Online trading or forex trading

Online trading or forex trading is mainly the act of buying and selling worldwide currencies, futures, bonds, stocks and other financial instruments throughout the Internet. Online trading normally requires an online trading platform presented by most online brokers for order execution. These platforms are accessible to every person who desires to try to make money from the online market. A lot of online brokers also offer free demo accounts allowing anybody connected to the Internet the possibility of virtual trading.

Most brokers offer a variety of financial products including Commodities, Shares and Forex. Although trading Shares like Google or buying and selling Commodities like Silver or Gold might be quite common. Over the last couple of years due to some of its major advantages Forex trading or online trading has gained extreme popularity.

These days, there is no need to go to a bank or post office, or even leave your home for that stuff. You can just trade online via your home computer or mobile phone. You can trade Forex, which includes currencies such as the Euro or Dollar, a range of Commodities such as Oil or Gold and even main market indices.

How to start trading?

To start trading first of all you have to choose a broker. You can search brokers list from the internet and chose one which suits you best. After selecting a broker you need to open a trading account. There are many type of trading accounts like cent account, Dollar account, euro account etc. In cent account you can start trading with small amount while in any other types you need large amount. Many brokers offered with $1 to $5 starting amount while it depends on you how much can you invest.

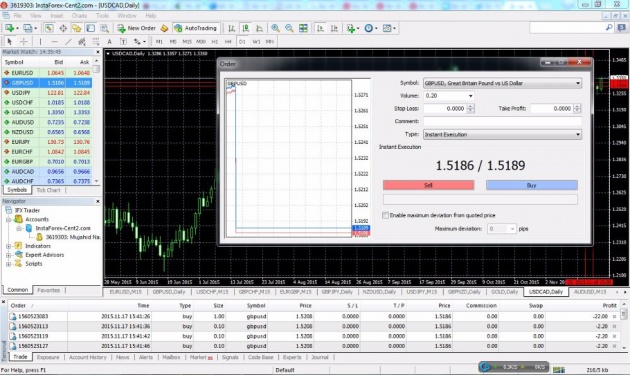

After registration you need trading software which you can get from same broker’s website free of cost. You can download it to your computer or mobile phone. After installing this software on your computer or mobile, log in with your account details. After logged in you can see major currency pairs, metals, indices etc and their graph where you can see rates moving up or down. You need to double click on any currency pair where you can see current rates moving up or down and buy/sell option. You can buy or sell this currency pair to start trading.

Here are some points to start trading which you can understand easily.

- First of all find best broker

- Register your account with actual details like phone number, home address etc

- After registration you will get an account number and password

- Now download mt4 software from same website and login your account their

- After logged in you need to deposit money in that account to start trading. You can also open demo account for practice and you will get free deposit for that

- After deposit to your account double click to open any currency pair and buy/sell to open a trade.

- You must check volume before opening a trade. Volume is actually called the size of your order how much you want to sell or buy

Advantages of online trading

Online trading is simple and quick. You can teach yourself on your investment options, place orders to buy and sell, and possibly make or lose a significant amount of money without ever talking with a broker or leaving the comfort of your home. Many years ago, you couldn’t make a trade without meeting or calling your broker. Now, it takes only a few minutes. This ease of access could definitely make online trading attractive for those who may not have had the finances or the connections to work with a full-service broker in the past. Without ever speaking to a broker Online traders can buy and sell. This doesn’t mean trading is done with no broker participation, as discount brokerages in reality facilitate the trade when you click the mouse. However, online trading allows you to trade with almost no direct broker contact.

- You can do this job online without leaving home. You just need internet connection to work on this platform

- You have the facility to handle your own stock portfolios

- You will have more power over the types of transaction you choose to do.

- The commission costs for trading are much less money than using the services of a certified broker

- You can start this business with small investment.

- Online brokerage companies tend to offer their consumers a slew of tools included real time Level 2 stock quotes, news, financial tools and graphs to help you do examine

- Some online brokerages will provide their customers to free entrée to high quality research news created by Standard and Poor and other dominate financial users

- Online account investors have access to their accounts 24 hours – even though trading hours are from 9:30am to 4pm

- As long as you have entrée to a computer and the internet, you can take steps to handle your finances wherever you may be

The disadvantages of online trading:

- Some people who first time invests their money is unable to understand trading technology and may forget that they are using actually real money.

- The professional broker and online account holder has no mentoring relationship. In this way he left the investor to make his own choices.

- Investors not familiar with the brokerage software and they can make costly mistakes because they don’t know the ins and outs of the brokerage software.

There are a many kinds of risks that are there when you trade online.

- The first kind of risk is from the hackers. The first thing the hacker wishes to do is to steal your username and password. There are a lot of ways in which they can do this. And new ways are being developed all the time. Once they have your username and password they can simply access your account and buy or sell anything they want to.

- To start a forex trading you must learn it, without learning you can lose all of your money which you invest there. So you must learn its basics and get full training before starting a trade.