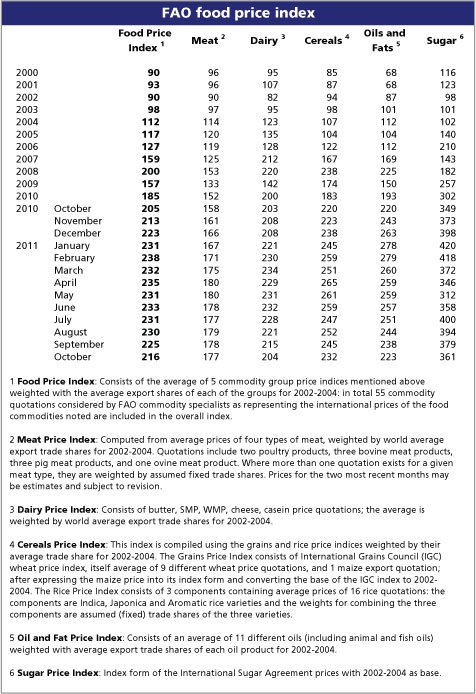

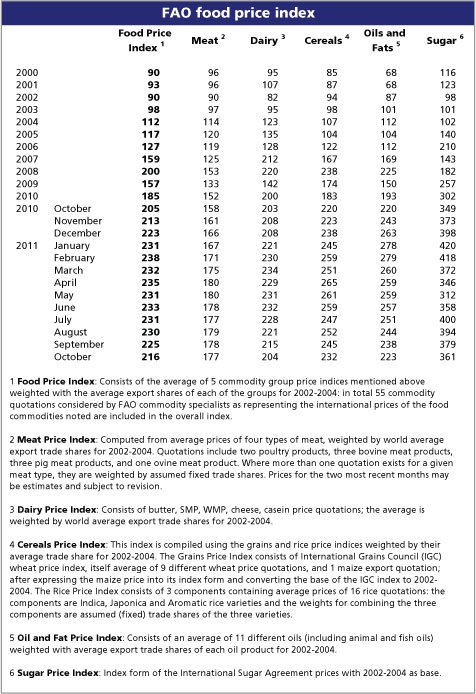

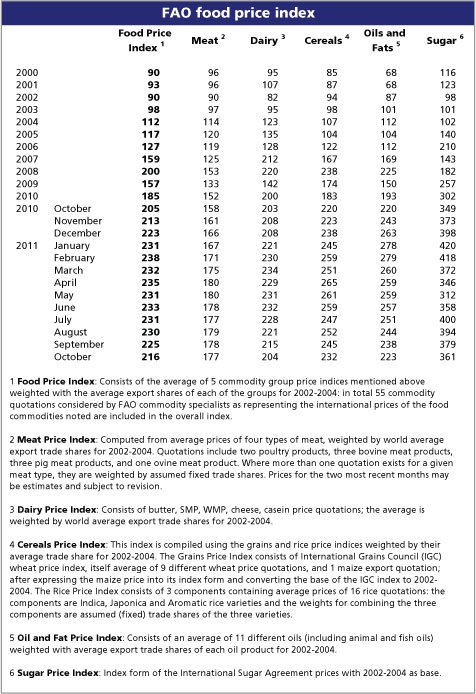

Prices declined 4 percent from September, but still remain generally higher than last year and very volatile, according to the UN’s Food and Agriculture Organization (FAO). The drop was triggered by sharp declines in international prices of cereals, oils, sugar and dairy products. Meat prices declined the least. FAO's November Index though showed that prices last month were still some 5 percent above the corresponding period last year. The social/political consequences of sharply spiking food prices as well as the impact on global hunger have prompted various UN agencies to urge the G-20 this week to address the risks. READ – “Food Price Risks on G-20 Agenda” -http://diplomaticallyincorrect.org/films/blog_post/food-price-risks-on-g-20-agenda-by-ambassador-mo/39134

An improved supply outlook for a number of commodities and uncertainty about global economic prospects is putting downward pressure on international prices, although to some extent this has been offset by strong underlying demand in emerging countries where economic growth remains robust.

Extended Period of Price Stability?

Most agricultural commodity prices could thus remain below their recent highs in the months ahead, according to FAO's biannual Food Outlook report also published today. The publication reports on and analyzes developments in global food and feed markets. However, I do not retain this optimism regarding price stability. Speculation continues to exaggerate volatility, and unfortunately more upwards. Speculation on the other side could – pushing prices sharply lower could also discourage farmers from growing enough.

According to the FAO - in the case of cereals, where a record harvest is expected in 2011, the general picture points to prices staying relatively firm, although at reduced levels, well into 2012. Food Outlook forecast 2011 cereal production at a record 2 325 million tonnes, 3.7 percent above the previous year. The overall increase comprises a 6.0 percent rise in wheat production, and increases of 2.6 percent for coarse grains and 3.4 percent for rice. Globally, annual cereal food consumption is expected to keep pace with population growth, remaining steady at about 153 kg per person. International cereal prices have declined in recent months. Nonetheless cereal prices, on average, remain 5 percent higher than last year's already high level.

SE Asia Floods & Rice:

Severe problems caused by flooding recently marred rice production prospects in Thailand. However, impact on the international market has been limited so far given large reserves.

Large global supplies of sugar have put downward pressure on sugar prices since June. Improved supplies also weighed on dairy markets while strong palm oil output and record sunflower seed crops have driven prices down in the oils sector in recent months.

“Extremely Volatile”

According to Food Outlook prices generally remain "extremely volatile," moving in tandem with unstable financial and equity markets. "Fluctuations in exchange rates and uncertainties in energy markets are also contributing to sharp price swings in agricultural markets," according to FAO Grains Analyst Abdolreza Abbassian. (READ – “State of Food Insecurity in World 2011” -

diplomaticallyincorrect.org/films/blog_post/state-of-food-insecurity-in-world-2011-un-report-by-ambassador-mo/36153 )

Greatest Impact on the Poorer Countries:

High food prices are putting pressure on Least Developed countries (LDCs) who have seen their food import bill soar by almost a third from last year, the report found. The global cost of national food imports is expected to approach $1.3 trillion this year. (See FILM REPORT – “Billion to Sleep Hungry” -

diplomaticallyincorrect.org/films/movie/billion-to-sleep-hungry/24674 ). World cereal inventories are forecast to increase by 3.3 percent from their reduced opening levels, to 507 million tonnes by the end of seasons in 2012. At this level, the world cereal stocks-to-use ratio for 2011/12 is expected to approach 22 percent, up only slightly from 2010/11.

By Ambassador Muhamed Sacirbey

Facebook – Become a Fan at “Diplomatically Incorrect”

Twitter – Follow us at DiplomaticallyX

International Financial Crisis Channel -

diplomaticallyincorrect.org/c/international-financial-crisis