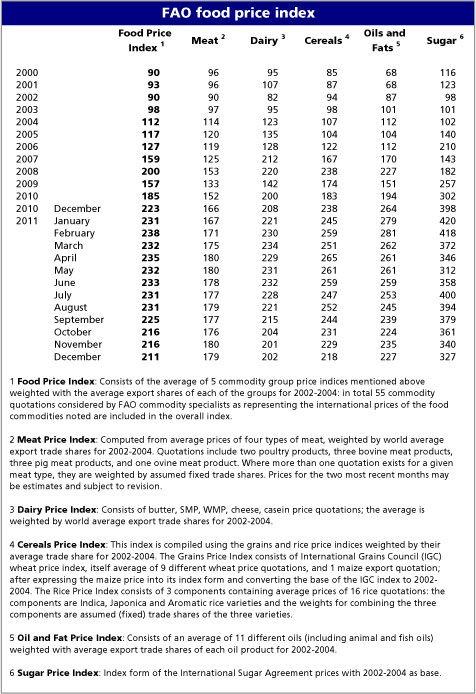

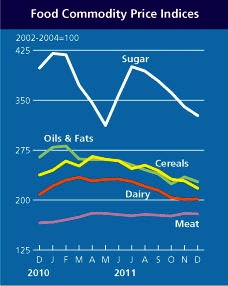

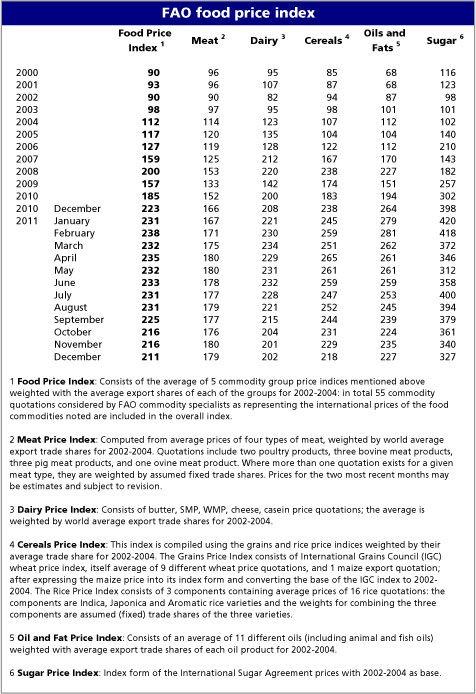

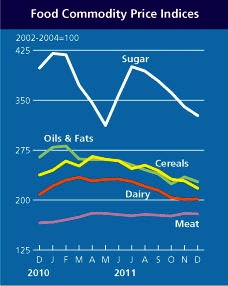

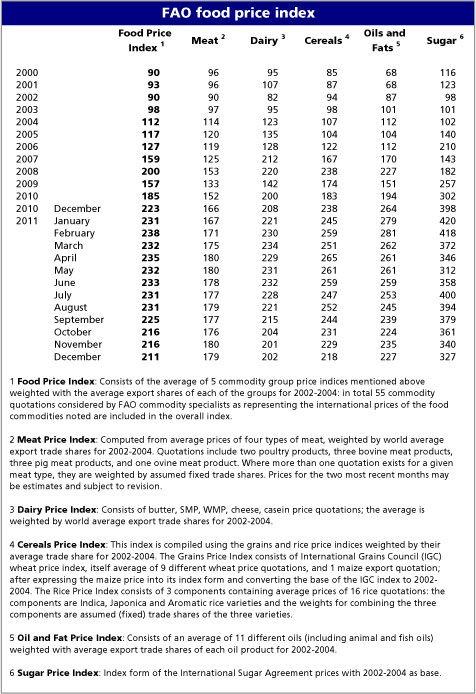

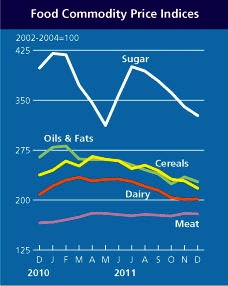

Petro prices still loom as biggest risk for food costs, but food futures prices sharply declined as speculators drew out yesterday –this extended a decline from December, but the overall annual for 2011 average was the highest ever on record. December’s FAO’s (UN’s Food & Agricultire Organization) Food Price Index level was 211 points – 27 points below its peak of February 2011. The decline was driven by sharp falls in the international prices of cereals, sugar and food oils due to a productive harvest coupled with a slowing demand and a stronger $US. The Index though overall averaged 228 points in 2011 – the highest average since FAO started measuring international food prices in 1990. The second highest average came in 2008 at 200 points. (READ – “State of Food Insecurity in World 2011” -

diplomaticallyincorrect.org/films/blog_post/state-of-food-insecurity-in-world-2011-un-report-by-ambassador-mo/36153 )

Broad Declines:

Cereal prices registered the biggest fall due to record crops and an improved supply outlook, with the FAO cereal price index dropping 4.8 per cent last month. However, the cereal price index for the year rose by 35 per cent from 2010, the highest since the 1970s. Oils and fats price index also dropped, with a three per cent decline from November due to the unexpected surge in supplies of vegetable oil (palm and sunflower oil particularly) which, coupled with poor global demand for soybeans, deflated prices. Read – “Food Price Index (November) “ Read -

diplomaticallyincorrect.org/films/blog_post/food-price-index-drops-to-11-month-low-in-october-uns-fao-money-flash-by-ambassador-mo/39670

Meat prices were slightly down from November, mainly due to the 2.2 per cent drop in pig meat prices, but as with other commodities, its annual price was 16 per cent higher than in 2010. Dairy prices remained almost unchanged, and the sugar price index declined for the fifth consecutive month, reflecting expectations of a large sugar world production surplus over the new season due to good harvests in India, the European Union, Thailand and Russia. From above chart it is discernable that meat prices overall were the most stubborn to decline at year end, although relatively steady.

Real Risk on Food is Rising Energy Costs:

“International prices of many food commodities have declined in recent months, but given the uncertainties over the global economy, currency and energy markets, unpredictable prospects lie ahead,” said FAO Senior Grains Economist Abdolreza Abbassian. Perhaps the greatest risk remains petroleum prices and its refined products. Unlike the trend with food prices toward the end of the year, petroleum and refined products has continued to rise through year end – around 15% higher than beginning of 2011. Read – “Petroleum Spikes but Why?” -

diplomaticallyincorrect.org/films/blog_post/petroleum-spikes-but-why-by-ambassador-mo/43382

Link to FAO Food Index -

www.fao.org/worldfoodsituation/wfs-home/foodpricesindex/en/

By Ambassador Muhamed Sacirbey

Facebook – Become a Fan at “Diplomatically Incorrect”

Twitter – Follow us at DiplomaticallyX

International Financial Crisis Channel -

diplomaticallyincorrect.org/c/international-financial-crisis