“…tendency has been lately for speculators to choke the goose even before it can lay the gold plated egg….” Oil and commodity prices spiked yesterday and over the last few days sharply, somewhere around 10-20%, but is this a reflection of global economic growth or more of a speculative character? On fundamental supply and demand basis at least for petroleum not that much has changed about the global economic forecast between the negativism of a few weeks earlier and optimism reflected in commodity and equity prices rapidly rising over last 10 days or so. To the contrary, the prevailing subdued demand and economic forecasts should not have been cause for such price spikes. In the OEDC, (Organization for Economic Co-operation and Development - the largely developed world including Europe, Japan and the United States), demand continues to be level to slightly contracting. The actual demand in new rising economic giants as China and India continues to rise, but not beyond previous expectations. (See IMF FILM REPORT -

diplomaticallyincorrect.org/films/movie/india-economic-road-ahead/28883). In fact, the performance of such economies has been at or slightly below expectations.

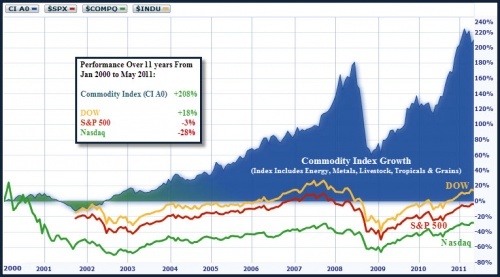

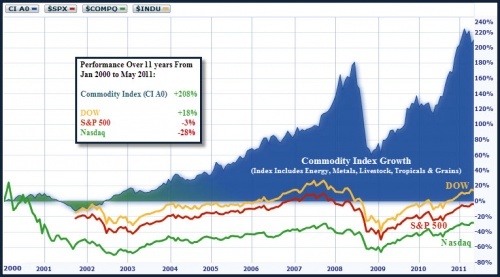

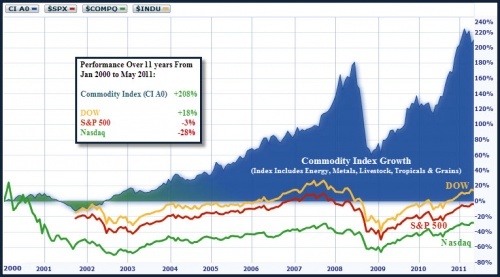

Commodities Above 2008 Bubble & Pre-Financial Crisis Levels - Spike is largely speculative driven - on what basis?

• On Monday,(October 24, 2011), Caterpillar Incorporated, the manufacturer of heavy trucks and other equipment used in mining, drilling and exploitation of raw materials, announced a better than expected profit and forecast and thus presumably demand for its products. This was immediately translated by speculative factors into higher demand for commodities itself –rises of around 5% from petroleum to metals. However, Caterpillars performance and forecast is as much or more an indicator of potential rising supply which could dampen some or all such commodity prices.

• “Quantitative easing” both by Europe and US central banks is anticipated to be the response to the current sovereign debt crisis and stalled economic growth. “QE III” by the US Fed and some yet to be fully defined liquidity facility for European banks is anticipated to inject such further liquidity as to encourage investment through ETFs (Exchange Traded Funds) and other financial instruments into petroleum and other commodity markets. However, this “financial demand” does not reflect actual user or consumption demand but is in effect speculation upon anticipated speculation.

• Rising financial liquidity on a broader basis can be seen as boosting economic activity overall; however austerity measures in the Eurozone and US are counterweights. Economic growth in the developed economies will continue to be slow to negligible overall. (As seen from above CHART - Commodity Index is well above inflated bubble levels of 2008 pre-financial crisis).

• More importantly, poor employment, housing and consumer sentiment recovery should douse any over-exuberance. In other words, the underlying fundamental reasons for economic malaise in the developed countries continues and energy/commodity price spikes only add to the economic subtraction underway in many such economies.

Is “New Normal” Cycle(s) of Commodity Spikes & Choking of Economic Expansion?

The tendency has been lately for speculators to choke the goose even before it can lay the gold plated egg. Speculative driven spikes in such fundamentals as petroleum, foods and industrial metals can suffocate the anticipated recovery even before it gathers enough air to fire the engine of economic expansion. Further, the cycles are trending to ever more rapid turns and extremes. My opinion is that neither the current speculative trend nor the employment and consumer fundamentals are particularly healthy for robust economic recovery. (That does not mean that some/many larger business concerns may not continue to show healthy profits through cost saving and growing margins). And, the more that commodity prices rise, the more likely this is to choke off demand in developing as well as the developed markets. It becomes a bit of a vicious cycle, like so many things in the “new normal:” As developed markets slow, so do the developing markets that export to them. This of course then has a dual effect on commodity producers. Further, spiking commodity prices can inject inflation fears thus curtailing monetary expansion, (which is the current rationale for the speculation). Some Asian banks will continue to maintain if not raise interest rates to keep domestic inflation in check. Rising energy and food prices will be such policy makers most significant indicators of how to drive monetary policy. (READ – “Asia Remains Strong but Not Quarantined from Euro-US Economic Woes”-

diplomaticallyincorrect.org/films/blog_post/asia-remains-strong-but-not-quarantined-from-euro-us-economic-woes-money-flash-by-ambassador-mo/36264).

The vulnerability of the global economy not only to commodity spikes but also such cycles is probably highly underestimated or not yet fully understood/calculated. On a global policy level, we speak mostly of such spikes in terms of food prices and impact upon the impoverished and working poor. (READ – “State of Food Insecurity for 2011 – UN Report” -

diplomaticallyincorrect.org/films/blog_post/state-of-food-insecurity-in-world-2011-un-report-by-ambassador-mo/36153 ). However, such spikes are having also a more direct effect on broader consumer and business confidence and capacity of even business to predict and thus expand their production and/or services.

In this context, spiking commodities prices, from energy to food, are factors for concern for “Occupy Wall Street” protestors to businesses and industrial producers.

READ – “Greed is Good – Abuse in Financial Markets Cause for Spiking Prices & Economic Instability” -

diplomaticallyincorrect.org/films/blog_post/greed-is-good-abuses-in-financial-markets-cause-for-spiking-prices-economic-instability-by-ambassador-mo/35002

READ – “Financial Jungle – Can Anyone Leash the Predator?” - Financial Jungle – Can Anyone Leash the Predator?”

diplomaticallyincorrect.org/films/blog_post/financial-jungle-can-anyone-leash-the-predator-by-ambassador-mo/27281 )

By Ambassador Muhamed Sacirbey

Facebook – Become a Fan at “Diplomatically Incorrect”

Twitter – Follow us at DiplomaticallyX

International Financial Crisis Channel -

diplomaticallyincorrect.org/c/international-financial-crisis