How To Start Saving

Image Credit: created by @artbytes for Bitlanders

Image Credit: created by @artbytes for Bitlanders

This is the part 2 of my 'Are You Saving For Your Future?' series. In this part, I will share with you some ideas on 'How to Start Saving Money', or to be precise, 'How To Start Your Saving Habit'.

If you haven't read the first part, please read: Are you saving for your future? Part 1: The Rat Race

In that post, I shared with you the dangers of having no savings and getting into debts and thus into the Rat Race!

Do You Have a Savings Account?

In the Philippines, according to Bank Sentral ng Pilipinas (BSP or the Central Bank of the Philippines)- in 2017, 86% of Filipinos don't have bank accounts.

The central bank yesterday said 86 percent of Filipino households are do not have a deposit account because they do not have enough cash to spare for keeping.

-source: https://business.mb.com.ph/

As stated the main reason that Filipino households do not have a deposit account because they do not have enough cash to spare.

According to the book 'Saving Your Future' by Xuan Nguyen (published 2015) 35% of Canadians do not have savings or investments. In the U.S. only 59% of the adults claim they have savings. (Please Google for the numbers for your country)

The question is, why don't they have the cash to spare? I can think of at least two possible reasons.

- People tend to live beyond their means (overspending);

- Or people do not earn enough.

Where do you think you belong to? If you are not sure, the discussion below will help you determine the right reason plus how to cut down your expenses. Before that, let's ask ourselves one very important question...

Why start a savings habit?

In the first part of this series, I gave four of my reasons why I wanted to save money. Those four reasons could be summed up in one...I want to have Financial Freedom within 10 years!

Financial freedom is much more than having money. It’s the freedom to be who you really are and do what you really want in life.

-source: richdad.com

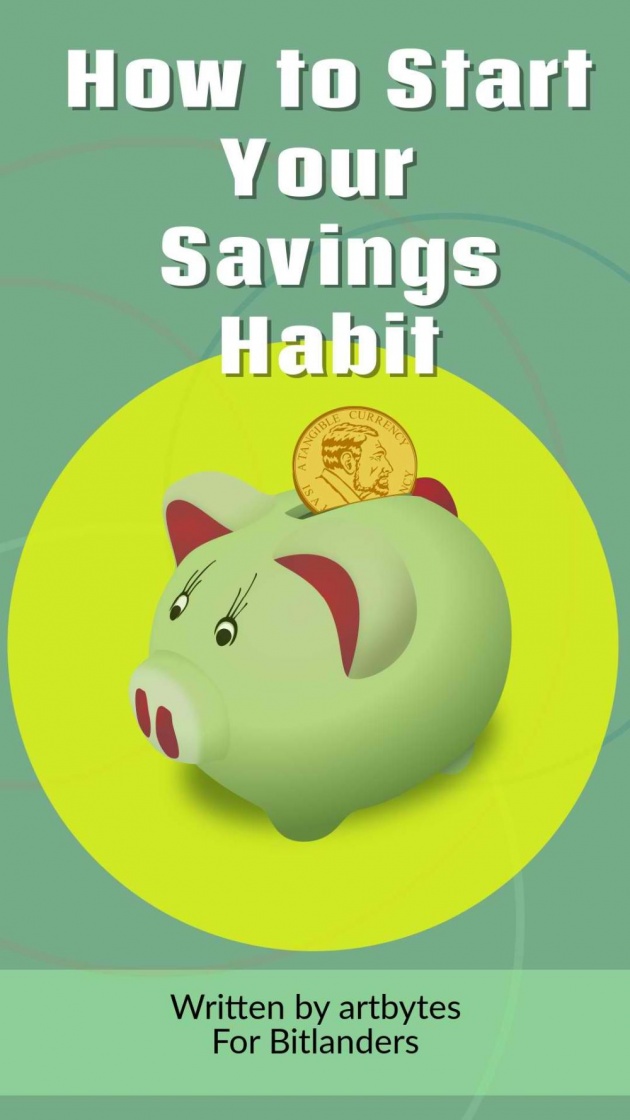

According to the SSS Survey

In a Career Orientation with Insular Life the other day (January 24, 2018), this data was presented to us:

An SSS Survey-*

Image Credit: By @Artbytes

65 is the retirement age in the Philippines. The data shows that 63% of the retirees are financially dependent. Meaning they depend on their children for their daily needs, e.g. food, medicine, etc... I believe some of these retirees are in a home for the aged being taken care of by strangers. 3% are forced to work after they have retired and only 4% are financially independent and 1% are rich! The rest... well they are resting in peace.

