Foreign Exchange Trading which is shortly know as Forex trading refers to the exchange of two or more foreign currencies in the recognized market. The Forex market is the largest liquid market in the world as per the average traded value of currencies. The daily average Value of traded currencies in the Forex market, including all currencies of the world, is $1.9 trillion. Forex trading is one of the well-liked investment of investors because investors can start investing from little amount of $10 and most vital get quick profits with positive fluctuations.

Reasons of Forex Trading

The major two reasons of the Forex trading are (a) Business Transactions (b) Speculation. The first reason of foreign trading is just to clear the transaction(s) in foreign currency. This type of trading is mostly done by companies around the world which traded goods and services in foreign countries. And the second most reason of the Forex trading is just to earn the profit with the fluctuation in the currencies. As the word speculation is used means with the expectation of higher profit the chances of great losses are also. That’s Forex trading is highly risky and need very vigilant decisions. In this type of Forex trading both institution traders and individual traders participated to earn profits.

How Forex Trading Works Or What’s Forex Trading Mechanism

Foreign Trading basically involves the exchange of one currency for another. This means in FX traders simultaneously buy one currency and sell another currency. Suppose trader willing to buy USD for EUR, then here he will sell EUR and buy USD. These currencies are called currency pairs. Each currency is represented in three letters the first two letters denote to country and third one denotes to local currency.

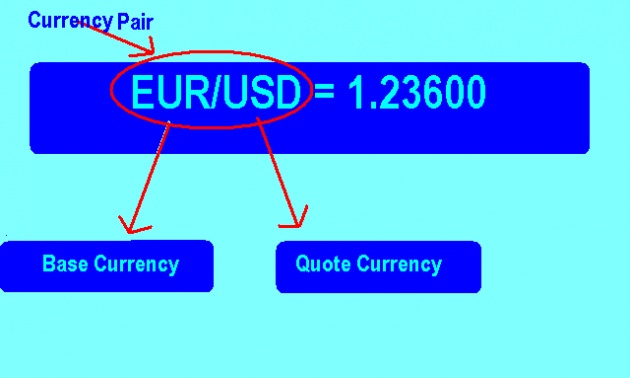

In the Forex trading mechanism the every currency has specified exchange rate for another currency. And most important is Forex pairs are read in the reverse direction of mathematical ratios. Let’s understand with example:

EUR/USD = 1.23600

Usually above type of pairing are used in FX market to denote the exchange rate of currencies. Here the currency (EUR) on the left side of / is called base currency and the currency (USD) on the right side of / is called Quote currency.

Base currency is always equal to one unit like US 1$ or 1 Euro and Quote currency is which reflects how much units quote currency is equal to 1 unit of base currency. And the above notion denote that 1 unit of base currency (which is EUR) is equal to 1.23600 U.S. Dollar. Means to buy 1 Euro you have to pay 1.23600 U.S. Dollar. But on other hand if you sell Euro for USD then exchange rate will indicate how much units of quote currency you will receive for sale of 1 unit of Base currency. And as per above notion you will get 1.23699 U.S. dollar for selling 1 unit of Euro.

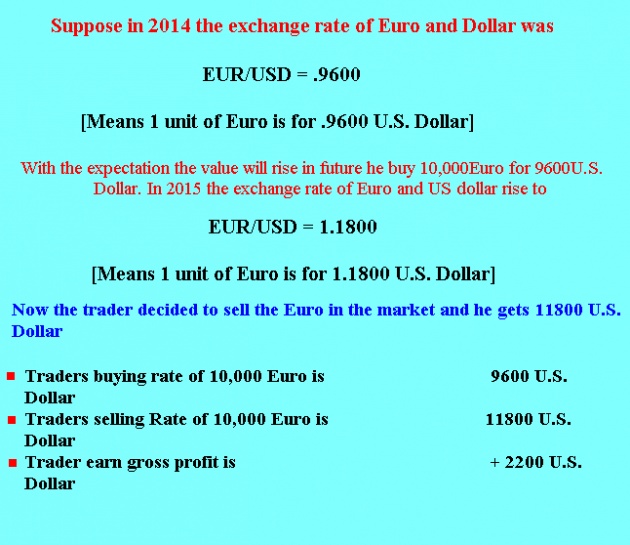

As we well know that the rate of one currency fluctuates relative to another currency that’s traders in order to earn profit buy and sell currencies as per the market conditions. Let’s understand with example how FX trader makes profit in Forex Trading:

Forex Trading market is worldwide market which opens 24 hours a day and 5 days a week. And most important is the transactions of Forex exchange are not centralized rather trade is done worldwide over the counter through telecommunications or internet. Anyone can invest in Forex trading through the services of commissioned based licensed broker. In order to enter in Forex trading the traders need to first decide whether they wish to buy or sell the currencies.

