Bitcoin is a cryptocurrency

a form of money that uses cryptography to control its creation and management.However, not all of the technologies and concepts that make up bitcoin are new; the presumed pseudonymous Satoshi Nakamoto (the creator of bitcoin see below) integrated many existing ideas from the cypherpunk community when creating bitcoin.

CONTENTS

- PRE HISTORY

- CREATION

- GROTH

- PRICES AND VALUE HISTORY

- SANTOSHI NAKAMOTO

- REGULARTORY ISSUES

- THEFT AND EXCHANGE SHUTDOWNS

- TAXATION AND REGULATION

- SPORT AND SPONSERSHIP

Pre-history

Prior to the release of bitcoin there were a number of digital cash technologies starting with the issuer based ecash protocols of David Chaum and Stefan Brands.Adam Back developed hashcash, a proof-of-work scheme for spam control. The first proposals for distributed digital scarcity based cryptocurrencies were Wei Dai's b-money and Nick Szabo's bit gold. Hal Finney developed RPOW. Bit gold, b-money and RPOW all used hashcash as their proof-of-work algorithm.

Independently and at around the same time, Wei Dai proposed b-money and Nick Szabo proposed bit gold. Subsequently, Hal Finney implemented and deployed RPOW a reusable form of hashcash based on IBM secure TPM hardware and remote attestation (centralized but with no issuer inflation risk).

In the bit gold proposal which proposed a collectible market based mechanism for inflation control, Nick Szabo also investigated some additional enabling aspects including a Byzantine fault-tolerant asset registry to store and transfer the chained proof-of-work solutions.

There has been much speculation as to the identity of Satoshi Nakamoto with suspects including Wei Dai, Hal Finney and accompanying denials. The possibility that Satoshi Nakamoto was a computer collective in the European financial sector has also been bruited.

In November 2008, a paper was posted on the internet under the name Satoshi Nakamoto titled bitcoin: A Peer-to-Peer Electronic Cash System. This paper detailed methods of using a peer-to-peer network to generate what was described as "a system for electronic transactions without relying on trust". In January 2009, the bitcoin network came into existence with the release of the first open source bitcoin client and the issuance of the first bitcoins, with Satoshi Nakamoto mining the first block of bitcoins ever (known as the "genesis block"), which had a reward of 50 bitcoins. The value of the first bitcoin transactions were negotiated by individuals on the bitcointalk forums with one notable transaction of 10,000 BTC used to indirectly purchase two pizzas delivered by Papa John’sCreation

On 6 August 2010, a major vulnerability in the bitcoin protocol was spotted. Transactions weren't properly verified before they were included in the transaction log or "block chain" which let users bypass bitcoin's economic restrictions and create an indefinite number of bitcoins. On 15 August, the vulnerability was exploited; over 184 billion bitcoins were generated in a transaction, and sent to two addresses on the network. Within hours, the transaction was spotted and erased from the transaction log after the bug was fixed and the network forked to an updated version of the bitcoin protocol. This was the only major security flaw found and exploited in bitcoin's history

Growth

The Electronic Frontier Foundation began, and then temporarily suspended, bitcoin acceptance, citing concerns about a lack of legal precedent about new currency systems, saying that they "generally don't endorse any type of product or service." The EFF's decision was changed on 17 May 2013.

On 22 March 2011 WeUseCoins published the first viral video which has had over 6.4 million views. On 23 December 2011, Douglas Feigelson of BitBills filed a patent application for "Creating And Using Digital Currency" with the United States Patent and Trademark Office, an action which was contested based on prior art in June 2013.

In January 2012, bitcoin was featured as the main subject within a fictionalized trial on the CBS legal drama The Good Wife in the third season episode "Bitcoin for Dummies". The host of CNBC's Mad Money, Jim Cramer, played himself in a courtroom scene where he testifies that he doesn't consider bitcoin a true currency, saying "There's no central bank to regulate it; it's digital and functions completely peer to peer".

