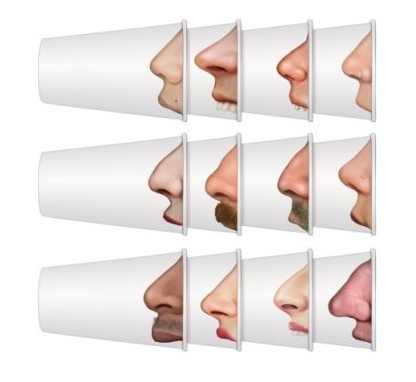

- “By the time the process is completed for a new Euro-treaty to address today’s crisis, there may be some bleeding, even more sniffling recessionary flu and almost all European noses out of joint.”

The track may be right but it is treacherous and likely to see a derailing or more along the way. There is now general consensus that a new treaty will be necessary to fix the structural problems in the Eurozone and bring to an end the drama – a view we have voiced from the outset. A more unified fiscal policy was necessary as part of complement to shared monetary policy currently coordinated by the ECB (European Central Bank). However, the exuberance evidenced in the rising Euro and financial markets is both overdone and premature.

Now, the methodology of amending the relevant EU/Eurozone treaties becomes the uncertainty. Last time that “constitutional” changes were proposed and voted upon within the EU countries, the debate was rancorous, many defenders of national sovereignty strongly opposed and then widened the debate, domestic populations were less than enthusiastic and many of the EU member states rejected changes to the EU treaty.

While the fundamental economic environment has changed considerably for the worse, electorate sentiment I believe has not – especially as “nationalism” and inclination toward less rather than more of Brussels control may be still the trend. In other words, the process of amending the treaty will now become the debate, and it is likely to raise political and financial uncertainty. Further, electorates in countries like Italy, Spain or even France may be disinclined toward fiscal union that could cause them to bear further austerity, less competitiveness and longer timeframe toward recovery.

The last time that such a debate raged, around 5 years earlier, the Euro also shrank to considerably lower than where it is today with respect to the US Dollar. One can make all sorts of rational arguments why Eurozone fiscal union is necessary now and the preferred way to turn in the fork in the road in the future, but such rational arguments will get overwhelmed by other cresting debates, from national identity to economic competitiveness. For example, Mario Baldassarri, the head of Italy’s Senate Finance and Budget committee favors a considerably weaker Euro – somewhere on parity with the US Dollar in order to make Italian and European in general products and services more competitive. This also appears to the implicit if not yet vocal drive of the new Italian PM Mario Monti who is inclined to join the chorus for a new European Treaty, but not necessarily on terms perhaps favored by Berlin or Paris. (Read: “ECB & Germany Dragged Down by Euro Crisis?” -

diplomaticallyincorrect.org/films/blog_post/ecb-germany-dragged-down-by-eurozone-crisis-by-ambassador-mo/42045.

The new ECB Chief, another Italian named Mario, (the three Mario's have been now branded as the "Super Marios" which is preferable over being labeled "Three Card Monti!") Mario Draghi, has already indicated a significant change of course from his predecessor by opting for lower interest rates, and assuming more inflation risk in order to enhance economic recovery. (Read: “Draghi Good – Trichet Bad!” -

diplomaticallyincorrect.org/films/blog_post/its-a-new-eurozone-at-g-20-by-ambassador-mo/39498

Even without Draghi’s policy shifts, the Euro is likely to be under pressure for several reasons. Most critically, the weaker Euro economies are not likely to be able to meet economic activity/GDP forecasts in the near term. Austerity and lack of competitiveness is likely to deliver a one-two jab to the Roman, Greek, Iberian, perhaps French and even Irish pug-nose. Further, both Germany and the ECB are not able to absorb all the financial blows to the periphery economies without placing their own financial health at risk. (See Above Article – “ECB & Germany Dragged Down by Euro Crisis?”). That is message from Berlin, Strasbourg and rating agencies.

There is also another further question spurred by a push for a new EU treaty: while such may help resolve dissonance within the Eurozone, could it also reignite debate (and probably demands in return for going all) from non-Eurozone members as the UK in terms of how far the whole European project is envisioned. Along with the UK, such now important EU but non-Eurozone states as Poland and Sweden will have to question to what extent there is still a European project beyond the Eurozone and most critically how they are affected and what seismic decisions are necessary for their own citizens and economies – and not just to be caught up and following in the wake. (Read: “European Crisis Beyond Eurozone” -

diplomaticallyincorrect.org/films/blog_post/european-crisis-beyond-eurozone-by-ambassador-mo/42053).

By the time the process is finished of a new Euro-treaty to address today’s crisis, there may be a few noses out of joint, some bleeding and even more sniffling recessionary flu.

By Ambassador Muhamed Sacirbey

Facebook – Become a Fan at “Diplomatically Incorrect”

Twitter – Follow us at DiplomaticallyX

International Financial Crisis Channel -

diplomaticallyincorrect.org/c/international-financial-crisis