One of the most fascinating things about the USA and its economy is the MEASURING ALGORITHM of Credit History, Credit Score or Credit Reputation. Later in this article, I will explain in further details my perspective on how this algorithm works.

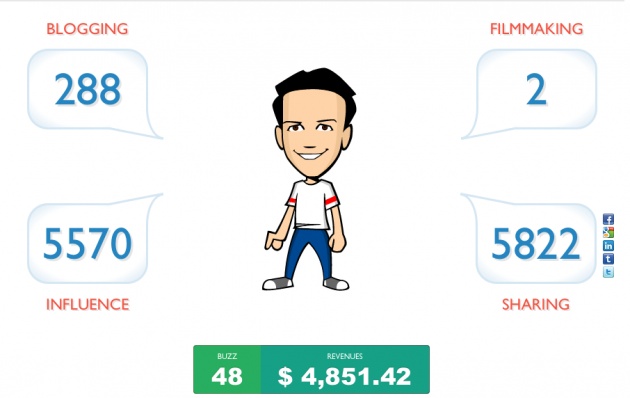

In the last year, at Film Annex, we developed the BuzzScore, a global MEASURING ALGORITHM. The BuzzScore allows us to measure the work of users and content providers from 245 countries, territories and islands. It also allows us to reward them financially. With the BuzzScore we can understand the content providers' skills and their reliability to work and collaborate with others. Starting February 1st, we will use BitCoin as our digital currency and method of payment, with no transfer fees costs, completely independent from traditional banking systems. We also believe that BitCoin is a perfect fit for Film Annex Philanthropic missions associated to the Women's Annex Foundation, like #DigitalLiteracy and #DigitalCitizenship. I invite you to read: .@FilmAnnex first believer of #DigitalCurrencies like #BitCoin from a true Philanthropic perspective!

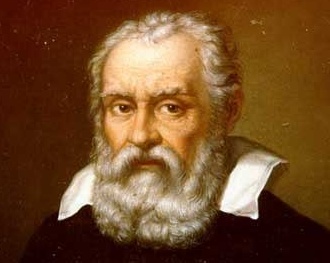

The BuzzScore was conceived in 2013 by Maurizio R. in collaboration with the Italian Film Annex team, and supported by the father of Modern Science, Galileo Galilei, who, in the 16th Century, said: "Measure what is measurable, and make measurable what is not so measurable."

To better understand the United States economy, it is very important to spend a few minutes reading the definition of Credit History on Wikipedia. This explanation shades some light on why, in North America, people have access to financing and development above any other region in the world. The value of MEASURING ALGORITHMS is proven by search engines like Google and financial exchanges like the New York Stock Exchange, to name a few. But the traditional Credit History and Reputation algorithms have geographic limitations that make them unfit for the Digital Citizenship of the World Wide Web. Here are a few quotes from Wikipedia: “Credit history usually applies to only one country. Even within the same credit card network, information is not shared between different countries.” and “An immigrant must establish a credit history from scratch in the new country. Therefore, it is usually very difficult for immigrants to obtain credit cards and mortgages until after they have worked in the new country with a stable income for several years.”

The BuzzScore resolves those limitations for Digital Citizens, starting from content providers, bloggers, filmmakers, and social media users.

Just imagine how incredibly difficult it is to have credit access for a person located in a developing country where corruption and discrimination are part of everyday life, where gender, race, social upbringing and many other factors can forbid access to basic financial needs and institutions. In essence, this person could NEVER access a fair credit system to sponsor and allow her/his dreams to happen. This person could not even access a fair currency structure as regulated by regional banking systems with very limited options, services and operations.

I remember when, in the fall of 1991, I was in Atlanta, Georgia, USA, and I visited a local Volkswagen dealership to test drive a grey Passat station wagon. The dealership run a credit report, but the next day I opted to buy in cash an Alfa Romeo, as I felt more comfortable to not create debt. That was a mistake! To this day, if you run my credit report, you can see the inquiry on that specific car, along with a long list of details including all my residences, my average cash accounts, estimated real-estate properties and taxes, and many more details. What is even more interesting is that “I lost a few points for not having established monthly debt with car financing”. In essence, debt is more important than cash! This is incredible for any cash-based society, especially Mediterranean and Middle Easter societies. Your credit score is higher when you owe money and you pay on time, while it is lower when you pay in advance and you have no debt forward!

Why is this? Simply because the economic system is based on the financial reliability of an individual. You could have tens of thousands of dollars in debt every month, but if you pay as required, the financial institutions can collect the principle and interests. The principle is what you own, the interests are their profit! Consequently, you are a fantastic customer as you allow the financial institution to have income (interests), and at the same time, you are reliable as you never miss a payment!!

The Credit History and Credit Score are the most valuable piece of information to access life changing amounts of financing. It is a very delicate score that can be lowered simply by paying one bill late of a few days or forgetting to mail the bill itself. It is advised to run a Credit Report on yourself every year to make sure there are no negative news you might not know. A $30 misplaced or forgotten electricity bill can make some serious damages to your Credit Score!!!! The system should not be abused. If you run too many reports and carry too many credit cards, even if you are solvent, you will lose precious points on your credit score. Consequentially, this very delicate and sophisticated Credit System will never apply to developing countries as the local infrastructure and technology do not allow the individual citizen to be fairly and reliably MEASURED with a good Credit History and Credit Score.

Since the implementation of the Film Annex BuzzScore, the citizen of a developing country can go online, log in on Film Annex, Women's Annex and Models Web TV, write articles, blog about daily events, upload films, comment on social media, gather thousands of subscribers and GENERATE REVENUES paid with BitCoin directly on their Digital Wallet. We can track with precision the user quality and productivity, and estimate her or his value for the future, granting the user a possible Credit History and Credit Score that can allow this user to access new financial opportunities. The BuzzScore is a MEASURING ALGORITHM that allows users and citizens from any country and region in the world, including the most remote developing countries, to enter the World Wide Web of Financial Sustainability and Opportunities.

If you have a few more minutes please read my message to Jeff Bezos on Digital Currencies and BitCoin: "Lets see if Jeff Bezos steps up to the plate on this one!"

In case you are NOT part of the Film Annex Family, do not wait any longer and register today HERE at my personal registration page! I will donate my affiliate commission to Women's Annex Foundation!

Please visit my personal page on Film Annex and subscribe. Please also visit Women's Annex and subscribe to it for updates, articles and videos.