The Basics of Investing. Second Lesson: Profit and Risk

Photo credit: Amber255 via Bitlanders.com

Welcome to read my new blog about the basics of investing. This will be the second lesson: Profit and Risk. Let's talk a little more about investing, and try to understand all the risks we can face if decide to invest our money. I want you to learn together with me the very basics of investing, and do not fear anymore allowing your money to make money.

The second lesson is designed to understand how much you can make money by investing in different investment types, and what the risk is involved there. Together with you, I will repeat what I have learned.

Before we begin to understand the very essence of the investment, I want to disperse the fog right away - you truly will not become rich just in one day by money investing. It's a time-consuming process. The good news is that you do not need to have a doctorate in financial engineering to successfully invest. So, have a good reading.

Where can we invest?

First of all, we will find out which types of investment asset classes can we invest in, and how much these asset classes earned in past periods? Let's briefly recall what are the main investment asset classes: cash, bonds, and especially popular investment ways- stock (shares) of the corporates. These three asset classes are basic, and others are called the most common ones' alternatives. Most often it is real estate, raw materials, and gold.

Each of them has its own benefits and risks when you invest in them. What can an investor expect if chooses one of the above investment asset classes?

LOWEST RISK INVESTMENTS! - Video credit: Ryan Scribner via Youtube.com

Profit and losses

But let's first consider one particularly important dependency on investment. Dependency between profit and risk, between earnings and potential losses.

There is a very simple dependency in the world of investment:

The higher the return you expect, or the bigger profit you want to earn - the higher the risk you have to take.

It's natural - there is no free lunch. You cannot expect to earn much without risking anything. If you take the lower risk - automatically this will mean that it is likely your earnings will be lower. Having in mind this dependency, we will examine, how much different investment asset classes earn at different periods, and the risk faced by an investor choosing one or the other investing type.

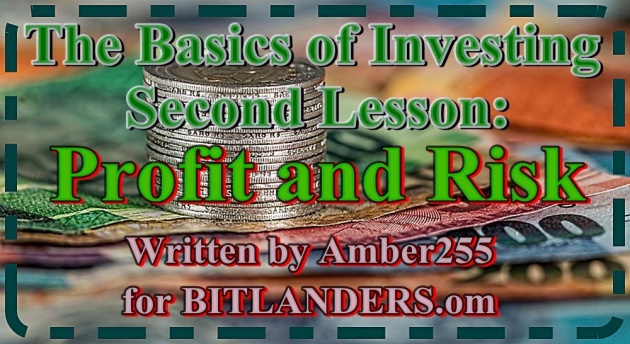

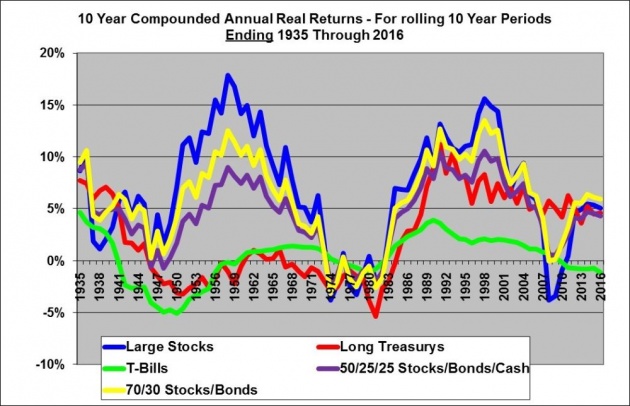

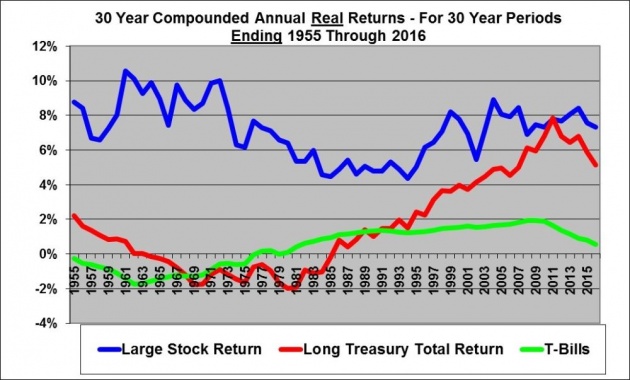

By analyzing graphs, we can estimate how different investment asset classes earned, for instance, in the last 30 years. That's long enough period. Not a hundred years, but long enough period from which we can create a common view. So, how much can I expect to earn investing my money in one or other investment type?

Profit graphs - Photo credit: investorsfriend.com

How much the different investment types earned?

The somewhat safer way of investing - bonds have earned an average of 8% return per year over the last thirty years. This period was enough good for the bonds. There is an opinion that it is possible that such a high return should not be expected in the future. Other investment ways - shares or real estate assets, managed to earn a little more over the same period - about 9, 10, 11% annual return. Average annual return on gold in the last 30 years was 3%.

Looking at the graphs, we can make two elementary conclusions:

- First, risky investment ways, such as shares, real estate or raw materials for a long period of time earn from 5 to about 20%. 10% is a certain average of the risky investment ways. Safer investment ways earn a little less.

