The Basics of Investing: Fifth Lesson - Investment Fund - Photo Credit: Amber255 via Bitlanders.com

Greetings! I have a little hope that you liked my previous lessons about investing. And I hope that I have lured some of you to save money for your future investments. Myself, I am too excited about the possibility to earn some extra money investing them. In my previous lessons, we learned what is the stock, the bond, and now we will learn what is the investment fund.

Investment funds are like salvation for beginner investors. Investing in investment funds is the easiest way to acquire a widely diversified portfolio of securities, without specifying what specific securities to choose. Because of this feature, mutual funds have become one of the most popular investment vehicles.

Investment funds were created for a person, who wants to invest but has no time or desire to analyze and trade on the stock exchange. Especially the Mutual Funds. You can buy units of the investment fund, and all the investment will be done for you. And though the idea of an investment fund sounds just great, in practice, investing in funds will not always meet your expectations. You need to have a common understanding of the investment funds so that you could choose the best one from thousands of them.

So, what we will learn in the fifth lesson? In this lesson, we will find out what is the most popular investment type, and why not all people tend to buy shares and bonds by themselves. What is an investment fund? How are the funds divided into? What are their advantages and disadvantages? What do we need to know before investing money in an investment fund? What kind of fees must we pay when investing in funds?

Let's start learning about one more way to earn money by investing.

Basics of investing - What is an investment fund? - Video credit: ALFILuxembourg via Youtube.com

Is the Investment Fund Popular?

As I wrote in my past lessons, that the total amount of money invested in financial assets of the world since last year was about $ 160 trillion. It is investments in the real estate, shares, and bonds. In order to earn money, there were invested about 140 trillion USD to the two main financial instruments. But you can ask - whether to buy shares and bonds is the most popular investment type, or investors are choosing other types to invest. How do they invest in stocks or bonds?

It turns out that the most popular way of investing is not a direct investment in stocks or bonds, but so-called investment funds. First of all, it is traditional investment funds, pension funds, life insurance funds. Through these funds, about 80 trillion USD of all money invested -it means, about 50 percent worldwide financial assets acquired through investment funds.

Another part of the investment comes from the exchange-traded funds (called ETF funds), state-owned investment funds (also called sovereign wealth fund - SWF), investments in real estate companies. In the gold is invested just 2 trillion USD.

The conclusion: currently, the most popular investment type in the world is investment funds. The largest amounts of money were used to invest through this instrument type.

Investing in Funds - Photo credit: rikvin.com

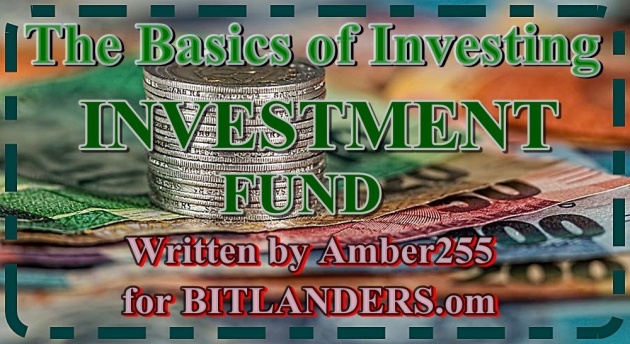

What is an Investment Fund?

How the investment fund it special? Why is it worth choosing, what are the disadvantages of this investment type? The investment fund can be defined very simply - the fund can be imagined as a basket to which many people are adding their money, and then a professional fund manager invests that money in a particular financial asset: bonds, shares, real estate or other means.

It is complex and may even a bit expensive for an individual man to invest in a sufficiently large stock or bond basket. Having 1000 or $ 10.000, you cannot buy many different stocks. But if there are a thousand, a few thousand, or even a million people, who bring in a small amount of their money, and all those monies are invested in a joint effort, then everyone has many advantages.

Let's look at the main advantages and some disadvantages of investment funds.

Investment Types - Photo credit: hanoitimes.vn

The Advantages of Investment Funds

I have mentioned a few advantages already, but now let's get deeper.

-

Professional management

One of the main and may most important advantage is a professional management. If you are a simple investor and want to invest in shares, you need to go deep into each company's financial situation, get interested in what is the success level of their managers, what the plans they have, and many other things. Are you able in a free time of your main job to analyze a sufficient number of enterprises in order to choose the best ones? It's better to let to do that to the professional manager.

