It’s rightly said money is not grown on tree until it’s wisely save and invested! On eyes blink one can find out big bucket of plans from small to long investments. But all is not suitable for one’s needs and preferences. That’s everyone need to have perfect knowledge regarding how to secure financial well being. It’s one of most important matters in life which is not negotiable at all. Capital market is one the most expanded and demanded segment of financial market where investors always seeks for high return investment. For newbie capital market may be a messy and most complicated section to invest. That’s only because of unawareness and lack of knowledge. In this blog my focus is to make aware regarding the various financial instruments of capital market for saving investment. Let’s start

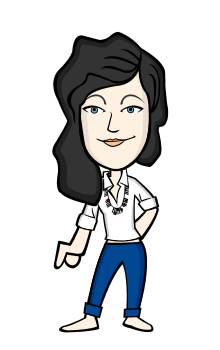

(Classification as per maturity period of securities)

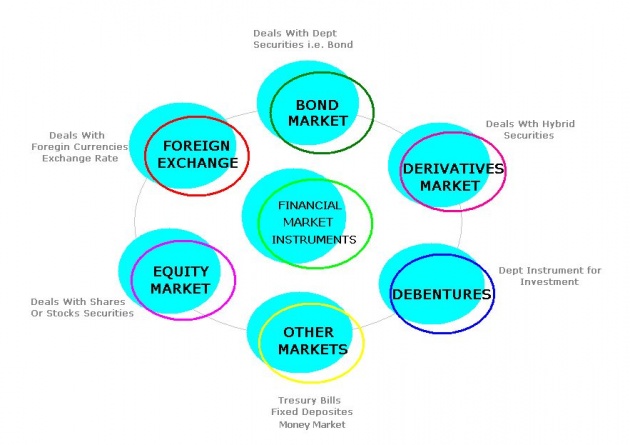

Why Capital Market? The capital market is that segment which is most potential if properly explore but also risky one where nothing is mostly certain. This arena of financial market deals with long term securities equity or dept. Capital market open the doors for savers to invest their savings in productive efforts of big institutions with the hope to earn profit. Its place where institution collects funds in form of equity or dept and savers invest their savings in their project but motto of both is somewhat same reaching at high potential.

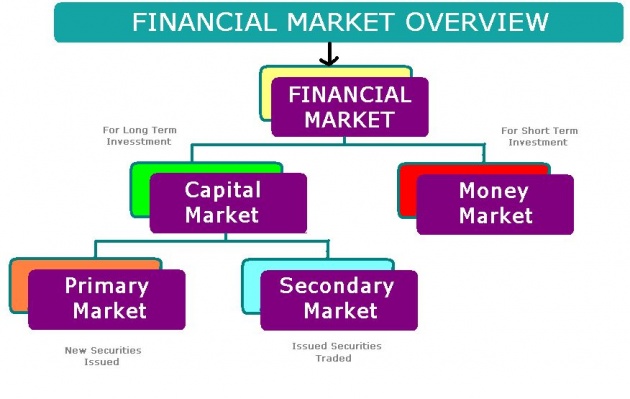

(Financial Market Financial Instruments)

Saving and investment both are most crucial for future. It’s easy to invest for short term but for long term investment one need to choose such plans which help to grow the money. Mostly people are attracted to capital market for long term investment because of high returns prospective. But the savers must know about risks and returns on investment before investing on any long term securities. Someone rightly said it’s not matter how much or little money you have, but important thing is educate yourself about opportunities. Let’s explore the various investing opportunities of capital market financial instruments and also risks associates with.

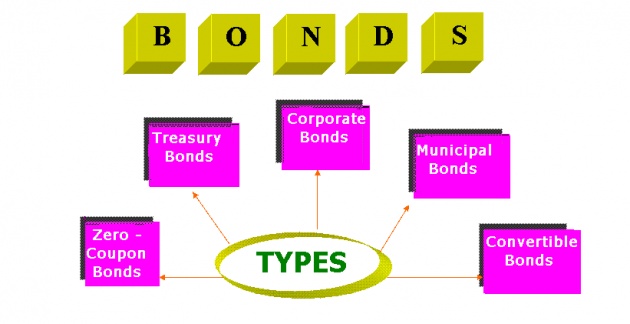

BONDS

Bonds are the dept instruments of the company to raise funds from the capital market. These are used by the company or even by govt to borrow funds on specified interest rate. Now the question is how investor can invested and benefited with these bond instruments? While companies are in need of funds they mostly have two options one issuing shares and second is rising through dept securities like bond or mortgage etc. Company’s financial portfolio regarding equity and dept mix is their on decision but when they issue bonds to raise the funds investors has the good opportunity to invest in this bond. For investing in this bond they will get fixed rate of interest at stipulated time for fixed period as agreement signed. Why to invest in bonds?

