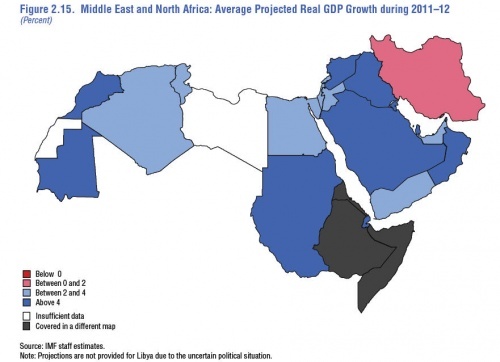

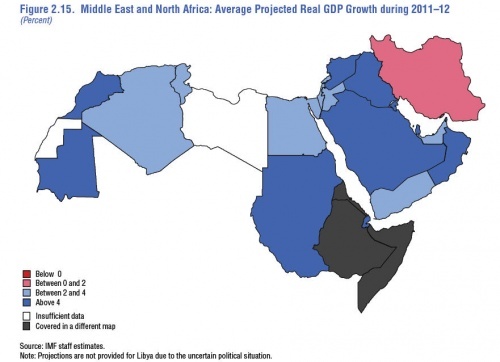

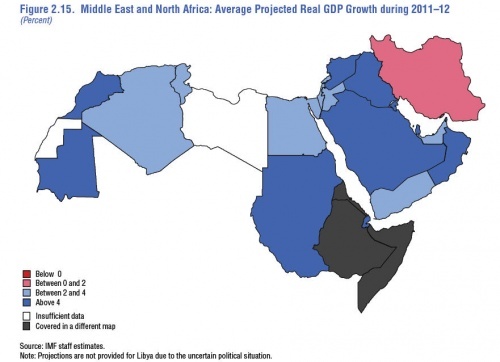

Economic fortunes differ, with oil exporters accelerating in growth on the back of higher oil prices for 2011 and oil importers seeing a dramatic downturn as the region faces heightened regional and global uncertainty according to IMF assessment. As a whole, the IMF’s Regional Economic Outlook for the Middle East and Central Asia, released October 26, projects growth in the Middle East and North Africa region at 3.9 percent in 2011, down from 4.4 percent in 2010. (ABOVE IMF Regional GDP Growth Map - From Summer/Spring 2011 Data/Projections)

Oil Exporters:

The region’s oil-exporting countries (excluding Libya) Algeria, Bahrain, Iran, Iraq, Kuwait, Oman, Qatar, Saudi Arabia, Sudan, the United Arab Emirates, and Yemen are forecast to expand by 4.9 percent in 2011, thanks to higher oil prices and oil production, before moderating in 2012.

---“Their overall growth rate is about 5 percent this year, driven in large part by the oil part of their economies, but they’re spending more as well and that spending helps their own economies, it helps the economies of their neighbors in the region, and it helps the rest of the world also by continuing to produce more oil. They have contributed to stability in global energy markets. The oil exporters in the region are doing well for now, but one issue which they do need to keep in sight is the fact that because they have been spending more over the last four years the break-even price for oil, which is the price at which their budgets balance, has tended to creep up and is now close to the current oil price for many countries in the region:” Masood Ahmed, Director IMF-Middle East and Central Asia Department.

Oil Importers:

Growth for region’s oil importers, Afghanistan, Djibouti, Egypt, Jordan, Lebanon, Mauritania, Morocco, Pakistan, Syria, and Tunisia, will register just under 2 percent in 2011.

---“So for this year and for next year we see economic activity in these countries really not growing very fast: about 1.5 percent this year; about 2.5 percent next year, which is really not enough to create the kinds of jobs that they need for the young population. At the same time, supporting them in maintaining a social consensus and macro-stability is not only a priority for them, it’s also a priority for the rest of the world which needs to support them through financing and through providing access to markets for their exports.” Masood Ahmed.

Gulf Cooperation Council – 7% Growth:

Economic activity in the region’s oil-exporting countries has clearly improved, bolstered by continued high energy prices. This expansion is driven by the high level of activity in the countries of the Gulf Cooperation Council (GCC), where growth is projected at 7 percent in 2011. Several countries, Saudi Arabia in particular, have stepped up oil production temporarily in response to higher oil prices and shortfalls in production from Libya.