-

Diversification

When you invest money in funds, you can achieve a great diversification (investment split, distribution). With an investment portfolio of 1000 USD, would be not very logical to invest in 10 different stocks. But if the same amount of money you invest in an investment fund that collects a big amount of money from different people, and then a manager invests yours and others' money in shares - there can be 20, 50, 100 or even more companies in such investment funs. Automatically, having only 1000 USD, through the investment fund you can achieve a much wider choice of investments types. And at the same time, it reduces the risk.

Money Diversification - Photo credit: quora.com

Investing individually in one or another company, you can make a bad choice and invest in a company which goes bankrupt, and you will lose all the money. Or if you have, for instance, 10 corporate shares, even one bankruptcy would have a rather strong impact on the total investment result for you. Investing in the fund, you invest in many companies. The maximum fund investment into shares of one company will likely to be 3 - 5%, and usually much less - it means that your risk is considerably reduced.

-

Lower costs

The third advantage is economies of scale. When you produce a single item, the cost per unit is much higher than when many of the same things are produced at the same time. If you decide to invest in stocks and bonds individually, you would most likely have incurred much higher transaction fees, time costs, and so on.

When many investors bring a lot of "small money" to the fund, all of that money is invested as one portfolio, and fund managers can expect much more favorable conditions for stock trading, accounting, auditing, etc.

-

Supervision

Another advantage is that most investment funds are supervised by certain institutions. Fund managers must submit reports.

Investing in Funds - Photo credit: twitter.com

-

Easy to buy/sell

Most funds can be purchased and sold on a daily basis. It is easy to exchange fund units into cash money.

-

Simplicity

The funds are characterized by the fact that you can simplify the investment itself - you can simply buy fund units, and fund managers work for you. It's just enough to go to one bank and purchase one fund. And you're already investing. Or if you want to invest individually - you will have to buy many different stocks or other tools, and to track and monitor them will be much more complicated than one position.

Earn Money By Investing - Photo credit: flickr.com

Disadvantages of the Investment Funds

It may seem a little strange, but the advantage may also be a disadvantage.

-

Management - disadvantage?

For example, professional management can be named as a disadvantage. Why? Because not every manager succeeds. There are managers who fail, or if the manager has chosen to invest in one market (country), he is not able to earn more than the total average of that market, i.e. as much as you would have earned by investing passively into the whole basket of that country's stock - a kind of unmanaged fund.

-

Expenses

When investing in an investment fund, you have to pay some kind of fees for managing your money in the fund: you pay to the fund manager, you pay to the fund auditor, you pay a depositary fee, sometimes it may be necessary to convert currencies in order to invest in certain funds. It worth looking at what costs you would have if invest in individually, and what costs you would have to experience if choosing investment fund.

Mutual Funds - Photo credit: Amber255 via Bitlanders.com

-

Fees

Sometimes the transaction has a fee inside the fund. Then, if the fund performs operations internally and receives income, the investor must pay for it real fees.

-

Excessive diversification

Diversification may also be understood as a disadvantage. Especially if the fund invests very widely - to several hundred or even several thousand different companies' shares. You can then question the manager's ability to select such a large number of truly viable companies. If the fund is investing in a large number of shares, it increases the risk that the fund will not be able to outrun the overall market average. Why then to pay additional fees for managing the fund, if you can earn as much as the market average by choosing the cheaper uncontrollable funds with less risk?

Now, let's examine what documents you should study before investing in any investment fund.

While reading my blog, please check the Querlo Chchat:

Documents of the Investment fund

There are three main investment fund documents:

- The fund prospectus;

- The fund rules;

- The key information for investors.

The first two are sufficiently comprehensive and capable to occupy about 20 pages. Nevertheless, reading them is recommended and necessary. Why? The prospectus describes the fund's investment strategy, what are the risks of investing in the investment fund, what the taxes and terms are there, how to calculate the unit value and so on. Fund rules are a very similar document as a prospectus, but some of this document aspects are described in more detail.

Be sure to read these documents, because it will be better for you if you understand the essential things - what a particular fund can invest in. Fund managers can not do anything they want. They have defined their region, their own market, are they investing in stocks or bonds, what risks they can incur, what can be the expected return on investment, etc.

The Basics of Investing - Investment Fund - Photo credit: actuarcontable.blogspot.com

Key investor information - usually 1 - 2 paper sheets that summarize the basic details about the fund's strategy, results, a degree of risk, taxes paid, etc. Each investor must review these documents before making a decision to invest in the fund and decide if this specific fund suitable or not?