This means only 5% of the people above 65 years of age are actually enjoying their lives after they retire! Sad, isn't it?

Suffice to say, we want to be in that 5% (financially independent or rich). Better yet, we want to decrease the number of financially dependent and working retirees and increase the number of financially independent and rich! That should be our goal!

Why? Let me share you a story.

Mr. Dee (just a fictional name), a retiree went to his son's house, one day. Upon reaching the door, he knocked. He then heard the tiny footsteps of a little child running towards the door. Mr. Dee was so excited that he is about to see his cute grandson again.

However, the boy did not open the door. He peeked through the window and asked who it was. Mr. Dee told the boy who he was. Still, instead of opening the door, Mr. Dee heard the footsteps running away from the door.

Mr. Dee was shocked to overhear what the boy said to his father.

"Grandfather is here again. He is going to ask you for money again!"

If you were Mr. Dee, what would you feel? Frankly speaking, I don't want to become like Mr. Dee in the future. In fact, I want to be the opposite of Mr. Dee. What I want is, when I visit my children's house, it is not to ask for money but rather...

"Hey, son! Pack your bags, I bought you and your family tickets for Hong Kong. We are going to Disney Land".

And my grandchildren would all be excited except for one.

"Aww... but we went there last year! Can we go somewhere else?"

Imagine This

When you are retired you have invested more than enough money that the interest alone is more than enough to support all your needs year after year. And you have some more to spare for a yearly vacation with your family. Isn't that wonderful?

Sounds unrealistic? Maybe... but not impossible. It could be done. And you don't need to be as rich as Warren Buffet or Bill Gates to have that kind of life.

To attain that, you need to create a Solid financial foundation!

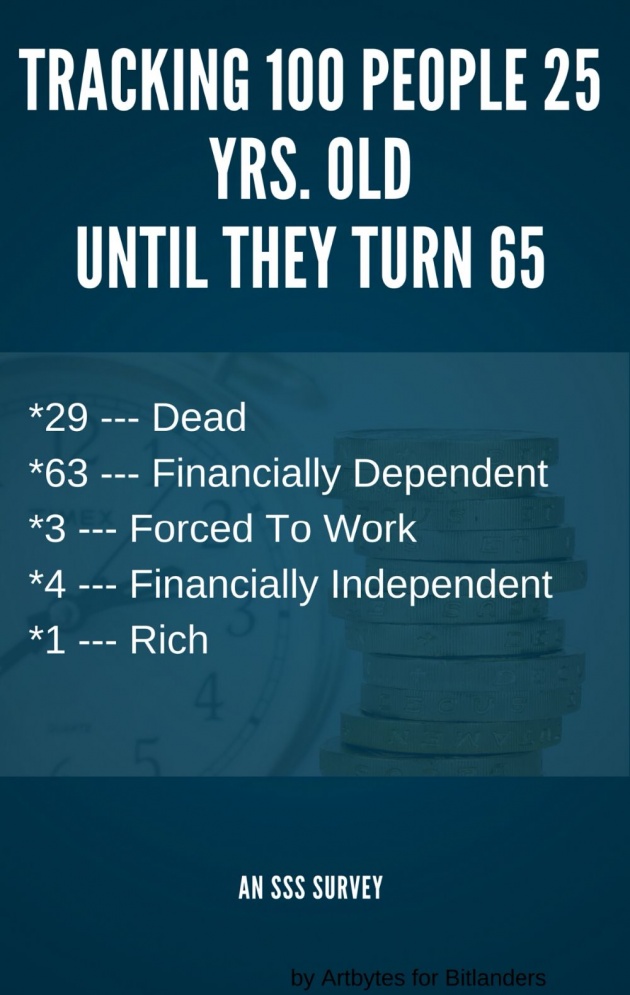

Build a Solid Financial Foundation

Building A Solid Financial Foundation

Image Credit: Created by @Artbytes based on the book 'Saving Your Future' by Xuan Nguyen

What does it mean to build a Solid Financial Foundation? To build a solid financial foundation, you must take care of your financial needs both at the present and the future.

Like building a house, you should build a solid financial foundation and build it from the ground up.

-reference: Saving Your Future by Xuan Nguyen

- First, you must have protection. Because if anything happens to you (heaven forbid), who will provide for your family? In case you get sick or got into an accident, how can you earn for your family?

Having protection means to have a life and health insurance. - You have to manage your debts. As much as possible don't get into a bad debt, in the first place. If you are already in debts, you should find a way to get out of it.