- Secondly, the riskier asset classes have much bigger fluctuations. The graph shows very well that in the past 30-years bond prices have been less volatile than all other assets. That means - if you have chosen these types - your risk would have been higher.

Investment risks - Photo credit: investorsfriend.com

Is it earned more than inflation?

When we know what kind of return on investment on quite a long period may reach one or another class of asset, it should be checked whether the profit gained exceeded inflation. As we recall from the first lesson, one of the investment objectives is to avoid inflation, means, earn more than the money goes down in value. If you search for graphs online, you will find that during the last years all investment asset classes (except gold) generated higher returns than inflation at that time.

It is clear, that no matter where you would invest your personal savings, you get the higher return on investment comparing how much value of money went down due to inflation. And this, in turn, means that you not only save the value of money but also steadily increased your capital. The exception is gold, but gold as an investment type is not suitable for everyone (we will talk more about gold in other lessons, so be sure to come back and read.

Most importantly, what should be understood from what we discussed - most asset classes, and especially the main ones: stocks, and bonds - overtake long-term inflation. This means that you can reasonably expect not only to save your capital but also to increase it.

While reading my blog, check Querlo chat:

Investment risks

We have discussed how much we can earn, and that's natural enough. We hope to earn money by investing, not losing money. But there is another side of the coin. If we invest, no matter where, whether it be shares, bonds or other assets, we always face a certain risk. And the investment risk always was the most scarring thing for me. But we must understand, that there is no investment with zero risks.

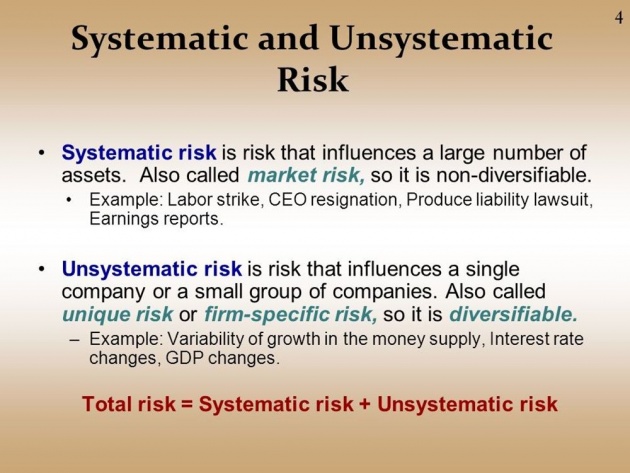

Risks can be perceived very differently. It can be understood as a loss probability or as a certain amount that can be lost. However, the risk in the investing world is usually grouped into two groups: systematic and unsystematic. The terms may be complex, but we just have to remember that they are.

Make money by investing - Photo credit: investorsfriend.com

-

The risk that cannot be avoided - systematic risk

If we very easily explain what the systematic investment risk is, we can understand it as a risk that cannot be avoided. It is characterized by the fact that no matter where we invest, we will not avoid some risks. For example, regardless of which companies we invest in, if something very bad will happen in the economy, it will affect all business - the value of the shares will go down. No matter what the company is.

-

The risk that can be avoided

We can understand the unsystematic investment risk as something that we can avoid or at least we can reduce it in a variety of ways. We will talk about these methods in other lessons, so far we have to remember only that there are risks that we will not escape, and there are risks that we can avoid.

Different investment risks - Photo credit: slideplayer.com

-

Other risks

Other risks are more specific. One of them is bankruptcy risk. If you invest in company shares or bonds - it can go bankrupt. The country can go bankrupt too. This means you will eventually lose most or all the money you invest.

Another risk is the political risk. Such a risk we can perceive when we invest in a particular country and its politicians decide to change the tax politics or to eliminate the incentives for investors, or apply higher taxes. It's one way or the other would affect our return on investment. We cannot control such a risk.

One more risk can be currency risk. If we invest only in our own country, and we invest in the currency that we receive income and expenses incurred, we do not have this risk. But if we decide to invest in other countries in order to have a more dispersed investment, we have not another choice as to invest in other currencies. In this case, we are already facing with currency risk.

There can be also mentioned such as interest rate and market risk.The market risk we can perceive as fluctuations in price over the day, week, or month, no matter whether we invest in stocks or bonds. The value of the investment inevitably fluctuates every day. In the world of investments, there is no such thing as a constant increase in daily income. With the exception of deposits, in all other cases, observing the value of our investment, we constantly see a change in the value of the entire portfolio. One day it increases, the second falls, then rising again, maybe rising day after day, then again falls. And so constantly. We have to accept this. If we cannot, then we have chosen the wrong path.

Understanding Investment Risks

Video credit: BPIvideochannel via Youtube.com

How to measure investment risks?

The most popular risk measure is an indicator called standard deviation. It is very easy to grasp it as the fluctuation amplitude. The more the value of the investment fluctuates more around the certain average, the higher is the standard deviation. Consequently, the higher the risk is of our investment. The lower the investment fluctuation amplitude, the lower the risk.