In February 2013 the bitcoin-based payment processor Coinbase reported selling US$1 million worth of bitcoins in a single month at over $22 per bitcoin. The Internet Archive announced that it was ready to accept donations as bitcoins and that it intends to give employees the option to receive portions of their salaries in bitcoin currency.

In February 2013 the bitcoin-based payment processor Coinbase reported selling US$1 million worth of bitcoins in a single month at over $22 per bitcoin. The Internet Archive announced that it was ready to accept donations as bitcoins and that it intends to give employees the option to receive portions of their salaries in bitcoin currency.

In March the bitcoin transaction log or "block chain" temporarily forked into two independent logs with differing rules on how transactions could be accepted. The Mt. Gox exchange briefly halted bitcoin deposits and the exchange rate briefly dipped by 23% to $37 as the event occurred before recovering to previous level of approximately $48 in the following hours. In the US, the Financial Crimes Enforcement Network (FinCEN) established regulatory guidelines for "decentralized virtual currencies" such as bitcoin, classifying American "bitcoin miners" who sell their generated bitcoins as Money Service Businesses (or MSBs), that may be subject to registration and other legal obligations

In November 2013, the University of Nicosia announced that it would be accepting bitcoin as payment for tuition fees, with the university's chief financial officer calling it the "gold of tomorrow". In December Overstock.com announced plans to accept bitcoin in the second half of 2014. In January 2014, Zynga[ announced it was testing bitcoin for purchasing in-game assets in seven of its games. That same month, The D Las Vegas Casino Hotel and Golden Gate Hotel & Casino properties in downtown Las Vegas announced they would also begin accepting bitcoin, according to an article by USA Today. The article also stated the currency would be accepted in five locations, including the front desk and certain restaurants.[60]

In September 2014 TeraExchange, LLC, received approval from the U.S.Commodity Futures Trading Commission "CFTC" to begin listing an over-the-counter swap product based on the price of a bitcoin. The CFTC swap product approval marks the first time a U.S. regulatory agency approved a bitcoin financial product.

Prices and value history

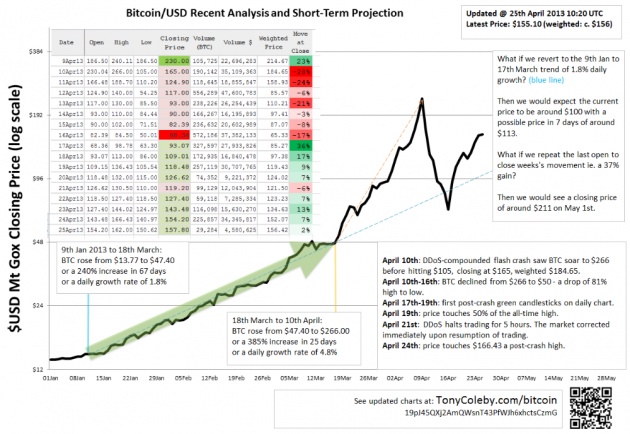

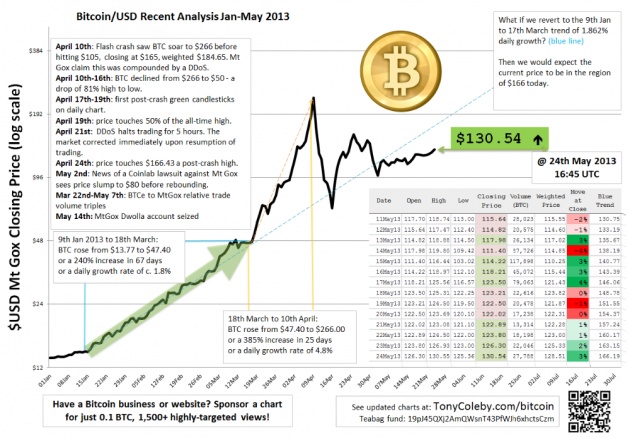

Among the factors which may have contributed to this rise were the European sovereign-debt crisis—particularly the 2012–2013 Cypriot financial crisis—statements by FinCEN improving the currency's legal standing and rising media and Internet interest. The current all-time high was set on 17 November 2013 at US$1216.73 on the Mt. Gox exchange

