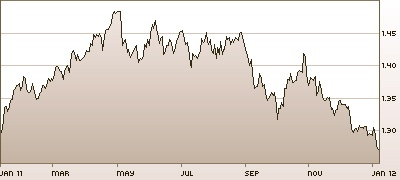

Just when you might think the slide is over, it will fake you out – that’s nature of currency markets and lesson again delivered over last week. After an initial surge earlier in the week, the Euro has receded to levels not witnessed in over a year. Most critically, despite shorter-term stomach churning turns, the trend tends to persist over an extended period, (“the trend is your friend” is one of the more durable rules of currency markets), until there is a fundamental factor for a turn. Expected summits between EU leaders over next month do not necessarily establish a substantive consideration for a change in trend, as evidenced by events over latter part of last year - full of meetings but Euro crisis persists. (Above Chart - One Year Euro/US$ Exchange Rate)

On-Going Economic Malaise Re-enforced by Austerity:

Europe’s ongoing economic malaise, at least some Eurozone states are effectively in recession, will keep the pressure on the Euro downward. News that Greece and perhaps some of the other austerity chained economies may not meet deficit targets, (due to the recessionary vicious cycle amplified by austerity), has only added to the Euro plunge.

Ironically, the most immediate antidote to the ongoing loss in the Euro’s relative altitude with respect to US$ and other currencies, may be if a few of the peripheral economies either parachute our or are thrown out. There is again renewed "talk" that Greece may have to drop out. However, that decision may be based more on political considerations and appearance than what economics might dictate. Core Germany and countries as Netherlands are doing well, and ironically a dropping Euro only makes exports more competitive.Is a dropping Euro perhaps desirable in eyes of some?

Parity? - Have Been Pretty Much Right on My Projections to This Point!

Without a fundamental change, the Euro could soon be at 1.25 to US Dollar. Some predict parity within a year or so. It is not out of realm of possibility or history. More than a decade earlier when the Euro was introduced, at around 1.2 it actually fell to below parity in short order. Subsequently, after reversing course toward higher, the climb of the Euro was long and steady but also built on many factors that may be more difficult to resolve/restore. Structural problems may be on agenda’s and a broad plan of action may be envisioned but critical political and financial details remain to be resolved. As mentioned above, politics as much as economic considerations are in play and on the loose. Euro’s standing to again become a credible alternative to US$ as global reserve currency will also require time and memory to fade a bit beyond this currency - no quick change.

Also Read: -“Is Eurozone or US in Greater Financial Turmoil?” -

diplomaticallyincorrect.org/films/blog_post/is-eurozone-or-us-in-greater-financial-turmoil-by-ambassador-mo/41996

“International Financial Crisis” Channel -

diplomaticallyincorrect.org/c/international-financial-crisis

By Ambassador Muhamed Sacirbey

Facebook Become a Fan at “Diplomatically Incorrect”

Twitter – Follow at DiplomaticallyX