The Forex Traders must know about Forex Trading basic terminology

1. Base currency/ Quote currency

The initial mechanism of the Forex trading is to specify the exchange rate of every currency in the market. In Forex trading currency is quoted in relation to another currency. Means the value of one currency will reflect the value of another currency. Generally, currencies are quoted in pairs for example

USD/CAD = 1.2237

Here two currencies are quoted which are U.S dollar and Canadian Dollar. The currency which is left side of slash is called base currency. Base currency always shows the 1 unit of that currency. And currency on the right side called quote currency which shows how much units of different or quote currency is equal to the 1 unit of base currency.

As per the above example the 1 U.S. dollar is equal to 1.2237 CAD. Means if traders buy USD they have to pay 1.2237 CAD or if they sell 1 USD they will receive 1.2237 CAD.

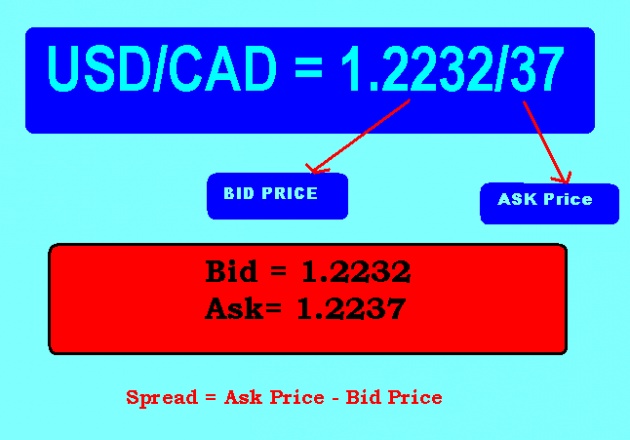

2. Bid/ Ask Price

In Forex market two types of prices prevail which are Bid Price and Ask Price. The both, Ask and Bid, prices are relative to the base currency. The Ask price is relevant to long trades and Bid price is relevant to short trades. In other words, the Ask price what you have to pay to buy 1 unit of base currency. And Bid price is at which you will receive with sell of 1 unit base currency. Let explain with example:

Suppose you wish to trade U.S Dollar (USD) for Canadian dollar (CAD). In Forex market all Forex Quotes are quoted with two prices that are Bid and Ask price. View the following quote:

USD/CAD = 1.2232/37

Bid = 1.2232

Ask= 1.2237

Here the amount shown on the left side of the slash is the Bid price which denotes to the price at which the market ready to buy the base currency means you will receive 1.2232 CAD in short order. On the other hand price on the right side of the slash is the Ask price at which market is willing to sell the base currency means here you have to pay 1.2237 CAD in long trade.

3. Short Order/Long trades

In Forex exchange the positions of the traders are classified into two categories (1) Long trades (2) Short trades. Here if you are going to buy currency pair like USD/CAD (with expectation to make profit with the rise in exchange rates) you are called in long trades. But if you are going to sell currency pair (whereby profits are expected with fall in exchange rate) that is called short trades. Let’s explain with example:

Suppose the existing exchange rate of the currency pair U.S dollar and Canadian dollar is

USD/CAD = 1.2232

Now if you expect the exchange rate of the base currency will rise, you will buy USD at give rate to sell this at higher rate in future. This is called Long trade. But if you expect the exchange rate of the base currency will fall, in that case you will sell the Base currency to buy it at low price. That is called Short trades.

4. Spread

The difference between the Ask and Bid price is called Spread in the Forex market. As the market conditions and liquidity change the spread is also reduce and extend as per changes. The ask price is always higher than Bid price. Let suppose

USD/CAD = 1.2232/37

Bid = 1.2232

Ask= 1.2237

Spread = 0005 [1.2237-1.2232]

