Forex Trading: the management of risk and capital

Photo credit: twitter.com Edition by Amber255 via Bitlanders.com

Greetings to all my loyal readers! In my blog Forex Trading: Training for Beginners, I promised to talk about how to manage the risk and capital in Forex Trading. Actually, it is a very important lesson you have to read if you want to start trading. Why is it so important? Well, since we are already engaged in this kind of business, like in every business, we need not only to make money, but also to ensure that our company does not go bankrupt one day. Ironically, the management of risk and capital in Forex is the most common missed topic amongst start-up traders. Often traders feel so excited about starting up trading currencies that they completely forget about the wisdom of managing Forex.

Therefore, trading often turns into mere gambling: either winning or losing.

Among traders is the following statement: Forex is not gambling. There is a casino for the gambling. Go to the casino, where you will not only be able to gamble but also have fun. So, if you read these lessons because you do not want to waste your money earned by the hard work, you should know the principles of risk management in Forex not less than the 10 commandments of God.

Forex trading lessons - Photo credit: bloomberg.com

There is no secret that the success of Forex traders depends on how they manage their capital, not on some kind of magical, mysterious system. Successful trading makes money, and successful trading with careful risk management can create tremendous wealth. As long as you do not learn how to use risk management techniques, you will earn some money at one point, some money will lose next time, but you will never earn a lot of money. When it comes to risk management, it's amazing how few people want to hear about it or learn the right methods. Untrained traders think that there is still some kind of magical trading method that informs about market behavior and allows traders to make always 100% profitable transactions.

Today, I will give a detailed overview of the ways in which capital management is known and used by traders around the world. In this article, I will discuss the importance of risk management, methods, and various aspects of the main problem, which most often hinders traders from achieving stability in Forex trading.

Forex Risk and Capital Management - Video credit: CurrencyCashCow via Youtube.com

What Is The Risk Management?

By entering the keywords risk management, we get a variety of offers: how to manage our personal finances, how to control the risks, how to properly manage the stop-loss, how to create and manage the investment portfolio, and so on.

In fact, risk management is nothing like the following points:

- This is not part of the system, which dictates how much you lose in a particular transaction;

- This is not diversification;

- This is not a risk avoidance;

- This is not part of the system, which dictates when to close a transaction;

- This is not part of the system, which dictates what tools to use in trade.

The risk management is part of the trading system, which tells how many of specific lots we should leave at the moment and how much we can risk. In other words, risk management is transaction size's management.

Today, there are many definitions of risk management as well as ways to calculate the risks in a transaction.

The Risk Management - Photo credit: twitter.com

The Capital Management

There are two distinct categories: correct capital management and mismanagement of capital. Correct capital management has two factors: the risk and remuneration for it. Incorrect capital management is a factor for each individual: either risk or remuneration.

Correct capital management involves all possible range of options. Incorrect estimates only individual attributes or account characteristics such as a percentage of profitable transactions or a profit/risk ratio.

Risk management is 90% of the game. Indeed, many successful traders treat capital management as the most important instrument in ensuring the market success. If capital management is an important influencing factor, then, it is necessary precisely to know what is the capital management from the objective side.

Start trading - Photo credit: valasonline.com

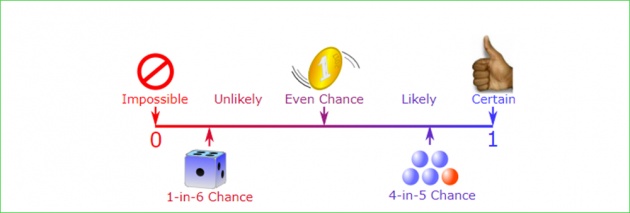

Probability and Mathematical Expectations

New traders often do not understand the concept of basic probability. They have to deal with the horrors of the random process and, therefore, create different myths for themselves. Those who are less aware of the probability will surely lose money in the forex trading market. The goal of each trader is to get at least acquainted with the mathematical probabilities associated with the game in the market.

Discard the coin in the air. In an instant, you will observe one of the most beautiful natural paradoxes: an occasional process. As long as the coin is in the air, there is no way to say with certainty whether it will drop down on one or the other side. But with countless times, the ending of the series can be predicted.

