Are you someone who have almost never listed down their day to day expenses, monthly income etc.? Well then, reading this today should make a difference in your life. Lol.

(Photo credit: From Justin Weinger's article via fijourney.com)

As a kid and while growing up, I've always seen my mother write down all the daily expenses and any form of income that come by. Sadly I've never liked keeping a tally of mine when I grew up. I didn't see it's importance or relevance in my life.

All throughout my employee days I thought doing this writing-a-budget-list thingy had no significance or meaning to me. I thought it was just a waste of time and effort to write all the expenses etc and keep tabs on my money. Fast forward to July 1, 2017 and I'm suddenly keeping track of my hard earned cash. Lol.

(Photo credit: Nick Seluk via emgn.com)

No, I haven't won the lottery nor am I in very deep debt, I guess it's just maturity finally kicking in. That and the fact that I have to really learn how to manage my finances wisely now. I'm not getting any younger you know. No one is gonna do this for me but me. My mom isn't and wasn't around to let me know about such and I'm stubborn af too so better late than never eh? :D

I don't want to be a Johnny Depp soon or someone who has other people to advice and manage his supposed millions (or billions?) of dollars. Look at how he's suing people left and right.

(Photo credit: from Getty via jezebel.com)

I just read an article about Depp last month saying he's basically losing money due to overspending or splurging more than he should. If we don't know how to manage our finances while it's small and manageable, it's definitely not gonna be easier once more dough comes pouring in. Better prepare being good in managing our money now than when we can't do it anymore.

So anyway I'll give you three reasons why we should know how to keep our finances in order.

1. You will know what are the things you spend most and too little on.

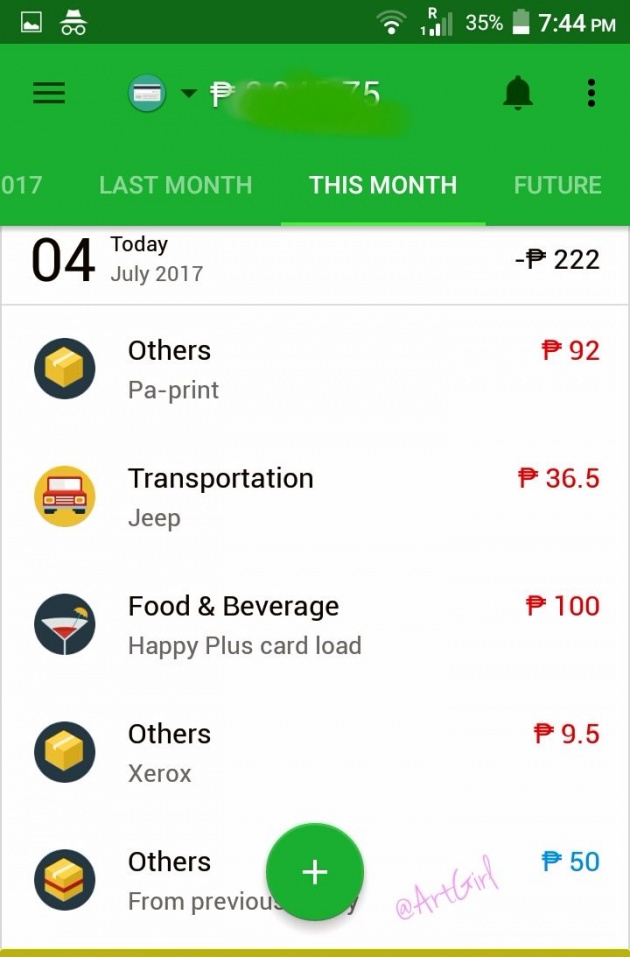

(Photo credit: ArtGirl via Bitlanders.com)

To be able to manage and control your finances you will need to know how you spend. Yeah you're probably spending most of your money on food but are you sure? Making a list will let you have accurate information you can use to plan your financial future.

To be able to think long term and be rich and successful, instead of just having short term plans, you have to know where your money usually goes. Why? So you will know where your money is leaking and if you're spending your money wisely. Once you know more about your spending habits, you can prioritize which to spend on first and foremost.

Check out these 3 money management steps from Bank of America to learn a bit more about the benefits of tracking your expenses, an important part of budgeting.

(Video credit: Bank of America via YouTube.com)

2. You will be able to plan your future finances a whole lot better when you know how you've been spending your money.

(Photo credit: From article via marketwatch.com)

There are several ways to start tracking your finances and managing your money. Of course I'm not suggesting you get a notebook and write everything down every damn day. That has never worked for me, ever. But if it works for you then that's perfect!

You can also use an excel file/sheet instead so you can store and keep a record of everything in your computer or online.