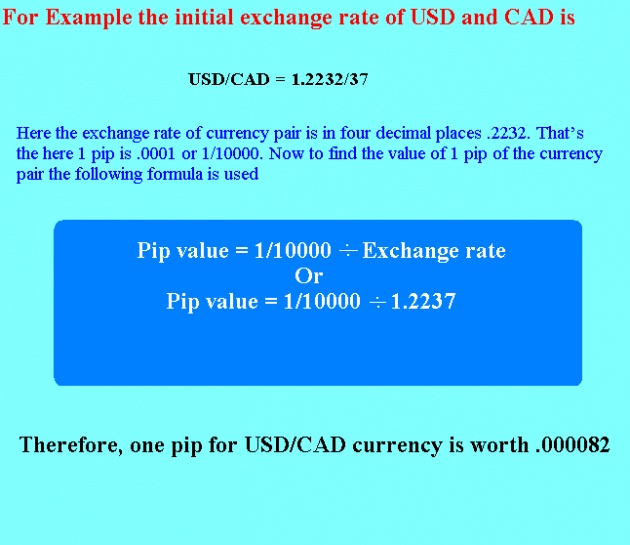

5. PIPS

In Forex market in order to measure the profit or loss the concept of PIP (Price Interest Point) and BP (Base Point) is used. The word PIP is an abbreviation of Percentage in Points. A pip is the smallest price changes that specified exchange rate of a currency pair can make. The profit or loss in the Forex trading can be evaluated on the basis that how many Pips you get or loss. Mostly currency pairs are displayed in four decimal places,except the Japanese yen, so the smallest change for mostly rates is .0001 which is equal to a 1/100 of 1%.

Now suppose, after few hours you discover change in the exchange rate of the given currency pair that is:

USD/CAD = 1.2240/47

The above rise in the exchange rate shows that the pair USD/CAD which you buy for 1.2237 now you can sell for 1.2240 which means exchange rate rise to .0003 [ 1.2240 – 1.2237] and you will gain 3 pips [ .0003/1000] if sell currency pair.

Now suppose you buy $I00,000 lot of USD for CAD at exchange rate of 1.2237 that’s to calculate the value of 1 pip for the lot of $100,000 the following formula is used:

Pip value = 1/10000 ÷ 1.2237 x 100,000

Here for the lot of 100,000 USD the 1 pip is worth of $8.17 which is$ .000082 for 1 unit of USD

Now to calculate the actual value of the profit in dollars earn, multiply the number of pips gain with the value of pips.

Now the total pips made due the rise in the exchange rate was .0003/10000 = 3 pips

Means with sell of currency pair USD/CAD you will earn 3 x 8.17 = 24.51 USD

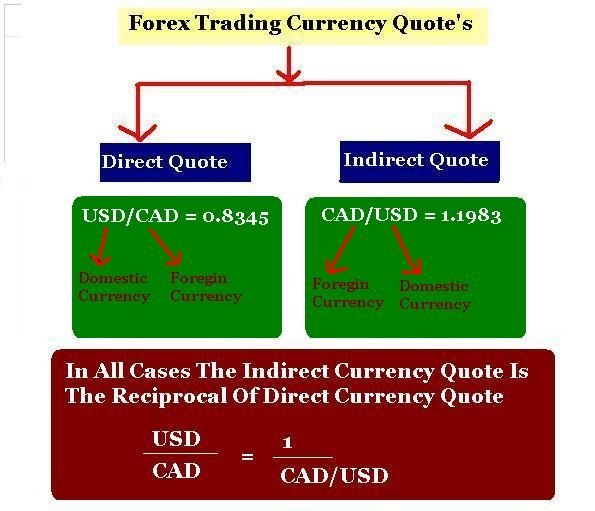

6. Direct Currency Quote

Direct currency pairs are those where domestic currency is base currency and foreign currency is Quote currency. Let suppose you are looking USD as domestic currency and Canadian Dollar as Foreign currency the currency pair quoted will be

USD/CAD = 0.8345

Here USD is base currency and CAD is Quoted Currency. Means with 1 unit of CAD you can buy 1.2345 Canadian dollar

7. Indirect currency quotes

The currency pair which quoted foreign currency as base currency and Domestic currency as Quoted currency is known as Indirect Currency quotes. As in the above example USD is taken as Domestic currency and CAD is as foreign currency. The indirect Currency pair of USD and CAD will be quoted as

CAD/USD = 1.1983

Here Canadian dollar is the base currency and U.S dollar is quoted currency. Means with one unit of Canadian Dollar you can buy 1.1983 USD Dollar.

8. Cross Currency

The currency pairs which are quoted without U.S Dollar are known as a Cross Currency pair. The very common pairs which are quoted without USD in the Forex Market are EUR/GBP, EUR/CHF and EUR/JPY. These currency pairs expand the possibilities of trading in Forex market.

