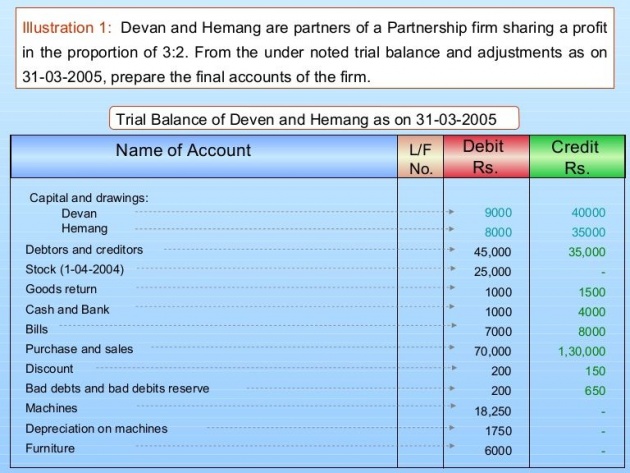

Final account includes trading and profit and loss statement account and balance sheet. Trading and profit and loss statement: It is used to ascertain the profit and loss during the year. It is the prepared for the year ended. The financial year is taken for which the firm follow. It may be from January to December or may be from July to June.

For preparing trading and profit and loss account: First of all name of a firm is written on top then trading and profit and loss account and then for the year ended is written. After it debt side and credit side is column is maintained. In trading account direct expensive is written on debit side.

The direct expenses include purchase made during the year. Wages paid electricity bill gas bill fuel bill carriage inward for carrying goods in the factory rent factory duty freight paid wages due factory rent due. Opening stock is also written on debit side of trading account. On credit side sales closing stock is written.

Then gross profit or gross loss is finding. In profit and loss account indirect expensive are written on debit side. The indirect expense are salaries to staff office rent bad debits carriage outward depreciation interest on loan administrative expenses stationary expenses postage expenses telephone bill travelling expenses sample expenses.

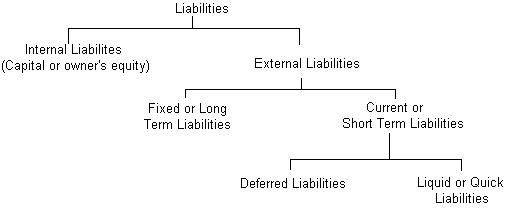

On credit side indirect income is recorded. These are rent received interest received on investment old provision for bad debts income. Then net profit or net loss is finding. Balance sheet: Name is written then balance sheet and after it for the year ended is written. Balance sheet is prepared at the end of year. It also has two columns assets and liabilities.

Assets are debtors cash in hand cast at bank stock bill receivable furniture car vehicle truck goodwill etc. Liabilities are creditor’s bill payable interest due bank overdraft capital. The net profit is added in capital and drawings are less in capital and tax is also less. In case of net loss it is also less from capital.