As the market valuation of the total stock of bitcoins approached US$1 billion, some commentators called bitcoin prices a bubble. In early April 2013, the price per bitcoin dropped from $266 to around $50 and then rose to around $100. Over two weeks starting late June 2013 the price dropped steadily to $70. The price began to recover, peaking once again on 1 October at $140. On 2 October, The Silk Road was seized by the FBI. This seizure caused a flash crash to $110. The price quickly rebounded, returning to $200 several weeks later. The latest run went from $200 on 3 November to $900 on 18 November. bitcoin passed a US$1000 all-time high on 28 November 2013 at Mt. Gox.

Prices fell to around $400 in April 2014, before rallying in the middle of the year. They then declined to not much more than $200 in early 2015.

Until 2013 almost all market with bitcoins were in US $

Satoshi Nakamoto

"Satoshi Nakamoto" is presumed to be a pseudonym for the person or people who designed the original bitcoin protocol in 2008 and launched the network in 2009. Nakamoto was responsible for creating the majority of the official bitcoin software and was active in making modifications and posting technical information on the BitcoinTalk Forum

Investigations into the real identity of Satoshi Nakamoto were attempted by The New Yorker and Fast Company. The New Yorker's investigation brought up at least two possible candidates: Michael Clear and Vili Lehdonvirta. Fast Company's investigation brought up circumstantial evidence linking an encryption patent application filed by Neal King, Vladimir Oksman and Charles Bry on 15 August 2008, and the bitcoin.org domain name which was registered 72 hours later. The patent application (#20100042841) contained networking and encryption technologies similar to bitcoin's, and textual analysis revealed that the phrase "... computationally impractical to reverse" appeared in both the patent application and bitcoin's whitepaper.[9] All three inventors explicitly denied being Satoshi Nakamoto. In May 2013, Ted Nelson speculated that Japanese mathematician Shinichi Mochizuki is Satoshi Nakamoto.[89] Later in 2013 the Israeli researchers Dorit Ron and Adi Shamir pointed to Silk Road-linked Ross William Ulbricht as the possible person behind the cover. The two researchers based their suspicion on an analysis of the network of bitcoin transactions. These allegations were contested. Ron and Shamir later retracted their claim.

Nakamoto's involvement with bitcoin does not appear to extend past mid-2010. In April 2011, Nakamoto communicated with a bitcoin contributor, saying that he had "moved on to other things

Stefan Thomas, a Swiss coder and active community member, graphed the time stamps for each of Nakamoto's 500-plus bitcoin forum posts; the resulting chart showed a steep decline to almost no posts between the hours of 5 a.m. and 11 a.m. Greenwich Mean Time. Because this pattern held true even on Saturdays and Sundays, it suggested that Nakamoto was asleep at this time, and the hours of 5 a.m. to 11 a.m. GMT are midnight to 6 a.m. Eastern Standard Time (North American Eastern Standard Time). Other clues suggested that Nakamoto was British: A newspaper headline he had encoded in the genesis block came from the UK-published newspaper The Times, and both his forum posts and his comments in the bitcoin source code used British English spellings, such as "optimise" and "colour".

An Internet search by an anonymous blogger of texts similar in writing to the bitcoin whitepaper suggests Nick Szabo's "bit gold" articles as having a similar author.Nick denied being Satoshi, and stated his official opinion on Satoshi and bitcoin in a May 2011 article.

In a March 2014 article in Newsweek, journalist Leah McGrath Goodman doxed Dorian S. Nakamoto of Temple City, California, saying that Satoshi Nakamoto is the man's birth name.