9. Leverage

The concept of leverage, in Forex trading, means using the borrowed funds to increase the chances of profit with fluctuation in currency rates. In other words Leverage is a type of loan provides by broker to investors. Generally, the ratio of leverage is based on the value of base currency (which are domestic currency) and the value of lot or position of investor. Let suppose, your broker permits the maximum leverage of 50:1, which means for every 1 dollar you can trade $50. Obviously, if you have lot of $100,000 to invest in Forex trading and your broker allows you for 50:1 leverage means you can now invest in market up to $500,000 for getting higher profits. In easy words you can say, Leverage is the capability of investors using borrowed funds over the Principal amount which they are able to invest.

10. Margin

The term margin denotes to the minimum required balance of amount which must be in your trading account to open a trade. Technically, when Forex traders open a lot or position in market they need to set aside a percentage of the total value of the contract in good faith which is known as margin or marginal requirements. Margin sometimes also referred as performance bond as it is that amount of equity which makes sure you can cover your losses. The following formula is used to calculate the margin requirements:

Margin Requirement = Current quote Price x Units Traded x Margin Percentage

Let’s Explain It with Example:

Suppose you wish to invest in currency pair USD/CAD and current quoted value is USD/CAD = 1.2232/37 and wish to buy 100,000 Canadian dollars and your broker ask for 2% margin to open the trade position. In that case the margin is calculated:

Margin Requirement = 1.2237 x 100,000 x .02

Margin Requirement = $2447.40 USD

11. Marginal Call

A Margin call is a type of a warning message which a broker send to trader’s while their account is running short of sufficient funds or short of margin requirements to support their current open position in the market. The following equation is used to calculate margin available for open position;

Usable Margin = Equity – Used Margin

Equity (Which is value of your account) is calculated using the following formula:

Equity = Cash deposit + Profits of Open Position – Losses Of Open position

That’s if usable margin is equal to zero (which means equity = used margin) and If usable Margin is Negative (Which means equity is less then used margin) then you can get a alert message which is know as marginal call. In many cases while you have not sufficient funds in your account the brokers can close your open trades automatically.

12. Rollovers/Swaps

Extending the date of settlement of open or holding position in the Forex market is known as rollovers. What is settlement in FX? Settlement is the day at which the trader has to deliver currency to another entity of contract and it’s the 2 days after the transaction held. In Forex market the trader trade contracts on currencies which are to be delivered in 2 business days. The traders who want to extend their trade position without settlement or without taking currency delivery must close their position before 5 p.m. EST on settlement day. Through Rolling over traders close the open position at daily closing rate and reopen the trade at new price on next day which will extend settlement period by one day. This strategy in Forex trading is known as Rollovers. Mostly, Rollovers is created through swap contract and most important this Rollover subject to interest rate which is known as Rollover interest. The Rollover interest is paid or gained by the trader for holding currency spot position overnight.

Is Forex Trading Safe?

If you are new to the Forex Trading then first question in your mind will be – How much Forex Trading Is Safe to Invest? Forex Trading, which is very volatile in nature, mostly trades on short term basis and offers higher potentials of gain or risk. In this Industry, where trading is done worldwide on the basis of over the counter concept, you can make millions in short span of time only if you carefully make analysis and study of currency trends. But downside is you can lose even millions if you work carelessly.

Image Source - corvuswire.com

To make sure you are safe on Forex trading the first step is registered with Legal Forex Broker who deals with Forex transactions or trading. This will help to make legal and secure trades in the Forex Industry. After registration you need to open the marginal account to start trading. Of course Forex trading is vibrant and demanding investment pitch and there is no 100% guaranteed strategy to earn profits in Forex but still you can adopt some techniques to tackle the trading risks

- Determine your Risk tolerance - Before opening the trade you must know how much risk you can afford.

- Recognize and pursue the Market Trend - You need to carefully study the Forex market trends before taking investment for picking right pair of currency.

- Make and Test Your own Strategy - You need to make good strategy to neutralize the risk/gain. For this you can use demo accounts of Forex to check your strategies.

- Keep Capital Reservation - It’s vital to preserve some capital to face the opposite situations.

- Must Avoid Over-trading - Over-Trading can hamper the ability of trader as the situations may be out of control with change in market.

Various strategies and methods are used to counter the risk of currency exchange rate fluctuations which is known as Hedging. No doubt, in Forex Trading risk is higher but it can be managed if well strategies are planned.