Coming at already highly dynamic moment for EU/EMS, S&P downgrade of 9 Eurozone countries can unravel recent deals and Eurozone itself. It cannot be seen in same context of last summer US downgrade – it’s more complex and with more far reaching consequences. Further, it should be highlighted that most of the Eurozone countries remain on "Creditwatch" meaning that further downgrades may be forthcoming in shorter term, further increasing uncertainty and heightening the tension as the EU/EMS needs to move ahead with structural and policy reforms and a major reformulation of the EU/EMS institutions.

Greater Borrowing Cost for Some/Most:

For Portugal and Cyprus, the news is far worse then rest because they fall out of key “investment grade” designation – or bellow BBB. Number of potential investors will be substantially limited/reduced by regulation and optional criteria and borrowing costs will significantly increase. In case of these downgrades, the rating is not just an “opinion” (as S&P and some others define ratings), it is immediate and real consequences. (See Rating Chart Below).

US & Germany as Safe Harbor – Other Eurozone as Roughwaters

The implications for the other 7 may be subtler, but it cannot be considered in similar light as how financial markets reacted to US downgrade last summer. When US was downgraded, most professionals understood that money would nonetheless run to US sovereign debt as the “safe harbor” in times of turmoil. Some had predicted an increased borrowing cost to US, but frankly that is not discernible, although over much longer term it may evolve (although not likely in my opinion). When France, Austria, Italy, Spain etc where downgraded, European and other investors again ran to US and also German sovereign debt, which is perceived as the other safe harbor.

Uneven Relationship Among Not so Equals:

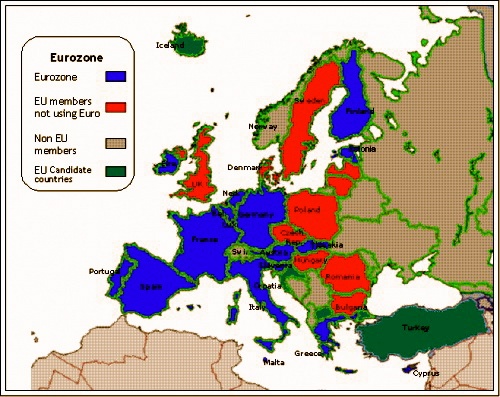

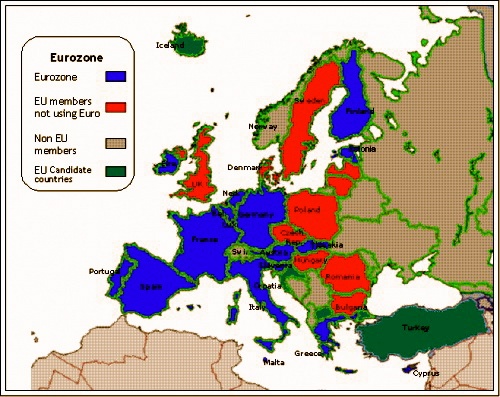

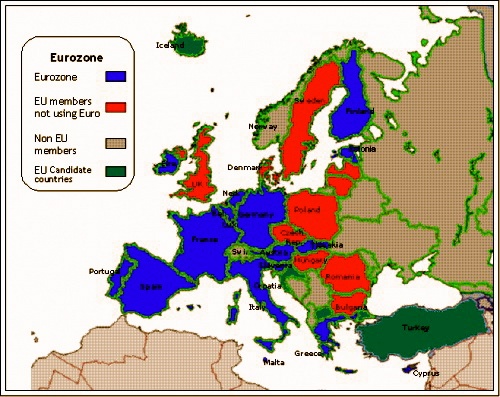

That European investors flocked to German debt is indicative of the problem – an uneven and highly fluid relationship of not so equals within the European Monetary System – Eurozone. At a time when stability is preferable because so money other elements of the EU and EMS foundation are volatile/fluid as consequence of last December’s summit decisions, (Read -“Another Downgrade for Europe?”

diplomaticallyincorrect.org/films/blog_post/another-downgrade-for-europe-by-ambassador-mo/42794), the ratings produce an element of dynamics, unpredictability largely beyond the would-be architects of the new EU/Eurozone. It also gives Germany even more authority to wield, not something that it has necessarily managed well. It could also cause some to opt out of going along with Berlin dictates and the preliminary “deals” achieved in December. It may turnout that UK PM David Cameron comes out looking the more wise for staying out in the first place, and that would be another irritant for almost all other EU/EMS leaders.

European Bailout Fund Needs Rescue Itself:

The other intertwined and more immediate consideration is for the EFSF, (the European Financial Stability Facility), which is Europe’s answer to TARP and is the intended backstop for Eurozone debt. It will now cost more to fund. Some states may have difficulty in delivering on their presumed share and most likely Germany will again have to in end be pressed to assume more.

Opportunity for mor Miscalculations & “Groundhog Day” Syndrome:

If it all sounds a bit complex and considerably more uncertain, it is. Europe’s political leaders have not evidenced a great talent of staying ahead of this problem, especially as many of their egos assume that they can talk the financial markets voting in the same way they would convince their electorate. The financial markets have been largely unconvinced so far, and the downgrade opens up a whole new dynamics for a vicious cycle of miscalculations. It is déjà-vu or if you prefer “Groundhog Day” – Read:

diplomaticallyincorrect.org/films/blog_post/groundhog-day-euro-crisis-trickling-to-us-economybusiness-by-ambassador-mo/42483. Back to the starting point even if most may not yet perceive it.

Read our Article from January 13, 2012 – Read- “Europe Gets Broad Sovereign Downgrade” -

diplomaticallyincorrect.org/films/blog_post/europe-gets-broad-sovereign-downgrades-by-ambassador-mo/43583

By Ambassador Muhamed Sacirbey

Twitter Follow @MuhamedSacirbey

Facebook – Become a Fan at “Diplomatically Incorrect”

Twitter – Follow us at DiplomaticallyX

International Financial Crisis Channel -

diplomaticallyincorrect.org/c/international-financial-crisis

Country To (Long Term/Outlook/Short Term) From (Long Term/Outlook /Short Term)

Germany AAA / Stable / A-1+ ----- AAA / Watch Neg / A-1+

Finland AAA / Negative / A-1+ ----- AAA / Watch Neg / A-1+

Luxembourg AAA / Negative / A-1+ ----- AAA / Watch Neg / A-1+

Netherlands AAA / Negative / A-1+ ----- AAA / Watch Neg / A-1+

Belgium AA / Negative / A-1+ ----- AA / Watch Neg / A-1+

Estonia AA- / Negative / A-1+ ----- AA- / Watch Neg / A-1+

Ireland BBB+ / Negative / A-2 ----- BBB+ / Watch Neg / A-2

One-Notch Downgrades

Austria AA+ / Negative / A-1+ ----- AAA / Watch Neg / A-1+

France AA+ / Negative / A-1+ ----- AAA / Watch Neg / A-1+

Slovenia A+ / Negative / A-1 ----- AA- / Watch Neg / A-1+

Slovak Republic A / Stable / A-1 ----- A+ / Watch Neg / A-1

Malta A- / Negative / A-2 ----- A / Watch Neg / A-1

Two-Notch Downgrades

Spain A / Negative / A-1 ----- AA- / Watch Neg / A-1+

Italy BBB+ / Negative / A-2 ----- A / Watch Neg / A-1

Cyprus BB+ / Negative / B ----- BBB / Watch Neg / A-3

Portugal BB / Negative / B ----- BBB- / Watch Neg / A-3