- Emergency Fund. An emergency fund is about 3 to 6 months of your monthly expenses. This is in case of a sudden change in your job or other source of income, you have a reserve good for a few months. Or if an emergency (calamity, sickness, etc...) occurs, you have some money set aside.

- Investment. This is for your future. For your retirement, if you may. Be careful though, some sales agents will try to convince you to buy something in the cover of 'investments'. I will share my thoughts on this topic on my the next part of this series.

Our Wealth and Responsibilities (The X Curve Concept)

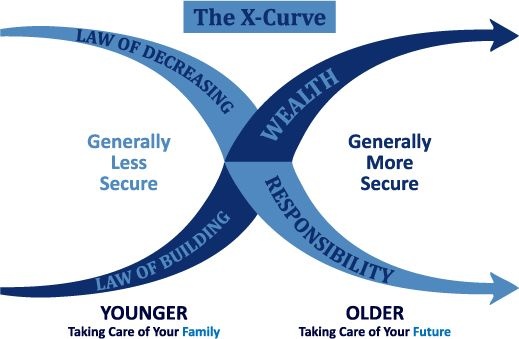

The X-Curve Concept

Image Credit: Source: Pinterest

The X-Curve Concept shows the relationship between our wealth and responsibility as we grow older.

- When we are young, we are not yet financially secure, and our responsibilities to our family are great.

- Our Wealth is low or starting from zero

- Our Responsibilities are high.

- As we grow old we should build up our wealth.

- Wealth is increasing.

- Responsibilities are decreasing.

- As we approach our retirement age, we should already have attained financial security or financial freedom.

- Our wealth is now at peak and our income is growing without lifting finger (passive income).

- We are now secure, and free from responsibilities because we are well covered by our insurances and passive income.

Let's Imagine Another Scene

On one summertime, 10 years from now... You and you're family are on a beach. Enjoying the view of the setting sun! Two days after you and your family went off to Hong Kong, or Canada, or any other place you haven't gone to yet.

Sunset Beach

Image credits: by Free-Photos via Pixabay.

You are not worried about the expenses because it is already covered. From just one of your numerous investment portfolios, you are earning enough to have a grand vacation with your family every year. Plus the e-book that you published 10 years ago, is still earning you $1,000.00 a day.

Is not that great? That's what the right side of the X-Curve means.Wouldn't you just love that? Will not do anything to attain just that? Guess what, this scene is attainable. YOU CAN ATTAIN it. How?

Start Your Saving Habit Now!

Yes, the solution is to start your saving habit now! However, a common reaction to this statement would be:

How can I start saving when I can I barely make ends meet with my current income?

Usually, whenever we see that we already have spent all our money before the next pay date, we would think:

"How I wish I get a raise soon."

or

"I need to find a second job!"

or

"I wish I would win the Lottery!"

Surely, it sounds logical. We need more money so we need an additional source of income, or win the lottery. However, as I have mentioned in the first part of this series, once we increase our income, it is our habit to spend all that we have and sometimes we spend more.

The more we earn, the more we spend!

Therefore even if get a raise, get a second job, start a part-time business, or even if we win the lottery jackpot, if we don't control our spending habits, we will still not be able to save money! Why?

Let's you got a raise of $500.00 a month. Then you saw this UltraHD smart TV which originally costs $5,000.00 now it is on sale, and the price tag dropped to $3,990.00. Plus there is a 1-year installment plan option with a monthly interest of only 3%. Thus you will be paying only $452.20 a month. You will reason than that, this is a reward for yourself and for working hard. You deserve to buy it.

Here's the catch, the total cost of the TV that you bought on sale via installment plan is $5,426.40! That does not include the additional cost of your monthly electric bill. Or the additional charges for the HD channels for your cable provider. The more you earn, the more you spend.

Lottery Winners

Here's the fact, at least 60% of the Lottery jackpot winners lost all their winning money and worse incurred debts after some time. Why? Spending Habits!

A habit is a routine of behavior that is repeated regularly and tends to occur subconsciously.

-Source: Wikipedia

Habits are formed over time and hard to break. The sad part is, it is we do it subconsciously, meaning we are not even fully aware that we are doing it. that is why, even if increase our income without breaking our spending habits, we will just ending up spending more. To break a bad habit, you need to consciously create a new one. Psychologists reports that it takes at least 21 days to form a new habit. Meaning you have to consciously and deliberately do the actions in the first 21 days or more.