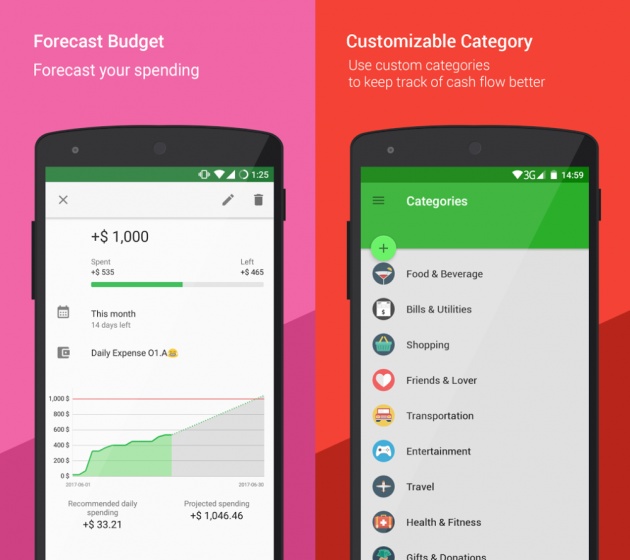

Fortunately, technology keeps making everything fun and easy for everyone. We can download and use any money manager or finance/expense tracker mobile app. I'm sure you'll finally see how fun it is to keep track of your money and organize your finances.

$$$ Money Lover App Review $$$

Check out a screenshot of my "progress" below using the Money Lover app. :)

(Photo credit: My mobile screenshot of Money Lover app)

Is it cool or is it cool? Lol. No I am not being paid to promote it or anything, I just like it more than what my brother uses. (Lol. "His" app sounds really plain and boring: Andro Money.) Forgot where I found "my" app but it took me maybe more than half a year before I actually started using it after downloading it.

(Photo credit: combined Money Lover images via play.google.com)

It's rated 4.4 stars in Google Play, Andro Money is 4.7; it don't matter to me. Lol. Am still gonna use my app for the meantime because it's great for helping me track my expenses and income. The debt manager part of it though is a bit confusing so I am not using it at all. Too bad for my credit card expenses eh? Because of that, I will give this app a rating of 4/5 stars.

So far so good. I'm still using the app now, it's already July 11 as of this writing. Back on July 4, I realized I'm actually having fun doing this. I started writing this blog on July 2 and so far I feel happy I'm doing this adulting thing. Lol. Must be because this app I discovered has cute icons and is generally easy to use! Now I feel like I'm finally on my way to making my first million! Hurray! Haha~

Wanna know the basics of how to use this app? Check out the video below!

(Video credit: Money Lover - Money & Budget Manager via YouTube.com)

♥ ♥ Take Note: Don't forget any transactions done ♥ ♥

Yeah, it's July 11 and my tally vs my actual money is still not matching up since July 4 I think. Lol. Probably I forgot to put some other expense I did the past few days. *sigh* This is why manual (written) list-making also didn't work for me. To think I thought this was easier to do but it's turning out to be quite the same? Lol.

(Photo credit: Unknown via Wikipedia.org)

Good thing I also use SnapCart (which I discovered here in Bit) where I earn some cashback from grocery receipts. At least I have a reference of my past grocery expenses. It helped me find out where P80+ went. Lol. I've added it on the app now but a few hundred pesos still seems to be missing. Oh no, perhaps my poor sleeping habit is causing more of my recent short term memory loss.

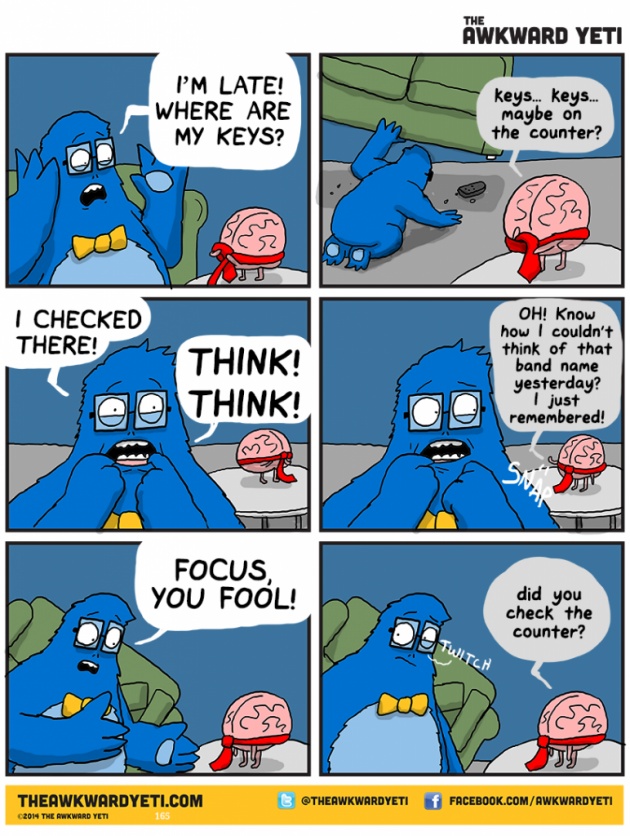

(Photo credit: Nick Seluk via theawkwardyeti.com)

I think it takes more time, discipline and practice to really get this done accurately. I'm sure when I've become used to this I won't forget whatever I used my money for. And then I'll finally and truly be rich! Lol.

3. You will be able to move on to saving better and investing seriously to build a nest egg for your golden years.

Once you've got your expenses and income history down pat, take note of it, study it and plan your future so you can move on to the bigger real adult stuff: Savings and Investments.

(Photo credit: Finance Maps of the World via finance.mapsoftheworld.com)

Of course before investing in anything, make sure to study and learn as much as you can about it first. Only then will you know what type of investments are best for you and which ones will be your favorites.

But in case you already know more about it and already have your preferences, then why not share it through this Querlo chat box below. :)

If you don't know anything about doing this basic thing in managing your finances yet, it's never too late to start today like I did just this July. I only realized the three things above a few days after I started this activity. Change has come indeed. Lol.

© Art x Stephanie Rue

All rights reserved.