilege of taking that out of the country dream vacations.

- Spend less than the rate of return during your retirement years.

For The Generation X

Those who belong in Generation X are already in their forties and fifties. Meaning they have a shorter period of time to prepare for their retirement. Most probably, they do not have the current means to save up more than $300,000.00 for their retirement.

If you belong to this generation, like I do, and have not started to save for your retirement yet, I got good news for you. You don't need to save that much.

How Much Should Generation X save?

Once again let's use our TVM Calculator. Let's use these number for our example

- Current Age: 50

- Age of retirement: 65

- No of Years to retire (period): 15

- Annual Expense: $10,600.00

- Inflation Rate: 4%

I'm afraid we may have to extend a few years before we retire. With these numbers, the annual expense during retirement would be: $19,090.00.

Multiply that by 10, you get: $190,900.00

Next, let's compute for the annual savings that we need to have in order to achieve this amount.

Since we have a shorter period of time to save up for this amount, we get $9,128.88 a year, or $760.74 a month. The numbers are quite high. This is the biggest disadvantage when you start late. However, some of you may already hold a high position in the company where you are working for and may be earning enough to save this amount.

However, what if you can only set aside $3,000.00 a month?

- Savings (payment): 4,000.00 per year

- Interest rate: 8

- Period: 15

- You get: 117,297.13

Though it's less than half our target amount of 190,900.00, that's still more than enough for your financial needs for a few years. And if you take a look at your list of expenses, there will be items there that you no longer need to spend on, like education, allowances, mortgages, etc... Also, you may already be spending less on vices.

Financial Planning In Your Fifties

Here's a YouTube Video that shows how to do it. Note that this is in U.S. setting but you can pick up a lesson or two.

Video Credit: Pure Financial Advisors, Inc. Via YouTube

Start as Early as You Can

I hope you realized one very important lesson here.

The earlier you save and invest your money, the more your money will grow.

Start saving and investing as early as you can. Even if you are still a student, you can already start.

Those who are in their forties or fifties, you can still start now. If you can find a financial advisor in your area, the better. Ask for the best options that will cater for your age and financial status.

A little bit of caution though. There will be someone who will offer you "investment schemes" that would promise you that you will double your investment in a very short period of time. Here's the rule of the thumb,

"If it's growing too big, too fast, then it's too good to be true!"

In my future post, I will be talking about some legitimate investments options and some indicators how to recognize the "get-rich-quick" schemes that could be a potential scam.

Disclaimer:

The values used here are all assumptions except for the inflation rate which is based on statistical data from the indicated source above.

The following interest rates are used in the examples as suggested by the Insurance Commission.

- Low: 4%,

- Medium: 8%

- High:10%

Investment gains or rate are not guaranteed. It may go up and down year after year but in the long term, the average will always show a positive gain.

Again the best way to enjoy your retirement is to save and invest now!

I Am Here to Help

As a Financial advisor, I am here to help.Though my knowledge and training is aimed limited to Philippine settings, I still might be able to give a tip or two. So, I would appreciate it if you ask questions through the comment section below.

Thanks For Reading.

Thanks for reading. But before you go, you might be interested on my other blog posts related to "Financial Literacy".

- 5 Things I Wish I Did in my 20s

- How to Improve Your Financial Literacy

- Are You Saving For Your Future? Part 1: The Rat Race

- Are You Saving For Your Future? Part 2: How To Start a Savings Habit

- Are Saving For Your Future: Part 3: Save For Your Future