image source: www.google.com

image source: www.google.com

Hello, guys!

Now that the Christmas/New Year's celebrations are here, in my country, a lot of presents are bought and everyone is shopping like crazy. It's a good thing to shop, but I'm not very keen on it. Spending a lot of time in different shops is not something I can say I enjoy; it's just the opposite, I feel like I'm wasting my time. Anyway, coming to the main topic, I want to write about Personal Finance Managers and useful software to take care of your budget.

image source: www.google.com

image source: www.google.com

Finance managers are useful tools which help for proper managing and tracking of incomes and expenses in an organized manner. They are helpful for determining the spending patterns, e.g. which types of expenses occur most often and how can expenses be optimized. Like, for example, knowing that the amount spent on a certain category is too high can indicate that this is an opportunity to reduce this expense and increase savings.

video source: www.youtube.com

Personal Financial Management (PFM) refers to software that helps users manage their money. PFM often lets users categorize transactions and add accounts from multiple institutions into a single view. PFM also typically includes data visualizations such as spending trends, budgets and net worth.

To start off, I'll talk about one tool which I have found very useful and I really like using. This tool is called HomeBank and it is a free tool.

HomeBank

image source: screenshot of HomeBank

image source: screenshot of HomeBank

The first thing to do in order to use HomeBank is to visit their website and download one of the versions, preferably the latest one, depending on your operating system. Good news is they offer their product for Linux, Windows and iOS so basically many users can try this software. Nevertheless, they try to make it available to as many devices as possible, that's why it will be probably available for Android soon, as well. Besides everything else, it offers a friendly user interface and is translated into most of the popular world languages. And the last thing, which should not be underestimated is the portable edition available at the time of installation. So, once you run the .exe file (under Windows) you have the option to install it on a USB drive or whatever device you prefer. For the functionality, which it offers, this program doesn't take up much space.

image source: screenshot of HomeBank installation

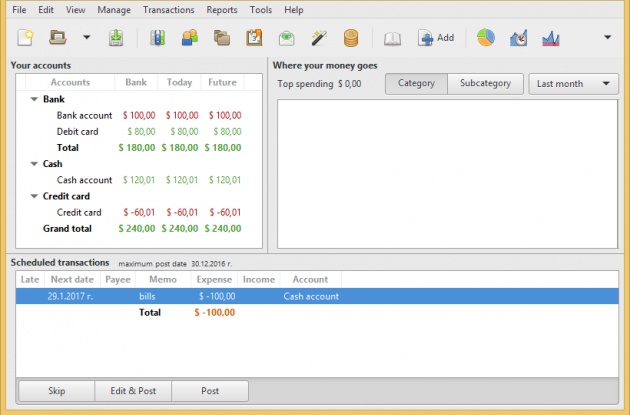

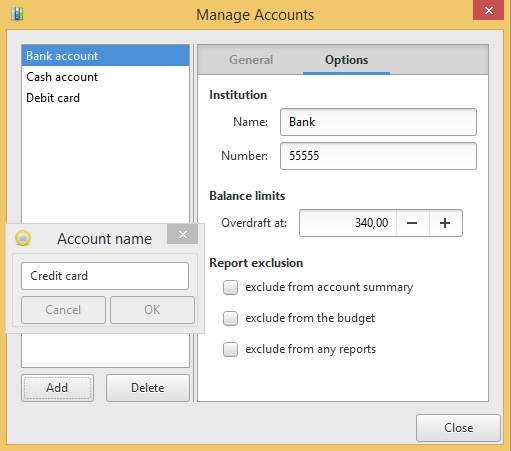

HomeBank is a nice program which allows management of multiple accounts and many different files (or budgets). It has so many features that I don't think I will be able to mention all of them here, but I'm planning to provide at least the most important ones. The first thing after opening the application would be to set up the accounts, for example, whether they would be a cash account, bank account, credit/debit cards, online accounts, etc. Each of those should represent the current balance, which I personally set up as start balance. It doesn't really matter for personal financing how things are set up as long as the amounts for each account much up with the actual balances.

image source: screenshot of HomeBank Accounts screen

image source: screenshot of HomeBank Accounts screen

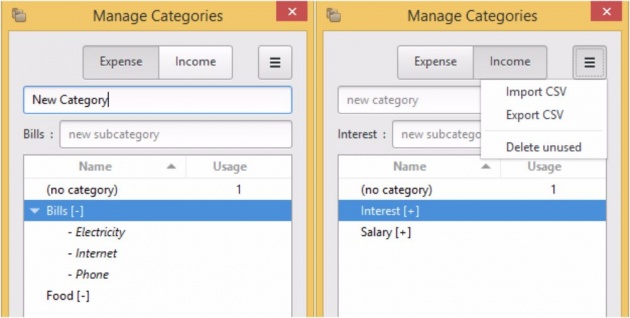

Once the accounts are ready and set up, it's a good idea to modify or add different categories. HomeBank allows exporting/importing categories from a CSV file as well as adding subcategories inside a certain category. Categories are simply the types of incomes/expenses that can occur in a personal budget. As an example, a category under expenses can be Bills, and subcategories might be electricity bill, phone bill, other monthly payments, etc. And the best is that anything that's not needed can be deleted and all categories can be personalized and optimized to fit the needs of the user. This allows better tracking of incomes/expenses and specific tracking of certain types of payments if needed. I believe it's best to have only the major categories and don't get too detailed when creating them as when adding the actual transactions things can get too complicated and time-consuming. The whole point of managing personal finance is to provide good knowledge of how money are distributed among different categories, and not to complicate it so much that it would be hard to summarize and make conclusions.

