to know about Risk and Insurance we have first to define some concepts like :

Risk : is an uncertainty concerning the occurrence of loss .

ex : the risk of dying because of an accident .

Loss Exposure : is any situation or circumstance in which a loss is possible , regardless of whether a loss occurs or not .

and there are many types of Risk :

1- Objective Risk : is defined as the relative variation between the actual loss and the expected loss and it depends on the calculations of the actual and expected loss .

2- Subjective Risk : is defined as uncertainty based on a person mental condition or state of mind and it differs from one person to another .

3- Pure Risk : is defined as a situation in which there are only possibilities of loss or no loss .

ex : a host of a family may die ( loss ) or not ( no loss ) .

4- Speculative Risk : is a situation in which there is either profit or loss is possible .

ex : if some on purchases 100 shares of common stock in the stock market and the price of the stock increases , there will be a profit but if the price of the stock decreases , there will be a loss .

5- Diversifiable , unsystematic or particular Risk : is the risk that affects only individuals or small groups of people and not the entire economy .

ex : the theft of some one's car .

6- Non-Diversifiable , systematic or fundamental Risk : is the risk that affects the entire economy or a large number of persons or groups within the economy .

ex : a flood , hurricane or a war .

7- Enterprise Risk : it contains all major types of Risks that may face a business firm such as : Pure Risk , Speculative Risk , Strategic Risk , Operational Risk or Financial Risk .

Risk Management : is the process of identifying Loss Exposures and selecting the most appropriate technique or combination of techniques for treating such exposure .

there are two techniques to treat Loss Exposure :

1- Risk Control

2- Risk Financing

1- methods of Risk Control :

A) Avoidance : it means that a certain Loss Exposure in never acquired or an existing Loss Exposure is abandoned .

B) Loss Prevention :it refers to measurements that aim at reducing the probability of loss , so that frequency of loss is reduced .

C) Loss Reduction : it refers to measurements that aim at reducing the severity of loss after it occurs .

2- methods of Risk Financing :

A) Retention : means that a person or a firm decides to retain part or all of the losses that can result from a given Risk .

B) Non-Insurance Transfer : is the method other than Insurance by which a Pure Risk is transferred to another party .

C) Insurance : there is no single definition for Insurance but the most accurate one is : the pooling of fortuitous losses by transferring of such risk to insurers who agree to indemnify insureds for such losses .

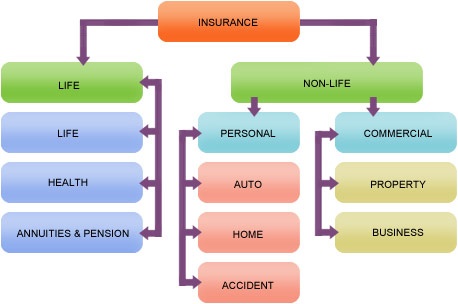

there are many types of Insurance policies to insure any thing that can be insured like :

Life Insurance , Health Insurance , Property Insurance , Liability Insurance , .. etc.

Insurance is so useful as it decreases worry and fear , reduce uncertainty , the Insurance company may provide other Risk Management services and most importantly the insured is indemnified for losses after they occur .

those were just some information about Risk and Insurance and hope you get some benefits from it .

written by : Mohamed Mostafa