Save For Your Future

Image credit: @artbytes via Bitlanders.

'Save for your Future' is the 3rd and last part of the Are you saving for your Future Series.

In my previous posts, I shared with you:

- the dangers of uncontrolled spendings and getting into the Rat Race (Are You Saving For Your Future? Part 1 );

- How to start your saving habits and cut down your expenses.(How To Start Saving - Are You Saving For Your Future Part 2)

In this part, I will share with you how to Save For Your Future. I will share with you the following

- Save With a Purpose and a Plan

- Increase you're earning!

- Save For Your Future

Let Me Start With My Story

About two years ago, I quit my daytime job to be a freelancer. I liked that job, but I don't like the environment, to put it mildly. To think, it was less than a year since I got my salary increase. After my increase, since I was already saving first, I was able to invest some money in the stock market. It wasn't much, but it was more than enough when my son got hospitalized last year.

Aside from my stock market investment, I also had savings that were more or less equal to my monthly salary.

I admit it was a mistake for me to quit my job at that time.

After I quit my job, I have at least a couple of companies that call me for their computer and network related needs. From those gigs, I was earning about 40% less than my previous salary. But I was able to make ends meet.

Another mistake that I did then was, I stopped saving regularly.

There was a time when our son needed to be hospitalized. The hospital bill was about PHP 20,000.00 (with PhilHealth already deducted). I only have half the amount in my savings account. However, I have more than the amount of my stock market portfolio.

The problem is, it takes at least three days to process the withdrawal from the stock market. So I went to a friend who was also a stock market investor and borrowed the needed amount from him. My assurance was the amount in my portfolio and promised to pay him in full once the money was withdrawn.

I do not have much in my portfolio at the time. But half the amount that I have withdrawn was actually the profit of what I have initially invested. The profit that I have gained for just a few months.

I. Save With A Purpose and A Plan

When you start saving, save with a purpose and a plan! You may want to save for the latest iPhone, or Android gadget, or a UHD SMart TV, etc... something you would buy much cheaper in cash rather than in credit.

But wait! I would not recommend saving for consumer items yet! Save for your current responsibilities first and for your future needs. Meaning, build your Financial Foundation First!

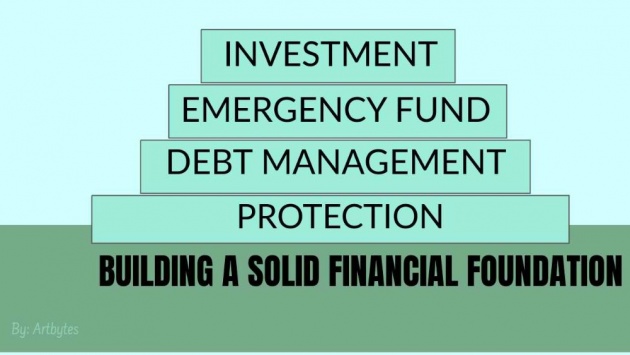

Building a Solid Financial Foundation

Image credit: by @Artbytes via Bitlanders

Let me run through the requirement for building a solid financial foundation again.

- Protection - Some people hate this, some people are afraid of this, but everybody needs this. INSURANCE! Yes, we all need this. Both life and medical insurance. Why? Heavens forbid, that if anything should happen to you and can no longer provide for your family, who will then provide for their needs?

However, you don't need to die first or get hospitalized or disabled before you could benefit from your insurance policy, there are insurance policies that allow you to withdraw or loan from your investments. - Debt Management - Debt rhymes with death! So before you replace your old-but-fully-functional TV because your neighbor bought a new Ultra High Definition Smart TV; or buy a brand new iPhone that you can't afford... DON'T!!! Manage your existing debts first (Watch: Strategies For Paying Off Debts ). Better yet, don't get into debt unless necessary!

- Emergency Fund - Perhaps one of the common causes of getting into debt is due to emergency cases. Unexpectedly, one of your children got sick (of course we are not asking for this) and needs to be admitted. When the hospital bill comes, you don't have enough savings for it. So the only quick solution is to borrow money. Or you quit your job and after three months you haven't got a new job yet, so in that time period, you sued up your savings.

It is advised that your emergency fund should be equivalent to three to six months of your monthly expenses, or salary (whichever is bigger). - Investment - This is my favorite. Investing your money on different forms would generate "passive income". Meaning your money will grow even when you are sleeping.

Another mistake that I did was to invest first in the stock market without protection. I will discuss this further in the last section of this post.

What is your purpose for saving?

When I started saving, I was saving for my emergency fund with a target amount. Half of what I save each month stays in my bank, and the other half goes to my stock market investment.

