Eurozone Biggest Hole:

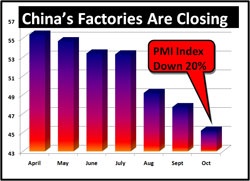

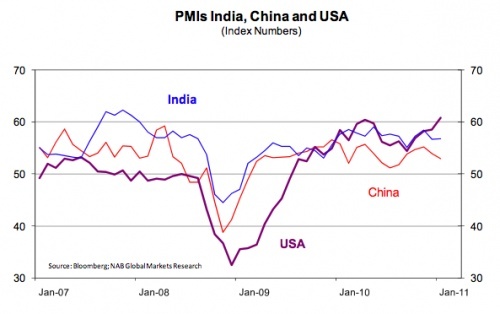

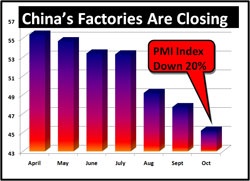

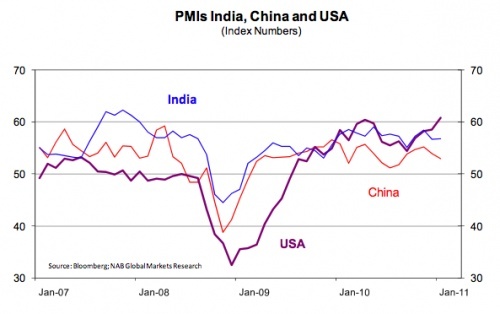

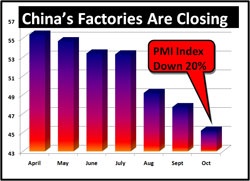

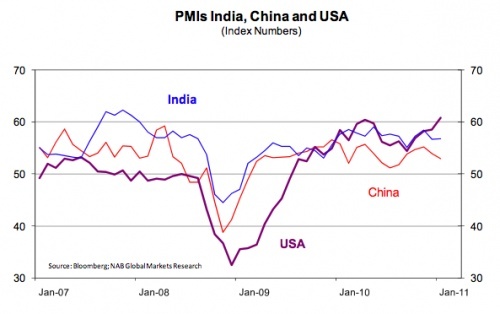

German manufacturing actually shrunk. Most of the rest of the Eurozone is performing even worse. China shrank to a 32 month low on the PMI (Purchasing Managers’ Index), which is employed as a reading on manufacturing activity. The PMI in the later economies registered below 50, generally viewed as recessionary.

China & Resource Driven Economies:

Today’s numbers do not include data on the service sector, but there is once again a rising sentiment that stagnation, if not recession is the near term future. China is not expected to go into recession, but a significant slowdown is a reason for worry internally for its own population and globally - China is increasingly viewed as the world’s economic driver. Australia and its resource rich economy have already evidenced the trend. The Australian Dollar has dropped in relative valuation to the US $ by around 10%. Commodities, such as copper, have fallen off sharply. Oil is the only commodity that appears to remain at bubble-like inflated levels, (but I and many others suspect that speculation/manipulation may be playing a decisive role).

US – Still Moving Forward, but Slowly:

The US economy, perhaps surprisingly to some, may be still growing, but at a subdued level. It is not enough to make a real dent in unemployment, and housing is generally still at post recession lows.

Asia: Export v Domestic Demand Driven?

China has vast currency reserves to re-stimulate its economy. Part of the slowdown in China may have been purposeful to prevent overheating and too much inflation (particularly hitting food and real estate prices). China may have overdone it with the brakes, but in the post 2008 period it exhibited the capacity to rather quickly reaccelerate. Some Asia neighbors also appear to be faring relatively well. Japan is still being carried by the momentum from the post-tsunami and nuclear accident economic recovery. Indonesia is exhibiting surprising resilience as it plays catch-up to meet demands from a productive population base.

India’s Rupee has dropped significantly indicating fear of significant slowdown and fleeing international investors. Some smaller export driven economies, as Malaysia and Thailand may be also vulnerable. (READ – “Asia Remains Strong but Not Quarantined” -

diplomaticallyincorrect.org/films/blog_post/asia-remains-strong-but-not-quarantined-from-euro-us-economic-woes-money-flash-by-ambassador-mo/362640

Causes: When China Sneezes?

The Eurozone contagion is undoubtedly a factor. However, fiscal austerity and its prospect in many countries is a consideration for private enterprise to be scaling back. Rapidly escalating commodity prices, from food to oil I think had produced their own unsustainable bubble like environment as such were driven up more by financial speculation rather than sustainable demand. Finally, China may be engineering part of the slowdown to address fear of its own economy overheating, and the internal disparities. The future may be with respect to China what it was for so long with the US – It used to be: “When the US sneezes the rest of the world catches a cold”? (Read - “Global Recession? Worst of Times. Best of Times” -

diplomaticallyincorrect.org/films/blog_post/global-recession-best-of-times-worst-of-times-by-ambassador-mo/36338 ).

Charts Above are more random although perhaps valuable as comparisons and indicative of possible trends. Be aware, all charts are 1-6 months old.

By Ambassador Muhamed Sacirbey

Facebook – Become a Fan at “Diplomatically Incorrect”

Twitter – Follow us at DiplomaticallyX

International Financial Crisis Channel -

diplomaticallyincorrect.org/c/international-financial-crisis