The Types of Investment Fund

The most popular type is MUTUAL FUNDS. These funds can be divided according to where they can invest. Some funds may only invest in deposits or short-term deposit bonds. Other funds invest only in bonds of the states or companies. The third funds invest in stocks. There are funds that invest in raw materials or real estate property. You can find out all this from the fund rules.

Funds can be broken down by region of investment. There may be a Global Equity Fund, possibly a US Equity Fund, and similar. Funds may be investing in a specific business sector only.

Funds can also be classified according to the risk. The risk can arise from where the fund invests in. There can be low-risk funds, and such funds are suitable for the investors who are more conservative. There can be high-risk funds - one that is suitable for young or long-term investing person.

Investing Basics: Mutual funds - video credit: TDAmeritrade via Youtube.com

It is possible to assign funds according to their investment strategies. They can be very diverse, but there are two main ones: active and passive. What is it?

Active managers try to select better companies and earn more than market average; passive managers try to earn as much as the market average. The more correctly, the better.

As an example, the stock market consists of 30 companies. An active strategist manager will do an analysis and try to select better and more prospective ones from 30 companies, investing in 10, 15 or 20 companies. A passive strategy manager will invest in all 30 companies, and his goal will be to replicate accurately as possible the overall return on the market (not to earn more than the market average).

Credit: Amber255

The Fees

The investment funds set different fees, but not necessarily will ask you to pay all those fees. Most commonly, there are three main fees:

- Distribution fee (sometimes called entry fee) is a certain percentage of the amount of money you have invested. A person pays this fee by transferring his money for the investment to the manager.

- Management fee payable to the manager (the company that manages the fund) for the supervision of money. Most often, the fee is expressed as a percentage of the amount invested per year.

- Redemption (sales) fee is paid on withdrawal money from the fund, means, exchange of fund units into money.

Two additional fees apply less frequently:

- Exchange fee. You are charged if you want to move from one fund to another fund managed by the same manager. You pay a fee for changing the fund.

- Success Fee. This is partly a management and maintenance fee, but it is paid only if a manager earns a profit. If he does not earn a profit, the fee is free of charge.

When investing, it is necessary to look not only at what management fee you will pay to the manager for the work he performs but also what additional costs manager may experiences throughout a year for maintenance of your investment (you indirectly cover them also).

Earn money by Investing - Photo credit: prasinomilogr.blogspot.com

On the Final Note

There is a belief that the new crisis is approaching, a bigger decline than it was. I do not believe it, but I also do not believe in a very bright future. Everyone should care about his own future. There are many investment ways, and everyone can choose by his own needs. I am a big fan of creating a portfolio with different investment types. And investment funds are very attractive to me. Theoretical knowledge, however good it is, does not protect against reckless, emotionally-based and often highly risky investment decisions. If we are not financially skilled, it is a good idea to invest in an investment fund or at least to consult with a professional.

It is obvious, that we need to invest. Invest due to the fact, that the value of money constantly is influenced by the inflation. The sooner we start investing, the better results we will reach. There is a very simple relationship between profitability and risk. That is, if we are looking for higher profitability, we will encounter with a higher risk. Shares and bonds are two main financial instruments, which make up the bulk of the world's financial assets. The most popular way to invest is through an investment fund - over half of the world's invested money has been invested via investment funds.

Earn Money by Investing - site-blog.ru

What should we remember from this lesson?

- Investment funds are currently the most popular investment tool taken by both the ordinary investors and institutional investors.

- The total assets managed by investment, pension and insurance companies count about half of the world's financial assets.

- Most commonly, investment funds are classified by risk (bonds - the safest, shares - the riskiest, mixed - in the middle).

- Before investing in any investment fund, you should familiarize yourself with its investment strategy, read the fund prospectus, rules, and key investor information, find out what taxes are, and most importantly - find out the total cost of the fund.

The three most important factors in the financial world are knowledge, intuition, and success. In my opinion, the same three factors are also the most important ones in our everyday life. Let's the lessons learned in everyday life apply to investing, as well as lessons learned from investing apply to real life.

In investing, what is comfortable is rarely profitable. - Robert Arnott

Credit: investopedia.com

*************************************************************************************************

Thank you for stopping by and reading my blog.

2018, All Rights Reserved.

You are very welcome to join Bitlanders and share your valuable knowledge and opinion.

***************************************************************************************************

You can check my other blog about investing:

1. The Basics of Investing: First Lesson - What is Money Investing?

2. The Basics of Investing: Second Lesson - Profit and Risk

3. The Basics of Investing: Third Lesson - Bonds

4. The Basics of Investing: Fourth Lesson - Stock

Come back to find more...

**************************************************************************************************