So when you save think of :

- Why do you save? What is it for?

- What's your target amount?

- When do want to reach that amount?

- How are you going to do it?

Why do I want to save money?

Image credits: edited by @artbytes.

Original image: PublicDomainPictures via Pixabay.

Now, assuming you already have a target amount. You have started to save between 10% to 20% of your monthly income. You were able to cut down your monthly expenses by about 15%. However, you still struggle financially a few days before your next payday!

What should you do now?

After you started your savings habit, That means you already know how to control your expenses. Whether you are struggling or not by doing this, you are ready now for the next step. That is to increase your earning!

II. Increase Your Earning.

If you are content provider here in Bitlanders, then you are in a right track already. This means you already found a way to increase your income. The truth is there are unlimited ways to increase your income. Financial gurus call it income stream. In order to increase your earnings effectively, you must build up multiple income streams!

- None-Passive Income - This is the most common way of earning.

- Your 9 to 5 job,

- buying and selling,

- freelancing services,

- even writing here in Bitlanders or any other site.

All of these would require you be active for quite some time. Active income means, in order to earn, you have to devote your time to work. No work, no income.

- Passive Income - Passive income means, you earn even when you are no longer working. This is our goal. To build a more passive income stream. This should be your goal. I will discuss this further in the next section

How to increase your earnings through None-Passive Income

As I have mentioned above, non-passive income requires you to spend time working in order to earn. However, some of these methods can be turned into passive income over time.

There are a number of other ways to increase your earnings, both online and offline. Let me list some.

Offline Jobs

The options below are just some possible ways to earn extra money without quitting your current job.

- Get a second job. Check your locality if there's a company that hires part-time employees that would fit your skill sets or something that you can do. A part-time or a night=shift waiter, cook, etc...

When a part-time teaching job was offered to me, I grabbed the chance right away. - Buy and Sell Business or Direct Marketing Business. Here in the Philippines, there are a number of companies that offer commissions to people who sell their products. Some offers, beauty products, RTWs, shoes, other items.

I also know some people who sell products that they get online. Some of these business does not even require capital. - Be an insurance agent. Did I mention I'm a financial adviser? Financial advisers are sort of 'upgraded' insurance agents. Insurance companies these days no longer offer traditional insurance packages, but investment packages with insurance. (I will talk about this again later).

- Be a real estate agent. This is another lucrative sideline if you are good in selling. You can earn about 3% commission for each sale. Check out the real estate developers, or brokerage firms in your area, they are surely looking for agents. Usually to be a real-estate broker requires a license, however, a broker can have several agents.

- Sell Your Skills. A lot of people do this online, but you can do this to your neighborhood as well. If you are good at carpentry, plumbing, cleaning, painting, laundry, etc ... use your skills and sell them. Tell your neighbors by mouth or print out some fliers. Tell them that you offer your services during your off days or hours.

These days some new car owners are paying for their cars by offering driving services through Uber or Grab.

Online Options

These online options may require you to have a fast and reliable Internet connection

- Online English Tutor- if English is your primary or secondary language, you can be a home-based online English tutor.

- Create a blog and/or write to social blogging sites like Bitlanders. Based on my experience, it would take some time and effort to earn from a new blogging site. Thankfully, there is social blogging platform like Bitlanders.com that pays their members for their contents.

- Use your skills and offer services through Fiverr, or Upwork. If you love to write, draw, take photos, design graphic images, sing, compose a song, etc... you can offer your skills through Fiverr or Upwork.

- Use your smartphone camera and sell your photos online. Almost everyone these days have a smartphone with at least 5Mega Pixel camera, or a digital camera these are very affordable. You can sell the digital photos online. I have once sold a photo for $16.00 through Twenty20.com. I just uploaded the photos and never did the active selling. There are other sites that offer similar services.

- Create a YouTube channel. I have seen a lot of YouTube channels that were made by a hobbyist, a group of friends, travelers, and families that gains a lot of views. And what do they show? Almost anything that they do. Their travels, unboxing of toys, the kids playing with their toy trucks, almost anything that you can think of. Once you monetize your channel, the more views you get the more you earn!

These are just some of the things of what you can do to earn offline and online. For the offline jobs, check your local newspapers' classified ads, somebody might be looking for something. Or check Sharon-Lopez' blog: 10 Small Business Ideas to Start This 2018

What is Passive Income?

Passive income is income resulting from cash flow received on a regular basis, requiring minimal to no effort by the recipient to maintain it.

To earn from passive income is my long-term goal. It should be your goal too. Why? I can give at least two compelling reasons.