Keep Calm and Save Money

Image Credit: FreeGraphictoday via Pixabay.

Do You Know Where You Spend Your Money?

In the first part of this series, I suggested that you list down your daily expenses. I know this is not easy at first. However, in order to effectively start your saving habit, you need to know where you spend your money.

List of your income and expenses every day:

Image credit: Coffee, pen, and notebook by Engin_Akyurt via Pixabay.

5 Habits That Will Help You Start Saving

Again, habits are formed. It is formed by doing conscious actions repeatedly until it becomes part of your subconscious. Forming new a habit is like programming your mind. These are the habits that you want to have as part of your saving habits.

-

List of your income and expenses.

So it's not just the expenses. List down also your income and your sources. Use a pen and notebook, a smartphone app or a spreadsheet, or a combination of these. Whichever you choose, the important thing is start listing your income and expenses.

Image Credit: Andromoney for Android via Google Play

If you are a techy one, here are three suggestions.

- Andromoney for Android: - as recommended by Google Play

- Evernote - not really a financial management app, rather a general organizer app. However, I don't want to cram up my phone's storage with specialized apps, thus I prefer this.

-

Pay yourself first.

The Abundance Formula By Bo Sanchez

Image Credit: kerygmabooks.com

To 'pay yourself first' means, each time you receive your income, you set aside a certain percentage. to your savings. You do this BEFORE you spend anything. As explained previously and in the book 'Abundance Formula' by Bo Sanchez, you should set aside 20% of your income. However, if you find 20% too big, you can start with at least 5%. In order for this to be effective, you have to feel a little discomfort in doing this at first.

Another alternative that I do is, I set aside a certain amount every day. Let's say, PHP 50.00 ($1.00) a day. Then increase this later once you have set your savings goals.

Doing this is like your income has been reduced. At least you should think this way. Why? You will now think that you have less money to spend and will be forced to cut down your expenses. - Lower your expenses.To compensate for your lowered spending money, you are now forced to reduce your expenses. This is where your list of expenses now comes in. From your list, we will determine which of your expenses you can reduce or ultimately remove.

- First and foremost, cut down your expenses on unhealthy habits!

Smoking. If you are a smoker, think about this. Let's assume you consume 1 pack (20 sticks) of cigarettes a day. Assuming a pack's costs, PHP 50.00 ($1.00). If you cut down the number of sticks you smoke to 10, you can now save PHP 25.00 a day, or $0.50. Multiply that by 30 days, you have saved PHP 750.00 or $15.00 in one month. If you stop smoking entirely, you can save up to PHP 1,500.00 or $30.00 a month.

Smoking. If you are a smoker, think about this. Let's assume you consume 1 pack (20 sticks) of cigarettes a day. Assuming a pack's costs, PHP 50.00 ($1.00). If you cut down the number of sticks you smoke to 10, you can now save PHP 25.00 a day, or $0.50. Multiply that by 30 days, you have saved PHP 750.00 or $15.00 in one month. If you stop smoking entirely, you can save up to PHP 1,500.00 or $30.00 a month.

Fast Food Restaurants. Eating in fast food restaurants or in any restaurants for that matter, you are paying at least 25% more, or 200% more or even bigger. Here in the Philippines, the prices of food in a restaurant comes with 12% tax. If you see a lot of service and kitchen crew, you are paying for them. If the place has a fancy design and ambiance, you are paying for them. If that restaurant is running advertisements on different media (tv, radio, print, etc...), you guessed it, you are paying for them.

Whereas, if you buy raw ingredients, they are not taxed in the first place. Plus you have the benefit of choosing the freshest ingredients you could find.

So a lunch that costs PHP 75.00 (or about $1.50) in a restaurant probably would cost only PHP 40.00 (about $0.80) if you cook it yourself. that's a saving of PHP 35.00. Healthier too. You can save then PHP 1,050 or $21.00 a month.

Soft drinks or any Sugared drinks. A litter of cola costs PHP30.00. (about $0.60). I used to buy one or two each day for our family consumption. That translates to at least PHP900.00 or $18.00 a month.

From these alone, you now have a monthly savings of PHP 3,450.00 or $69.00. Do you still think you are not earningough? -

Don't Buy Brands. Why buy a branded pair of jeans which costs more than PHP 2,000.00 ($40.00) when you can buy two pairs of the lesser known brand with less than half the price?