• First there is very less chance to lose-out the investment

• Interest rate are higher than other investment i.e. the banks saving or fixed account

• No anticipation every thing is clear about maturity date to interest due date.

How Can Invest In Bonds

In the bond market one can find variety of individual bonds to make their portfolio as per returns and risks. And moreover one can invest in individual bonds, bonds funds or unit investment trusts of bonds. Let first discuss how can invest in bonds. Suppose a corporation need of $1000000 for their future project and they decided to raise this amount through bond market for this they issue $100000 10 year, at 8% corporate interest. Let suppose you ready to buy it’s 1/5 proportion, means $20,000, in that case you will recipe every month 8% interest amount of bond till 10 years and on maturity date you will get principal amount plus interest due.

Bonds are issued by the issuer, which is a corporate or govt, in form of certificate. In this form the par value and annual interest rate along with maturity date is stated. Bonds are somewhat processed in market like shares. As like stocks, new bonds are also first issue in primary market and then forward to secondary market for buy and sell. After making the through analysis of various types of bond available in the market one can invest with the help of their broker or investor. To buy bonds one need to

• Open the brokerage account

• Set the portfolio with bonds

• Place your order through broker or investor

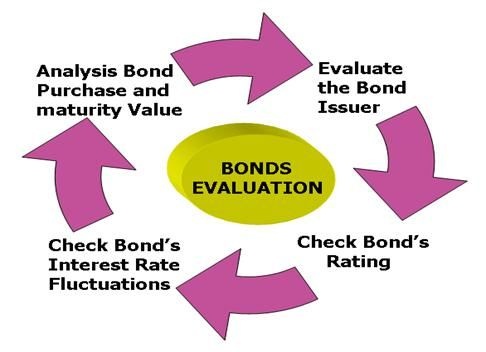

How can evaluate the bonds?

The question which springs ups mostly in investor’s mind – Is bond safe? Or how can choose or evaluate best  ones for portfolio? You know most of the financial planner suggests bonds to must include in investment portfolio. The reason is quite apparent that’s its attractive consistent returns. In bond market one can find variety of bonds like corporate bonds, convertible bonds, bear bonds, treasury bonds etc. but to evaluate each and best one need to consider some of the facts which are

ones for portfolio? You know most of the financial planner suggests bonds to must include in investment portfolio. The reason is quite apparent that’s its attractive consistent returns. In bond market one can find variety of bonds like corporate bonds, convertible bonds, bear bonds, treasury bonds etc. but to evaluate each and best one need to consider some of the facts which are

1. Evaluate The Bond Issuer: - Here bond issuer means entity who issues the bonds to borrow funds from the investors to pay at specific date at promised rate of return with principal amount. The bond issuer may be a corporate or government. So that’s it’s important to evaluate or decide whose bond you are interested to buy because each has their own reliability.

2. Check Bonds Rating: - If one interested in invest in the bonds then they must consider it’s credit rating. What’s credit rating? Credit rating refers to the ability of bond issuer to pay all the interest amount on bonds and principal amount on time. Bond’s are normally rated “AAA” to “C”. Bonds with low credit rating are considered more risky with regard to payment of interest and principal amount.

3. Check Bonds Interest Rate Sensibility: - It’s always recommended to check the bonds interest rate sensibility with regard to bond’s duration and it’s fluctuation with market general rate interest. Mostly bonds offer varied interest rates like, fixed interest rate, floating rate and interest payable at maturity. That’s while choosing bonds investment investors should clearly revise its interest rate type and sensibility.