One range of fluctuations will be if investing in stock and it will be completely different if investing in bonds. It

will be much smaller. If we invest in an inappropriate period before such as a major crisis, the value of investments can fall by 20, 30 or even 50%. This is the stock risk that the investor has to take in order to eventually achieve a greater investment return.

Measure investment risks - Photo credit: baomoi.com

In addition to the standard deviation, we can use another method of the risk measurement - the maximum drop from the highest value. Or simply - what is the maximum loss we can experience investing in one or other financial investment type. If we understand the risks, we will be able to prepare for it and accordingly to avoid a sufficiently large number of mistakes, that make the investors who never think about the risks.

How much do we need to earn after a specific loss?

What kind of return on investment should earn an investor who has suffered a certain loss of his investment in order its value would return to the original level? It's a simple but very eloquent dependance. It is interpreted approximately so - if you experience a 10% loss, your investment return should increase by 11% in order the investment portfolio would return to its original value. If you experience a 20% loss, the return must be 25% to get back to the starting point.

This means that the greater loss you experience, the more you have to earn later.

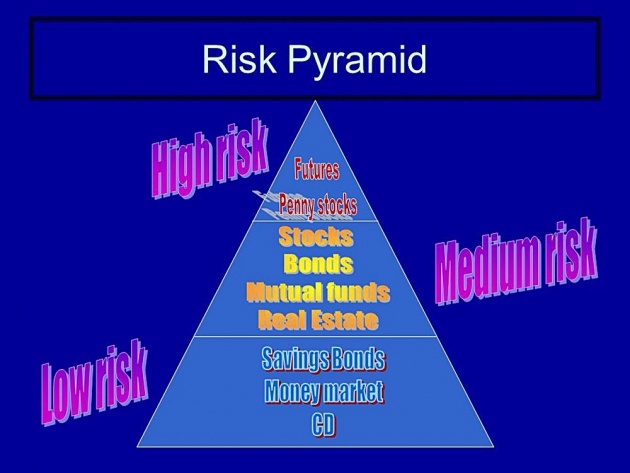

Investment risks pyramid of different investment asset classes

Photo credit: slideplayer.com

Decide how much you can lose

One of the key things every investor should keep in mind, one of the future tasks is to accurately determine what risks can be taken. Investing in a common stock basket to wait for 90% of the loss maybe not necessary, but sometimes it happens such situations also. Maybe once in 50 years. Maybe even less often. A good example is Greece. Greek stocks since the 2008 year fell down ~ 90%. So, there is a need to clearly state the risk that is acceptable to you.

Because if you lose a lot of portfolio value, you may need to wait for not a 2 or 3 years, but 10 or even 20

years to bring your investment back to its starting point. First of all, you should evaluate the risks you can tolerate.

Profit and risk - Photo credit: rethink401k.net

Profit and risk

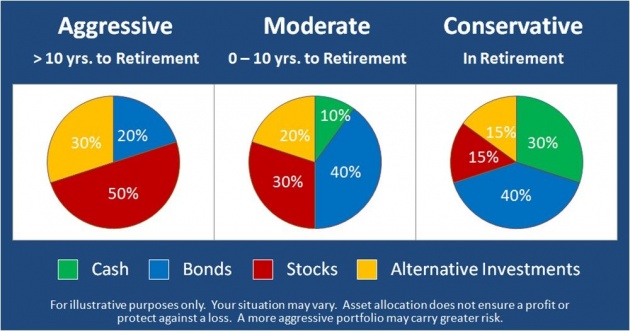

So, it is obvious, that deposits and bonds are safer ways to invest. Their returns are lower, lower is the risk also. The way of higher risk investment - stock, where expected return is higher but the risk level is higher also.

However, the higher risk doesn't always mean more earnings. Alternative risky investment types such as raw materials do not necessarily generate more returns than inflation. Knowing all this, you can answer the question of what the risk is acceptable to you, and then you can focus on what the profitability of the investment you can expect.

Profit and Risk - Photo credit: binaryoption-blog.jp

On the final note

There is a very simple dependency in the financial world:

-

The more secure you invest, the lower the return you can expect.

-

The higher the risk you can take - the bigger earnings you can expect.

If your goal is to invest safely - you cannot tolerate big fluctuations. If you are older, or a retirement is near - in such case you should choose a safe investment. If you are a young investor or you still have a sufficiently long investment horizon (10, 20 or 30 years), then short-term value fluctuations do not scare you - think about investing in stock, real estate or other risky assets (and that is what I decided to do myself).

Make money by investing - Photo credit: zona-1.ru

Why it's worth investing? The simplest answer would be to have a better life in the future. Everyone wants to be financially independent, to have what we have always dreamed of, eventually retire earlier and devote our entire leisure time to our hobbies. Money is the security and freedom to do what we like.

It's not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for. - Robert Kiyosaki

Credit: investopedia.com

***************************************************************************************************

Thank you for stopping by and reading my blog.

2018, All Rights Reserved.

You are very welcome to join Bitlanders and share your valuable knowledge and opinion.

***************************************************************************************************

You can check my other blog about investing:

1. The Basics of Investing: First Lesson - What is Money Investing?

2. Investing for Beginners: Easy Steps and Tips to Start Investing

Come back to find more...

**************************************************************************************************