Forex traders need to understand the concept of mathematical probability. It is called the player's proportion (positive mathematical probability) or the casino ratio (negative mathematical probability), considering what side there has more chance.

If we take the coin, none of the sides will have the advantage, and our odds of winning will be equal to 50%. But if the coin is thrown at the casino, at least 10% will be charged for each bet, and we will win 90 cents only from each dollar we have won. Casino proportions make our mathematical probability negative.

Credit: Amber255

No capital management system will stand up against negative mathematical probability over the long term. In trading, the benefit is given by a trading system that generates higher statistical profits than loss, commission, and spread. It should be remembered that the capital management will not save a bad trading system.

Another equally important factor is the stress test of the system. The simplest way is to optimize system settings. If most of the parameters make a profit, then the system is good. The point is that nobody knows if the market will behave tomorrow as yesterday when the system showed good results.

We can earn on the Forex trading only if there are a positive mathematical probability and a statistically predictive trading system. The result of trading by your intuition is the loss of a deposit.

Mathematical Probability in Forex Trading - Photo credit: sites.google.com

I am very surprised by the people who test their new strategies over and over, and then wonder why they have lost their deposit. Many do not even try to explain the reasons, but simply justify themselves to the myths that we talked about earlier. Many start-up traders behave like casino players who go from table to table jumping from one strategy to another, having received several stop-loss in a row. All this comes from insufficient testing of strategies and ignorance of the basics.

The best forex strategies are the simplest, consisting of a small number of items. The more complex the system, the more elements may not work. Keep it simple stupid - it's the key slogan that's needed to build your trading strategy.

And, in the end, if you have created a good trading system, do not squeeze it like lemons. Create a new system if you are looking for variety. Most players take a good trading system and break it when trying to make it even more perfect. If you have a good trading system, it's just time to apply the capital management rules with it.

Why 90% Of Traders Lose Money - Video credit: SkyViewTrading via Youtube.com

So How Much We Can Risk?

Most beginners die on the market from two bullets: from ignorance or from emotions. The new traders try to market by their intuition and create contracts that are never worth to create due to the negative mathematical probability.

Those who survive in a stage of ignorance, begin to trade in accordance with the more or less clear rules of the trading system. When they become more confident in the market, they get their head out of the pit and usually the second shot finish off them. Excessive confidence makes them greedy, they start to risk too much in one transaction, and a short series of unsuccessful transactions take away their deposit.

If in each transaction you risk a quarter of your deposit, then your crash is not over the mountains. A short series of unsuccessful transactions - and bankruptcy will be inevitable, even with the very best trading systems.

Risk management in Forex Trading - Photo credit: medium.com

Even if you risk one-tenth of your deposit in one transaction, then, in that case, you will not be able to stand much longer.

A genuine professional can afford to risk only a very small part of his deposit in one transaction.

The relationship of the amateur with the market is like an alcoholic with alcohol. He starts to have a good time, but the result is that he destroys himself.

Global research and practice have shown that the maximum amount that a player can afford to risk in a single transaction without losing his long-term prospects is 2% of the deposit.

With a long list of risks, losses associated with foreign exchange trading may be greater than initially expected. Due to the nature of leveraged trades, a small initial fee can result in substantial losses and illiquid assets.

credit: investopedia.com

I am not talking about aggressive increasing of the deposit when the trader attempts to increase money by one thousand per month in one-two months. I talk about profitable long-term trading. Most amateurs shake their head when you say that. This is because many beginners have low deposits, and a 2% rule ruins their dreams of high returns. However, successful professionals, on the contrary, find that 2% is a risk limit. Usually, they allow themselves a risk of no more than 1% or even 0.5% in one transaction.

The 2% rule reliably protects the deposit from burning, which the market can provide at any time. Even lossy transaction series in a row of 5-6 will not be able to impair your prospects significantly.

Start trading - Photo credit: pixabay.com

The Key Is To Stay In the Market

The first task of capital management is not to help the trader earn more, but help him survive, stay as long as possible on the market. This helps to avoid the risk that could take away you from the game. The second goal is stable profit growth, but survival is the first.

Do not risk the whole capital - here's the key to capital management.