Regulatory issues

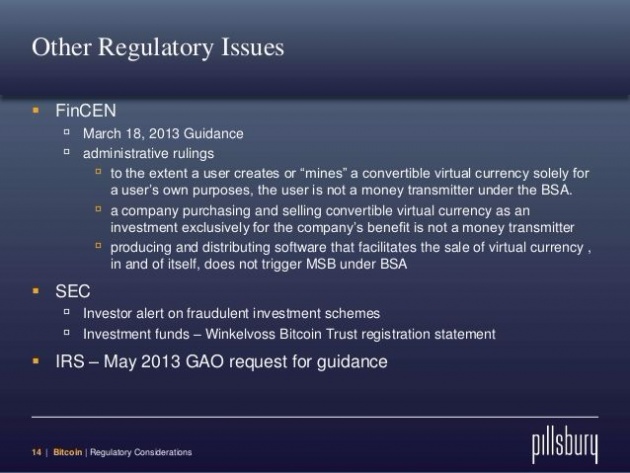

On 18 March 2013, the Financial Crimes Enforcement Network (or FinCEN), a bureau of the United States Department of the Treasury, issued a report regarding centralized and decentralized "virtual currencies" and their legal status within "money services business" (MSB) and Bank Secrecy Act regulations. It classified digital currencies and other digital payment systems such as bitcoin as "virtual currencies" because they are not legal tender under any sovereign jurisdiction. FinCEN cleared American users of bitcoin of legal obligations by saying, "A user of virtual currency is not an MSB under FinCEN's regulations and therefore is not subject to MSB registration, reporting, and recordkeeping regulations." However, it held that American entities who generate "virtual currency" such as bitcoins are money transmitters or MSBs if they sell their generated currency for national currency: "...a person that creates units of convertible virtual currency and sells those units to another person for real currency or its equivalent is engaged in transmission to another location and is a money transmitter." This specifically extends to "miners" of the bitcoin currency who may have to register as MSBs and abide by the legal requirements of being a money transmitter if they sell their generated bitcoins for national currency and are within the United States. Since FinCEN issued this guidance, dozens of virtual currency exchangers and administrators have registered with FinCEN, and FinCEN is receiving an increasing number of suspicious activity reports (SARs) from these entities

Additionally, FinCEN claimed regulation over American entities that manage bitcoins in a payment processor setting or as an exchanger: "In addition, a person is an exchanger and a money transmitter if the person accepts such de-centralized convertible virtual currency from one person and transmits it to another person as part of the acceptance and transfer of currency, funds, or other value that substitutes for currency."

In summary, FinCEN's decision would require bitcoin exchanges where bitcoins are traded for traditional currencies to disclose large transactions and suspicious activity, comply with money laundering regulations, and collect information about their customers as traditional financial institutions are required to do.

Patrick Murck of the Bitcoin Foundation criticized FinCEN's report as an "overreach" and claimed that FinCEN "cannot rely on this guidance in any enforcement action".non-primary source needed.

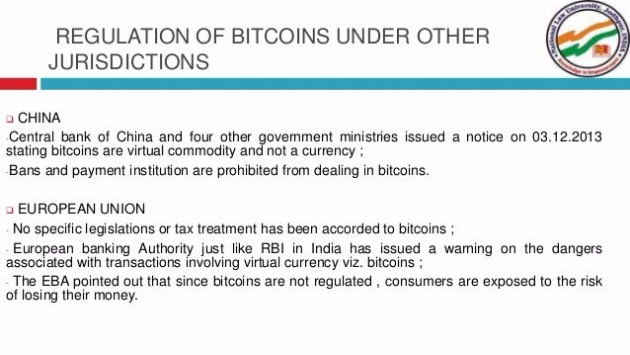

n its October 2012 study, Virtual currency schemes, the European Central Bank concluded that the growth of virtual currencies will continue, and, given the currencies' inherent price instability, lack of close regulation, and risk of illegal uses by anonymous users, the Bank warned that periodic examination of developments would be necessary to reassess risks.

In 2013, the U.S. Treasury extended its anti-money laundering regulations to processors of bitcoin transactions.

In June 2013, Bitcoin Foundation board member Jon Matonis wrote in Forbes that he received a warning letter from the California Department of Financial Institutions accusing the foundation of unlicensed money transmission. Matonis denied that the foundation is engaged in money transmission and said he viewed the case as "an opportunity to educate state regulators."