- There will come a time that you will no longer be able to work. Probably because of old age or another reason. When the time comes, your passive source of income will keep on providing you with your financial needs (and more) without lifting a finger.

If you have established a steady passive income stream early in life, you may be able to do what you will love to do without worrying about your financial needs. You will attain what we call "Financial Freedom". You may go to Boracay anytime you want, spend as much time as you like with your family, while your income keeps on growing. - Having a passive income stream is like having an orchard of different fruit trees. Different trees that bear fruits in different months all year round. You have people harvesting the fruits and selling the fruits for you. All you do is wait for the income to be brought to you.

Passive Income

Image Credit: Source: iremet.com.au

How To Earn From Passive Income

There are several ways to earn from passive income. I will list some them here in two groups based on the methods to create them.

Method 1-Work For It.

As defined above, passive income is income from steady cash flow that requires minimal to no effort to maintain them. It did not necessarily mean you don't need to exert effort to start them. Here are some of my ideas that you need to work on at the beginning but later on could be a potentially lucrative source of passive income.

- Publish ebooks. The biggest advantage of publishing ebooks is once, it is published and available online, customers could easily buy them with a few clicks. You don't need to spend on printing, binding, and shipping. Thus, if your e-book title and content is Interesting, people will keep on buying even 10 years after you first published it. See, you write the book for maybe three to six months, then you will reap the harvest for years.

For my fellow Filipinos, I recommend you visit this site https://www.negosyouniversity.com if you want to learn how to start writing your first ebook. - Create a tutorial Youtube Channel. Internet users love to search for tutorial videos on YouTube. You might ask, tutorials on what topic? Here's my tip, make a tutorial on the things that you love to do the most (make sure it is legal). If you think you know how to make the perfect fried egg... make a video tutorial on how to do it. Like an ebook, you publish your video once, people would keep watching your videos for years, thus it will keep on earning.

How to Monetize Your Youtube Chanel

Video Credits: Kristen Marie Via YouTube

- Write on Pay Per Content Sites like Bitlanders. There are a number of sites that pay their members for their contents. If you take a look at the leaderboard below, the top earners were members of the site for many years. By the way, the system goes, the articles they posted many years ago are still earning them some money up to now.

- Create your own blog. I suggest you create a blog while writing for other sites. Why? It takes time to promote your blog. Therefore, it will take time before you start earning money. But if you are successful you could earn thousands of dollars in a month. (link top earning bloggers.)

- Multi-Level Marketing MLM - I admit, I don't like the way Multi-level Marketing companies do their marketing here in the Philippines. However, I was able to discuss this with a Singaporean friend about this many years ago and I realized the full potential of MLM. There are two ways to earn from MLM.

- You sell the products directly and you will earn commissions.

- You recruit members and you get a commission from their membership fees and every time they sell.

When friends would try to recruit me to join an MLM, I ask one thing,

"Do you make money from their products or from recruiting members?"

It's up to you then how you would decide once they give their answers.

These are just some of the possible ways to build up your passive income stream. There are still countless of ways out there. In these examples, you need to work or even invest a little. But your biggest asset here is your skill and passion.

Method 2- Save and Invest!

It's not really a matter of selecting between Method 1 and Method 2. You could start with Method 1 to build up your income stream then proceed to Method 2 - Save and Invest! Or you can start with Method 2 while building up your income stream using Method 1.

The only requirement for Method 2 is your SAVINGS HABIT! Once you have established or even just starting to establish your savings habit, there is a question now as what do with your savings? Initially, you could deposit them into a bank for security purpose. However, to make it grow, you to invest!I will explain the different ways to invest in the next section.

Save and invest to make your money grow!

Image credit: nattanan23 via Pixabay

III. Save For Your Future (and make your money grow!)

Before you start investing your money, first make sure that you invest for your...

Protection

Going back to the Solid Financial Foundation concept, what you need first is to have protection. Get a life and/or medical insurance. Currently, though, most insurance companies are shifting to investment plans with insurance coverage which I will explain later. However, you could get a term insurance renewable every year for protection. This is just in case something happens that you can no longer earn for your family, you will have a temporary alternative source of income. Plus if the plan covers hospitalization, you don't have to worry about the hospital bills.

Once you started investing for your protection, you can now...

Invest to make your savings grow

To make your savings grow, you have to invest them where it could grow even when you are sleeping. This is passive income. There are different ways or institutions where to invest your hard-earned money. Some of these are:

- Mutual funds- in mutual funds, you invest your money through fund managers. These fund managers would invest the money in other top-earning companies. How much your money will grow is not guaranteed but they will grow much faster than a bank's time deposit.