Driven by Higher Petro-Revenues & Public Sector Spending:

Increased oil revenues have created additional room for government spending in the GCC. Several countries announced spending programs early in the year covering a wide spectrum of measures, such as subsidies, wages, and capital expenditure. At current projected oil prices and levels of production, revenue gains will more than offset the high levels of public spending. In 2011, the oil exporters’ combined external current account balance is expected to increase from $202 billion to $334 billion (excluding Libya), and from $163 billion to $279 billion for the GCC.

Ever Increasing Breakeven Oil Price/Production Levels:

Fiscal vulnerability has also increased, however, as break-even oil prices, the prices at which the fiscal balance is zero given the level of expenditure and non-oil revenues have risen steadily and are now approaching observed oil prices.

GCC Banks:

As economic activity picks up, financial sectors are gradually recovering. GCC banks in particular, which showed considerable resilience during the global crisis, are now registering capital adequacy ratios of between 15 percent and close to 20 percent, with nonperforming loans of less than 10 percent. Private-sector credit growth remains cautious though.

Risk of Slowdown in Developed Economies US/Europe:

In 2012, growth is expected moderate to about 4 percent. Several factors could result in a less positive growth scenario for region’s oil exporters. The most immediate risk is a sharp slowdown in Europe and the United States. Global oil demand would contract substantially, possibly leading to a sustained drop in oil prices.

Arab Spring Consequences-Political/Economic Transformation(s):

As for the region’s oil-importing countries, the political and economic transformations occurring in several of them are expected to extend well into 2012. Together with a worsening economic outlook globally, and in the European Union, where growth is forecast to slow from 1.7 percent this year to 1.4 percent in 2012, the region is seeing a sharp drop in investment and tourism activity.

Draining Resources/Reserves on Social Spending:

As a result, growth is down sharply this year, and the recovery in 2012 is expected to be weaker than earlier anticipated, with growth projected at just over 3 percent. In response to growing social unrest, the economic downturn, and higher commodity prices, governments in the region have significantly expanded subsidies and transfers. The cost of this social spending is high, exceeding 10 percent of GDP in Egypt and more than 5 percent of GDP in most other countries. As a result, oil importers’ fiscal deficits are widening by an average of about 1.5 percent of GDP to –7.6 percent of GDP in 2011. In the near term, such spending measures are appropriate to lessen the impact of the downturn. But from an efficiency and equity standpoint, it is better for governments to gradually replace universal subsidies with targeted social safety nets, the IMF report states. Resources can then be used for critical investments in infrastructure and education and for supporting much-needed reforms.(See FILM REPORT - "Global Peace Index" -

diplomaticallyincorrect.org/films/movie/global-peace-index/27144 )

Draining International Currency Reserves:

Meeting the rising demands of the population will not be easy, the report notes particularly as most countries have already used their fiscal and international reserve buffers to respond to deteriorating economic conditions in the wake of the Arab Spring, and have much less room left to respond to future shocks.

---“If you look out three to five years, this historic transformation that is now taking place in so many countries in the Middle East has the potential to really improve the living standards and the futures of the people in the region.” Masood Ahmed. (See FILM REPORT – “Egypt/Tunisia – World Bank Focus”

diplomaticallyincorrect.org/films/movie/egypttunisia-world-bank-focus/27063 )

Regional & International Partners Need to Assist Oil Importers:

Given the increased risk aversion of international financial markets, the cost and availability of private financing will be constrained in the near term, but governments have the option of turning to official sources for external and fiscal financing, says the IMF assessment. Regional and international partners can help formulate and implement a reform agenda through technical assistance, debt relief, concessional financing, and greater market access.

Conflict & Post-Conflict Environment:

Conflict across the region—particularly in Libya, Syria, and Yemen—has taken a massive human toll in addition to its enormous economic costs. The immediate priority for these countries is to avoid further humanitarian crisis and, once the conflict is over, to pursue an agenda of reconstruction and reform. According to Masood Ahmed:

---“Countries that are going through conflict in the moment of the Middle East will clearly face not only a human cost but also an economic impact and it’s very important that when we look at Libya, when we look at what’s happening in Syria, when we look at Yemen, that we not only bring the conflict to closure soon, but begin the process of reconstruction and of putting those economies back on track.”

(See FILM REPORT - Previous IMF Outlook for Region" -

diplomaticallyincorrect.org/films/movie/middle-east-haveshave-nots-economic-outlook/26749 )

By Ambassador Muhamed Sacirbey

Facebook – Become a Fan at “Diplomatically Incorrect”

Twitter – Follow us at DiplomaticallyX

Related Reports at “International Financial Crisis Channel” -

diplomaticallyincorrect.org/c/international-financial-crisis