Video Credits: MSY Federal Credit Union via YouTube

Image Credits: Sharon Lopez via Bitlanders

(Image Created via Canva)

To have a credit card or not is one of the most challenging decisions one has to face. Individuals who are conscious about their spending would usually stay away from having one. Uncontrolled spending, high-interest rates, fees and charges, and proliferation of fraud are some of the reasons why there are still a great number of people who refuse to get one.

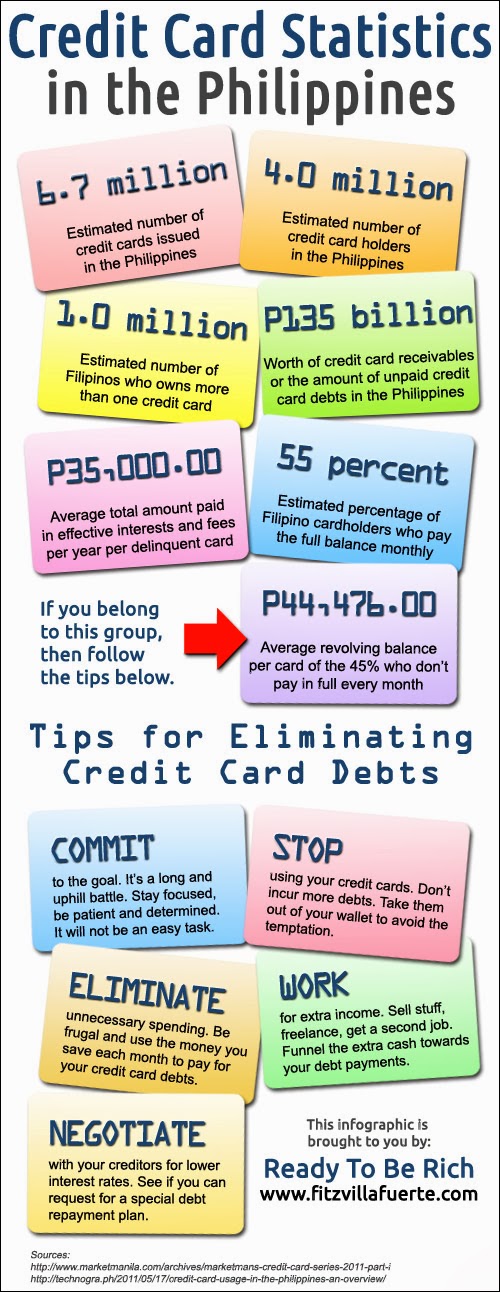

While browsing the web looking for some statistical data that could show how many credit card holders in the Philippines at the current time, I came across this infographic about credit card:

Image Credits: FITZVILLAFUERTE.COM

Analyzing the above-given data we can somehow come up with the following conclusion:

➤There are more or less 6.7 million credits cards circulating within the country that has been released by the different banking institutions in the country.

This data might not include those credit cards issued by local merchants.

➤There are approximately 4 million cardholders.

➤1 million individuals own more than one credit card.

➤There are 135 Billion Pesos receivables from clients from credit card transactions.

If there are 107,503,699 million Filipinos and if we will base on the above data, it only shows that the number of cardholders is merely 3.8% of the total population of the country.

WHAT IS A CREDIT CARD?

Image Credits: JJuni via Pixabay

A Credit Card is a payment card issued by a financial institution such as a bank, credit institution or a shopping center that allows the cardholder to purchase merchandise or service on credit. The cardholder is entitled to a specific amount of credit line or credit limit.

DIFFERENCE BETWEEN VISA AND MASTERCARD

Image Credits: RJA1988 via Pixabay

There are some questions being raised by a lot of individuals as to which is better between a Visa and a Mastercard. To make it clear, Visa and Mastercard are payment networks and not a type of credit card.

The first thing to understand is that neither Visa nor Mastercard actually issues or distributes credit cards. Credit cards are issued by banks, and those banks are the ones that set interest rates, charge fees and offer rewards. Visa and Mastercard are payment networks: They process payments between banks and merchants for purchases made with the cards.