- Investment plans with insurance (VUL) - This is my favorite. Variable Unit Link or VUL is relatively new to the Insurance industry. First of all, you are not buying an insurance policy directly. You are investing your money in different funds. You may select a high yield, but a bit risky, Equity Fund, or a more secure but low yield government bonds. You have different choices and you can even have a mixed investment. Your investment could grow from an average 4% up to 12% per year. If the market is doing good, it could even grow as high as 20% in a year. 20% growth while you are doing nothing!

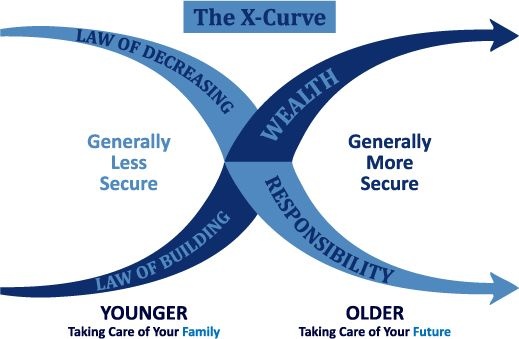

After a few years of investing in VUL, you may even withdraw a part of your earnings.The bonus here is, a tiny portion of your investment will go to insurance. Meaning you and your investment is secure. By investing in a VUL product, you are hitting two stones in one bird in the financial foundation - security and investment! Looking at the X-Curve again, with VUL, you cover both your current responsibilities and future needs.

The X-Curve Concept - Image Credit: @artbytes via Bitlanders

The beauty of this investment plan is not only that you are secured but your investments as well. Meaning, not even your government's internal revenue services can touch your investment. Thus, if anything happens to you, your investments will go to your beneficiary, every centavo. and the Internal Revenue cannot tax it.I will discuss this topic further in my future blog post. I will include some tips how to secure your earnings from cryptocurrencies. - Stock Market - I admit I made a mistake in investing in the stock market first before investing in insurance. Why? If anything happened to me, how will my family get my investments from the stock market? Also, once it becomes an inheritance, the government will add the amount on my estate! In which it is taxable!

However, investing (not trading) in the stock market is could give an income of up to 30% or even higher... assuming you have a good stock broker or online guide.

Image Credit: Geralt via Pixabay - Real Estate - investing in real estate could be a really lucrative source of passive income. However, it could be really risky as well. Real estate agents will offer you different real estate products and will convince you that it will be a good investment for you. If you ask them how they will reason that the value of real estate will significantly grow over time. That is true. However, you have to consider the monthly amortization, the annual taxes. If it is a house and lot or condominium unit, you have to consider the maintenance cost plus other expenses.

Image Credit: Geralt via Pixabay

Personally, I would invest in a house and lot or condominium units only if:- I am currently living with my family in an apartment;

- I have enough extra income to cover the monthly amortization and other expenses;

- or the monthly amortization is equal or just a little over my monthly dues for the apartment;

- I can lease the property and earn from it.

I came to know a couple who bought a house and lot property located on another city. They said it was an investment. They rented the place. However, they are renting it at about 15%-20% lower than their monthly amortization. Plus they loaned some money to improve the place.

Was it a good or bad investment?

On the other hand, I have a friend who is a Real Estate Broker who would teach his clients how to earn from the condominium units they are selling. In the end result, the client would own a condominium unit without paying from his own pocket. If he continues the process, he will be earning passive income from his condo units in the future.

To learn more about investing in real estate, check out this video:

Robert Kiyosaki Real Estate Investing

Video Credits: Evan Carmichael via YouTube

If you're wondering why I did not include Bitcoin or Cryptocurrency here, it's because at the time of writing the price of Bitcoin and some other cryptocurrencies plummeted. I believe now that it is as risky as trading in mining stocks. Unlike the stock market, you have indicators if the market is going up or down.

Image Credit: Geralt via Pixabay

Don't get me wrong, I have a few amount placed in Bitcoin. I don't dislike or discourage you from putting some amount in cryptocurrency, but as of now, I don't have enough knowledge to discuss it.

Word of Caution

Before you invest your money on the stock market and real estate, make sure you understand the risk first. The Internet is a great source of information for these topics. If you personally know someone who is doing good in at least one of these investments, talk to them.

--oO0Oo--

Thank You For Reading

In my future posts, I will expound some of the topics discussed in this series. For the meantime, if you have any questions or reactions regarding this subject, please don't hesitate to ask them on the comment below. If you are anywhere in the Philippines, I would be happy to talk with you about this subject.

Check out my other blog post as well at http://www.bitlanders.com/Artbytes/blog_post

If you like this post, please share.

Thank You!