- Don't Buy on Impulse. One of the most common culprits of overspending is buying on impulse! The video below suggests that if you see something you want to buy, wait for thirty days before buying it. My personal strategy to prevent me from buying on impulse is, I bring only a certain amount of money in my wallet every day. I call it my daily allowance. The amount is just enough for my daily expenses.

-

Don't Buy On Credit. Don't bring your credit card with you every day. This will prevent you from buying things even when you don't have cash. Don't take the zero interest bait. When you see a price tag that shows Zero interest on credit card purchase, don't believe it. Try to see if there is a discount on cash purchase on the price tag. The truth is the discounted price is the regular price. The listed price has a built-in interest for a credit purchase.

- Simplify Your Lifestyle. This is the bottom line. If you really want to cut down your expenses, simplify your lifestyle.

By doing the suggestions above, I believe you can cut down your monthly expenses to about PHP 6,000.00 a month.

I will repeat my question. Do you still think you are not earning enough?

How To Save Money Fast

Video Credit: Project Better Self via YouTube

- First and foremost, cut down your expenses on unhealthy habits!

- Plan Your Expenses.

If you have been listing your expenses already, the next step is to plan your expenses. From your list, classify your expenses by the following (after you have taken out the 20% for your savings):- Yearly Expenses- Expenses that you need to pay once or twice a year. Like, house and vehicle maintenance. Annual taxes. Include also things that you need to buy like, one or two pairs of pants, a pair of shoes. List down how much, when you plan to buy or pay for them. Then compute how much you need to save for them monthly.

- Monthly Expenses - This includes utility bills, car wash, and salary for helper(s)/driverr if you have. If you prefer, pay the tuition fees monthly. Again, set aside the amount needed.

I would also suggest buying your household needs from the grocery store. Buy in volume that would last a month. The little price difference when you buy them from a retail store could total to more than a hundred pesos (a few dollars) in a month or two. Furthermore, you can save a trip or two in \going to the grocery store, thus saving time and travel expense. - Weekly Expenses - If you have a car, gas money should be listed here. Also buy your food ingredients weekly. Every two or three days for perishables like meat and vegetables. If you have kids that go to school, the best way to teach them how to handle money properly is to let them budget their own weekly allowance.

- Daily Expenses - More often than not, your biggest spending goes to the small daily expenses. Again, from your list, you can determine how much of your daily expenses are really necessary. Reduce, if not remove, your budget for the unnecessary expenses such as your vices. Bring only the amount that you need for that day. This will also prevent you from buying on impulse.

- Open A Second Bank Account - If you already have a bank account, open the second one. In the first one, you keep your monthly budget. in the second one, your savings. Never bring the bankbook or ATM card of your second bank account with you unless there is an emergency.

Discipline Your Self

Self-discipline is important. Habits are formed through conscious efforts. So in the first few months, it might be difficult. But once, you get into the savings habit and break your spending habit, most likely you will realize that you were just spending too much. The next that you need to do is pay your debts fast.

How To Get Out Of Debts Fast

The other thing that could hurt your monthly budget is your debts. Hopefully, in a month or two, you could cut down the expenses that you no longer need to borrow more money before the next payday. And hopefully, you now have some extra cash to start paying off your debt fast. Here's a short video on how to get out of your debt fast!

Strategies For Paying Down Debts.

Video Credit: Bank of America Via YouTube

Let's Recap

To start your savings habit you need to:

- Save first before spending.

- Make a List of your income and expenses.

- Cut down on unnecessary expenses.

- Make a Plan for your expenses.

- Open a second bank account.

- Pay your debts.

As you establish your savings habit, you must get protection and prepare for your future. I will discuss further how to build a solid financial foundation on my next post.

Start Now

What is important is, no matter what is the state of your financial situation, you must start your savings habit and you must start now! Again, as you establish your savings habit, you must also find a way to increase your income and grow your money. These will be the topics of the next installment of this series.

Thanks for reading.

Related Article

*- Disclaimer: The data is as presented during the meeting but I have not verified personally.

SSS - Social Security System is a government-run social insurance program in the Philippines.

-oO0Oo-`

John Loberiza (@artbytes) is a freelance graphic artist, web developer, and blogger. He is also a licensed Financial Adviser under Insular Life- the only Filipino owned Insurance company. The content of this blog post is based on the author's studies and personal experience on the subject.

If you have any reactions or inquiries regarding the subject of this post, please write it in the comment or send the author a private message.

Join Bitlanders

If you have not joined Bitlanders yet and you are a content creator- a writer, blogger, photographer, an artist or a hobbyist, you can earn from your creations by uploading them in Bitlanders. Join now by clicking here.