In late July 2013, the industry group Committee for the Establishment of the Digital Asset Transfer Authority began to form to set best practices and standards, to work with regulators and policymakers to adapt existing currency requirements to digital currency technology and business models and develop risk management standards.

In 2014, the U.S. Securities and Exchange Commission filed an administrative action against Erik T. Voorhees, for violating Securities Act Section 5 for publicly offering unregistered interests in two bitcoin websites in exchange for bitcoins

Theft and exchange shutdowns

Theft of bitcoin has been documented on numerous occasions. At other times, bitcoin exchanges have shut down, taking their clients' bitcoins with them. A Wired study published April 2013 showed that 45 percent of bitcoin exchanges end up closing

On 19 June 2011, a security breach of the Mt. Gox bitcoin exchange caused the nominal price of a bitcoin to fraudulently drop to one cent on the Mt. Gox exchange, after a hacker used credentials from a Mt. Gox auditor's compromised computer illegally to transfer a large number of bitcoins to himself. They used the exchange's software to sell them all nominally, creating a massive "ask" order at any price. Within minutes, the price reverted to its correct user-traded value. Accounts with the equivalent of more than US$8,750,000 were affected

On 3 April 2013, Instawallet, a web-based wallet provider, was hacked, resulting in the theft of over 35,000 bitcoins[133] which were valued at US$129.90 per bitcoin at the time, or nearly $4.6 million in total. As a result, Instawallet suspended operations.

On 11 August 2013, the Bitcoin Foundation announced that a bug in a pseudorandom number generator within the Android operating system had been exploited to steal from wallets generated by Android apps; fixes were provided 13 August 2013.

In October 2013, Inputs.io, an Australian-based bitcoin wallet provider was hacked with a loss of 4100 bitcoins, worth over A$1 million at time of theft. The service was run by the operator TradeFortress. Coinchat, the associated bitcoin chat room, has been taken over by a new admin.

On 26 October 2013, a Hong-Kong based bitcoin trading platform owned by Global Bond Limited (GBL) vanished with 30 million yuan (US$5 million) from 500 investors.

On 3 March 2014, Flexcoin announced it was closing its doors because of a hack attack that took place the day before. In a statement that now occupiestheir homepage, they announced on 3 March 2014 that "As Flexcoin does not have the resources, assets, or otherwise to come back from this loss [the hack], we are closing our doors immediately." Users can no longer log in to the site.

Taxation and regulation

In 2012, the Cryptocurrency Legal Advocacy Group (CLAG) stressed the importance for taxpayers to determine whether taxes are due on a bitcoin-related transaction based on whether one has experienced a "realization event": when a taxpayer has provided a service in exchange for bitcoins, a realization event has probably occurred and any gain or loss would likely be calculated using fair market values for the service provided."

In August 2013, the German Finance Ministry characterized bitcoin as a unit of account, usable in multilateral clearing circles and subject to capital gains tax if held less than one year.

On 5 December 2013, the People's Bank of China announced in a press release regarding bitcoin regulation that whilst individuals in China are permitted to freely trade and exchange bitcoins as a commodity, it is prohibited for Chinese financial banks to operate using bitcoins or for bitcoins to be used as legal tender currency, and that entities dealing with bitcoins must track and report suspicious activity to prevent money laundering. The value of bitcoin dropped on various exchanges between 11 to 20 percent following the regulation announcement, before rebounding upward again

Sports sponsorship

On June 18, 2014, it was announced that bitcoin payment service provider BitPay would become the new sponsor of the St. Petersburg Bowl game under a two years deal

renamed the Bitcoin St. Petersburg Bowl. Bitcoin will be accepted for ticket and concession sales as part of the sponsorship, and the sponsorship itself was also paid for using bitcoin. On April 2, 2015, after one year of sponsorship, BitPay declined to renew sponsorship of the game

WATCH ALL HISTORY OF BITCOIN

THANKS FOR READING