Losers ignore it, making stakes much bigger in one transaction. They continue trading in an attempt to increase positions, especially after unsuccessful transactions, so that they can quickly recover after the impact. Good capital management, above all, helps to prevent such strokes. Including heart.

If you lost 10% in one transaction, you need to make 11% to recover, or if you lose 20%, you will need to earn 25% to get back your own money. If you lose 40%, you will have to make even 67%, and if you lose 50%, you will have to do impossible - 100% in order to get back to zero loss. That's such rude mathematics. When losses increase in arithmetic progression, the profits necessary to compensate are in a geometric progression.

For each trader it is necessary to know how much he can lose, when and at what level it is necessary to limit his losses. Also, you need to decide what the percentage of your deposit you are ready to lose.

Forex Trading risk - Photo credit: pixabay.com

Get Rich Slowly

Traders working for a company are generally more successful as a group than individual traders. There is a responsibility to traders' superiors, who in turn are responsible for the discipline. If the trader loses more than the allowed amount, he may be dismissed due to this disciplinary violation. Such a system forces corporate traders to avoid significant losses. Individual traders act on their own.

The trader, having opened an account with $ 20,000 and hopes to turn this deposit into two million over a couple of years, is similar to a person who comes to America with a big wish to become a star of a movie. Of course, theoretically everything is possible, he can achieve this, but these are just exceptions that confirm this rule. The new traders want to get rich quickly but drown themselves when risking unreasonably. They can achieve short-term success, but sooner or later, a series of loss-making deals will destroy their dreams.

The risk management in Forex trading - Photo credit: pixabay.com

Here comes a popular and debatable question about how much a successful trader is to earn. For some reason, only a few are asking themselves how much they have to learn and lose money to start trading at least to zero loss. Those who stably make 40% a year, and do so in the course of five years - have already reached a great deal. A player who is able to double his deposit per year is already a star, equally rare, as a popular singer or great athlete.

If you set to yourself modest goals and reach them, you can go very far. If you are able to make 30% per annum, without major downturns and over a long period of time, investors will ask you to trade for them.

The goal must be to ensure that trading takes place at low risk and good statistics, with constant profit and low downturns, i.e., so that the rising profitability curve would be an even, without sudden jumps down and up.

Real money does not like high volatility and high risks.

While reading my blog, please check QUERLO CHAT:

On The Final Note

The risk management is one of the most important topics in the Forex trading lessons. Entrepreneurs must always calculate different risks and/or costs when determining the price of a product; the bankers must assess even more risk opportunities before setting a profit margin.

First of all, consider how well you are ready to trade. It would not be very pleasant, as soon as you start trading, to lose all your money, right? To avoid this, you can initially trade in demo versions, read various topics in traders' forums or attend individual lessons from traders who earn real money. Before hiring a Forex lecturer, it is advisable to make sure he is capable of trading profitably: ask him to submit a trading history. Otherwise, your money paid for lessons will be thrown away, and the lectures themselves are nothing worthy.

The management of risk and capital in Forex Trading - Photo credit: pixabay.com

But nobody and nothing will not help you to learn as tough and long-term trading on a demo account. Tips and knowledge on Forex are not enough. If there is no experience, there will be no money. Well, if to say more precisely - if there is no experience, then you will lose your money.

Life is like risk management - we try to anticipate the potential hazards of the future and create a certain tactic (strategy) that would help us avoid that danger (for example, loss).

Risk Warning: Forex Trading is risky, and it may not fit for everyone who wants to invest. It may happen that you will lose the total amount you have invested. You should not invest more than you can lose. Before investing, make sure you understand all the risks associated with Forex Trading. - Amber255

Credit: bitlanders.com

I wish you success in making extra money!

*************************************************************************************************

Thank you for stopping by and reading my blog.

2018, All Rights Reserved.

You are very welcome to join Bitlanders and share your valuable knowledge and opinion.

***************************************************************************************************

You can check my other blog about earning extra money:

1. Investing for Beginners: Easy Steps and Tips to Start Investing

2. First Steps To Starting An Online Store

3. Forex Trading: Training for Beginners

Come back to find more...

**************************************************************************************************