4. Analysis Bonds Purchase and Maturity Value: - Bonds purchase value is at which investor decided to buy the bonds and maturity value is what receive at the maturity time of bonds. As already mentioned bonds offer varied interest rate to investors. So it’s better for investor to have clear analysis of different bonds purchase and maturity value to make a diversified portfolio of bonds investment or to choose best one. Moreover this will also aid to predict the future value of bonds if investors decided to sell the bonds in secondary market before maturity.

DEBENTURES

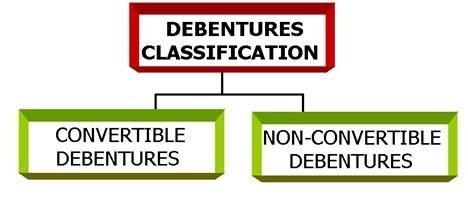

These are also type of dept instruments which used by corporations to raise loan from the market. Corporate Debentures  are used as short or long term dept instrument to borrow money with fixed rate of interest. Sometime debentures are used interchangeably with bonds but these are different from bond. How? The main basic difference between debenture and bonds are collateral. Yeh, debentures are not secured by collateral or physical assets but bonds are secured one. Debentures are just backed by goodwill and standing of the issuer or corporate. Like bonds debentures are also classified into different categories.The convertible debentures are those which can convert into stocks or bonds of the company but on other side non-convertible debentures are those which can not be converted into stocks or bonds.

are used as short or long term dept instrument to borrow money with fixed rate of interest. Sometime debentures are used interchangeably with bonds but these are different from bond. How? The main basic difference between debenture and bonds are collateral. Yeh, debentures are not secured by collateral or physical assets but bonds are secured one. Debentures are just backed by goodwill and standing of the issuer or corporate. Like bonds debentures are also classified into different categories.The convertible debentures are those which can convert into stocks or bonds of the company but on other side non-convertible debentures are those which can not be converted into stocks or bonds.

Is It Safe To Invest In Debentures?

While investors decided to invest in debentures it might be in their mind about the security and potential of debentures. As already mentioned, debentures are not secured by collateral which may be more risky with regard to repayment. It’s mostly advised by the professional to invest in convertible debentures rather than in non convertible debentures.

DERIVATIVES

These are financial instruments which actually work like a security to isolate the risks associate with financial or capital market investments. Derivatives are the contract between two or more parties which is based upon the asset or assets. The value of contract determines as per the underlying asset. The very common assets used for underlying in derivative contract are stocks, bonds, commodities, interest rates and market indexes. Let’s see how these derivatives work.

Derivatives, a financial contract between two or more parties, are used to hedge the risk of one party x but it offer high returns potential for another party y. Mostly derivatives are used to mitigate various risks like fluctuations in stock, bonds, index prices etc. The most common types of derivatives are

Derivatives, a financial contract between two or more parties, are used to hedge the risk of one party x but it offer high returns potential for another party y. Mostly derivatives are used to mitigate various risks like fluctuations in stock, bonds, index prices etc. The most common types of derivatives are

- Options

- Future

- Swaps

- Forwards

To understand the concept of derivatives let’s first discuss its various types and how these work.

Futures

This is the most common type of derivatives contract between two parties and mostly used to hedge the risk of assets at particular period of time. Let explain with example: - Suppose on Jan 21, 2015, X owned 1000 @ $17.50 shares of XYZ Ltd, but to lessen the risk of shares price fall X decide to enter into the Futures contract to secure the value of stocks. On the other hand Y (predict share price will rise) ready to enter into the Future contract with X that after one year y will buy X 1000 shares of XYZ Ltd at rate of 17.50.

That’s future contract will obliged between the parties after the one year or time decided. Now suppose a year later prices of shares valued at 16.50, now Y have to buy these shares at decided price $17.50 from X which is profitable for X but poor lose transaction for Y. But if shares prices valued 18.50 or more than decided prices then it will profitable for y and lose for X.

That’s Future derivatives are like a bet where purpose of one party is to hedge the risk and another party enter to earn profit potential.

Forwards

Forward derivatives are same as future contracts but these are not traded on future exchange rather traded on over  the counter.

the counter.

Options

It’s a contract between the two parties where one party agrees to buy or sell the security to other party at predetermined future rate. Here buy or seller has opportunity to deal with pre-decided rate but it’s not obligation. Options have two types’ puts and calls. The Call options provide the buyer a right to buy the asset at decided rate on or before time. But puts gives the right not obligation to buyer buy asset at decided price on or before time.