image source: screenshot of HomeBank Categories

The actual tracking happens after adding some transactions. It is good to make this process at least for a few months so that all types of expenses can get their way to the reports and that you'll be able to see an avarage of all incomes/expenses. For example, it is common that in some months expenses are bigger. If let's say you decide to prepay bills or get late with one of the payments, the expense will be recorded for one month instead of for two, because you'll add them at the same date. So, that's why considering the average is important to get a real idea of the transactions each month.

video source: www.youtube.com

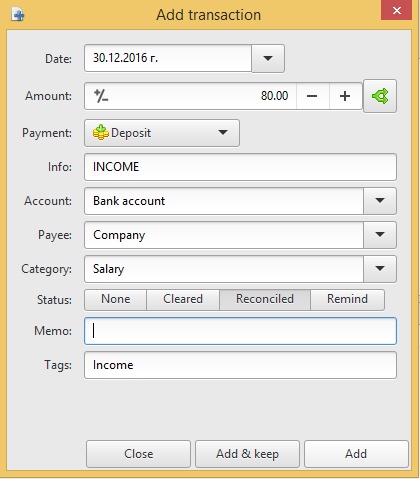

Adding a transaction happens with the Add button on the toolbar, which also has a plus (+) sign to indicate that. Another option to quickly get used to the interface is hovering over the buttons of the toolbar; this will show you the exact purpose of the button. After clicking on Add, a pop-up for adding a transaction will appear. The most important options in it are: the date (it will be the current date if not changed), amount (income (+) or expense (-)), type of payment (cash, bank transfer, etc.), the account and the category (can be selected from drop-down menus), and the status of the transaction (whether a transaction is completed or still needs to be checked additionally). And there are also some other options for filling more information, like tags, reminders, notes, etc.

image source: screenshot of HomeBank Add transaction

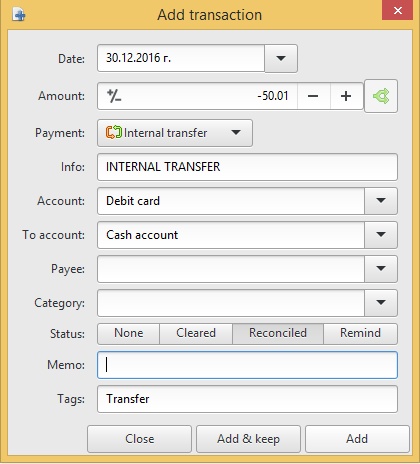

Most of the payment types which are available by default are pretty much straightforward. There is no need to do anything special but add the amount and category, and save the transaction. But there is one special type of transaction which is called Internal Transfer. What that means, is that you can use the software to record the changes in your accounts, like depositing cash into a bank account, or the opposite, getting cash using a debit/credit card. With this transaction, it is required to select both accounts from the drop-downs (Account and To account) and be careful about the sign (+ or -) when entering the amount. This transaction is different because it is neither an expense nor an income, as the total balance remains the same, only the amounts in the separate accounts are changing.

image source: screenshot of HomeBank Internal Transfer

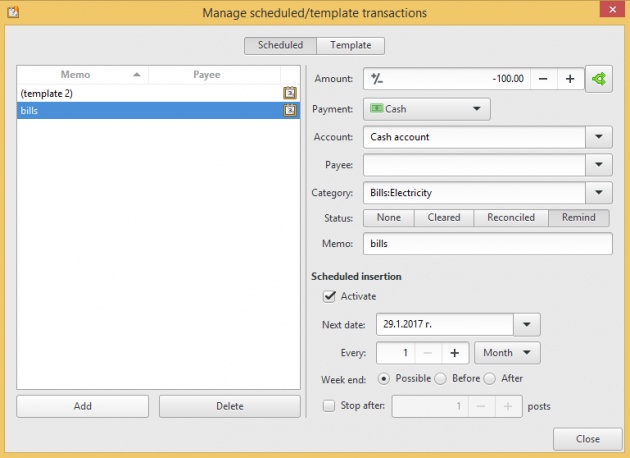

The last option I'm going to mention is the scheduled transactions. These are payments (can be income or expense) that occur during certain periods of time, e.g. monthly, weekly, yearly. If you know you are going to pay a certain amount at a certain date, you can add this payment as a template (a scheduled transaction) and set it to be activated on that date. This way you'll not need to add it manually each time, but instead, the process will be automated. Even if the amounts are different each time, it's a better option to add it and after it is triggered the amount could be easily fixed.

image source: screenshot of HomeBank Scheduled transactions

Besides HomeBank, there are many other tools that can help in managing financial operations for your personal needs. And also online options are available, but I definitely prefer downloading and then dealing with the transactions.

That will be all for now. I hope this blog was useful!

image source: www.google.com

image source: www.google.com

Thanks for reading!

- NinaB