Source: NERDWALLET.COM

DIFFERENCE BETWEEN A CREDIT CARD AND A DEBIT CARD

Image Credits: Sharon Lopez via Bitlanders

Some individuals are often confused between these two terms. The main difference between these two is that a prepaid card requires that an amount is available at the member's account while credit card allows us to purchase items on credit.

Debit Card may be used the same way that we use a credit card. We can use it to purchase merchandise online, book accommodation, tickets, and other items. However, with a debit card, can only be used if it has an existing balance.

CLASSIFICATIONS OF CREDITS CARD

There are different types of credit cards circulating in the country based on the features they offer. These classifications can also be based on the benefits the card issuer is offering to its members. Some of which are:

➤Shopping

These are the type of credit card that can be used for shopping or purchasing merchandise on credit. Depending on the credit card issuer, it may carry with it some special privileges and discounts.

➤Rewards

Some credit cards offer rewards program which allows cardholders to earn points which can be convertible to cash or freebies.

➤Cash Back

Apart from rewards, there are also cards which allow cash back promo to members. These are rebates which are credited back to the member's account.

➤Balance Transfer

It's a feature which allows a member to transfer credit balance to another card.

➤Travel

Frequent travelers may avail of some rewards and discounts using the credit card that they have.

ADVANTAGES OF OWNING A CREDIT CARD

If you are a person who knows how to control your spending, owning a credit card can be a good thing to consider. Here are some known benefits which an individual could enjoy:

➤Convenient Cashless Shopping

Image Credits: Mediamodifier via Pixabay

For some, carrying loads of cash can be very inconvenient. Aside from the fact that they may be an easy target for criminals who are looking for prey. With a credit card, you can go on shopping without the worry that your cash might fall into the hands of these criminals.

➤Online Booking

Image Credits: JESHOOTS via Pixabay

There are various cards that offer discounts on their online bookings which may include, purchase of plane tickets, hotel accommodation as well as the rental of vehicles to be used during the activity.

➤Verifying PayPal

Image Credits: mohamed_hassan via Pixabay

One of the most important features of a credit card is it can be used for PayPal Verification process. This is one of the features applicable to online workers. As an online worker, this is the primary reason why I opened my first credit card account.

➤Perks and Rewards

One of the best examples for this are those who use gasoline for their vehicles. Patronizing a specific company and using a credit card can give you more rewards.

DISADVANTAGES OF HAVING A CREDIT CARD

While there are known advantages of owning a credit card, it is also imperative that we know the disadvantages so as that we may weigh which is more beneficial to us.

➤Uncontrolled Spending

Image Credits: Borevina via Pixabay

This is one of the most common disadvantages of having a credit card that I heard from other individuals who opted to give up the use of this facility. According to them, having a credit card would most likely make them spend than necessary.

➤Fraud

Some people experienced to be a victim of either online or offline frauds causing them to lost a large amount of money because of using a credit card. One of the common cases recorded was when some individuals would be able to copy the details of a particular account through the use of phishing emails and other fraudulent activities. Once these criminals get hold of the login details of the owner, they could use the credit line of the member holder. The member will only discover such fraudulent activity once the bill comes in.

➤Annual Credit Card Fee

Some banks and financial institutions charge extremely high annual fees. But there are banks which have no annual fee collected and there are some which give the first year annual fee for free.

➤High Interest Rates

Image Credits: Openclipart Vectors via Pixabay

It depends on the bank issuing the credits card. The monthly fee would range from 2.25% to 3.5%

➤Hidden Fees and Charges

There are some banks with hidden fees and charges. This is one reason why credit card holders may lose interest in maintaining a credit card.

Here is another video that will give us insights on how to use a credit card to our advantage.

Video Credits: Total Debt Freedom via Youtube

ON THE FINAL THOUGHT

Using a credit card can give us more benefits if we are knowledgeable of the proper use of technology and know how to secure our transactions. We need to learn how to handle situations that may bring us a threat.

Stay tuned for my upcoming blog post where we will be talking about tips and strategies in order to get the most out of our credit cards.

Thank you for reading and have a great day!

Written for Bitlanders

by ♥Sharon Lopez

Date: February 15, 2019

Connect with me!

♥ IDEAL CAREER IDEAS ♥ FACEBOOK ♥ TWITTER ♥ PINTEREST ♥ LINKEDIN ♥