Swaps

These are also one of the most common and used types of derivatives which is a private contract between parties to trade the loans. As one can use interest rate swaps to deals with variable interest loan fluctuations or to switch fixed to variable interest loan etc. Whatever the deal but purpose is somewhat same to lessen the decline value risks. The most common types of swaps are “Interest Rate Swap” and “Currency Rate Swap”.

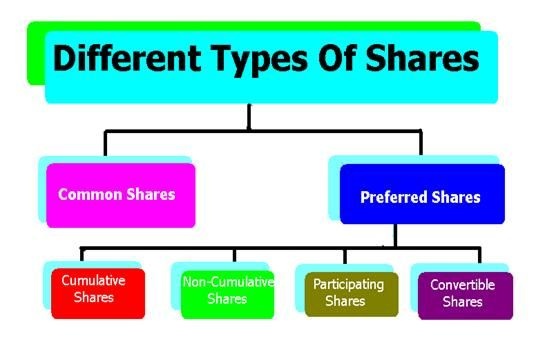

SHARES

Investing in company Stocks is one the easiest and profitable decision of saving investment. Yeh, it’s true if investors make perfect portfolio for investing in stocks it can be a fruitful investment. But here all mostly depends of selection of stocks and portfolio decided. What’s Shares and how these work? While corporations need of funds they raise it mostly through two ways once is issuing equity securities in market like equity shares or common shares for public subscription and secondly  borrowing funds from the market through dept securities like bond. In case of equity securities company’s sharing its portion of ownership with the buyer of company’s shares. While investors buy the shares of company means they are investing them in the company’s working with the hope to earn profit in return. For this company issue the share certificates to the buyer (who knows as shareholders of company) which reflects the number and value of shares purchased buy the shareholders or buyer. This stock or share certificate is the legal proof of shareholder’s proportional ownership in the company. Let explain with example:

borrowing funds from the market through dept securities like bond. In case of equity securities company’s sharing its portion of ownership with the buyer of company’s shares. While investors buy the shares of company means they are investing them in the company’s working with the hope to earn profit in return. For this company issue the share certificates to the buyer (who knows as shareholders of company) which reflects the number and value of shares purchased buy the shareholders or buyer. This stock or share certificate is the legal proof of shareholder’s proportional ownership in the company. Let explain with example:

Suppose XYZ Ltd. Issues in the market 50,000 shares at rate of $10 each for sell. You find the shares profitable and ready to invest $10,000 in the company’s shares. Now let’s calculate the number of Shares Company will issue, your proportional ownership, and how you can earn profit.

Total shares issues by company = 50,000

Rate of per share = $10

Amount you decided to invest = $10,000

Company will issue you = $10,000/$10

= 1,000 shares @ $10 each

To calculate the Shareholder’s proportional ownership Interest in Company’s the Following Formula Is Used

Proportional Ownership = Number of share holder by shareholder × 100 / Number of Shares Outstanding

P-NOTES

P-Notes which are know as participatory notes are used to make forging investments. If any foreigner wishes to invest in India’s capital market without registering him/her selves on security exchange of India then they can buy these P-Notes from the registered foreign institutional investors. These P-Notes are used to make investment in stock markets securities listed in India. These notes are also known as offshore notes as it can be used only outside India for making investment in shares listed in India.

These notes aid foreign investors to make direct investments in India stock market. For example - Indian based broker buy Indian securities then issued these to foreign investors through P-Notes. In that case any divided or profit on securities subject to investors.

All these are some of the most famous and commonly used capital market investment instruments. The very common saying for making portfolio is “Don’t Put All Eggs in One Basket” which means don’t invest only one type of security while investing your saving rather use varied to diversify the risk. The capital market multiple investment instruments provide huge option to investor. Mostly all instruments are designed to offer returns on investment but the risk factor associated to securities are mostly different. That’s for investor it’s vital to consider the both risk and return associate with securities while making their investment portfolio. For this they can take help of professionals or even make their own research. But one thing that investors must keep in mind is to diversify their saving in different instruments systematically which can help them to lower the risks plus higher the return